Since the start of the year, two main narratives have emerged in early stage investment:

The first is that we’re paying for the drunken ZIRP excesses, with LPs firmly clamping down on their purse strings, and investors demanding ever more stringent terms from founders. In short, cut your burn to default alive, or die trying because there is little hope of fundraising picking up until next year.

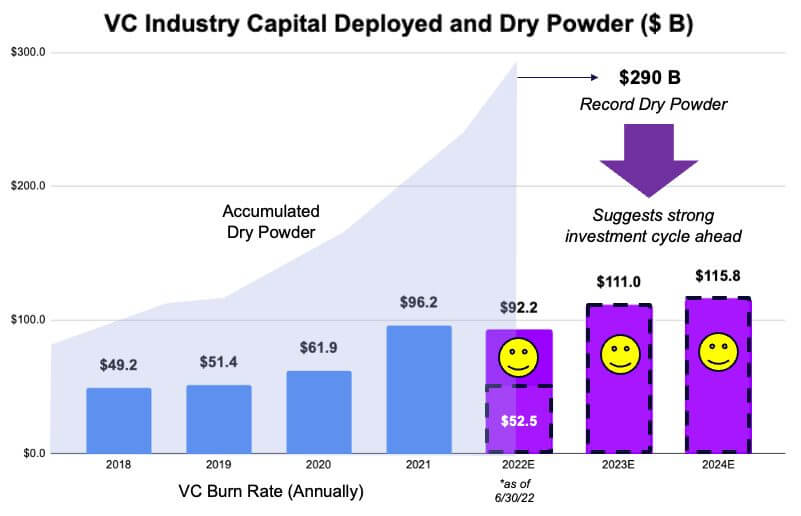

The second refers to the sea of ‘dry powder’ accumulated by VCs in the last year. VCs amassed roughly $580B in capital through 2022, similar to the capital-cushion which produced the incredible activity of 2021/22. With so much capital ready to be deployed, this could be a good year for fundraising once we’re over the bumps of H1.

‘Opening the Floodgates: The $290 Billion Venture Capital Reserve‘ by Jon Sakoda, Founder at Decibel Partners

As we get deeper into 2023, and see how valuations and rounds are shaking out, we can start to see which way we’re headed. As usual, there is some truth to both sides: VCs are being more cautious with how they disperse capital from a less enthusiastic LP-base, but there is capital.

Thanks to Pitchbook, we get a view on the bid-ask imbalance in today’s early stage VC market: sitting at around 1.5x, rather than the comfortable <1x. We can also see that this bloat on the ask-side began developing in mid-2021. It represents an overhang of capital-hungry entrepreneurship which investors aren’t willing to sustain this year.

However, the good news is that deals are still getting done, and – at least at the earliest stages – terms remain quite friendly. In most regions, valuations are down from their peak but still broadly maintaining a steady upwards trend. In Europe we’ve even seen pre-seed valuations climbing in the first few months of this year.

In the US, where the contraction has been felt most keenly (as was the inflation which preceded it), valuations fell a precipitous 32% between Q3 and Q4 2022. Taking its cues from the US market, with a little lag, valuations in Europe held up until Q4 2022, at which point they fell by a slightly more modest 21% into Q1 2023.

The important caveat here is that a recovery of median valuations at pre-seed does not mean we’ll see the same excesses. Many of the highly-publicized deals of 2021/22, with mind-boggling multiples on forward-ARR, will remain a source of embarrassment for those involved. Broadly, though, pre-seed SaaS companies are worth more or less the same in 2023 as they were in 2022.

This all fits fairly well with the idea that companies at this stage are both the most uncertain (read: greatest potential returns) as well as the most distant from public market woes. This might be helping pre-seed founders weather the fundraising crunch, and continue to attract capital from the more adventurous investors.

Some pre-seed markets are more turbulent than others

Away from our core markets of Europe and the US, we’ve seen fundraising activity in Africa Southeast Asia, Latin America and the Middle East follow a broadly similar pattern, demonstrating shared macroeconomic woes and their connections to venture capital networks throughout the US and Europe. Of all four, Southeast Asia would appear to be the least strongly correlated (which may make sense, geographically) recording its all-time peak for valuations in Q4 2022, before dropping a staggering 50% by Q1 2023.

Round sizes remain about what you would expect

Targeted fundraising amount can be pretty reliably correlated with valuation trends, as founders raise more capital when times are good and dilution is lower, and tighten their belt when the market is less friendly and terms are stricter.

This is broadly evident in our data, and perhaps most easily observed in Europe. What is interesting is the intensely formulaic approach to pre-seed investment in the US, with startups only breaking from the boilerplate $1M raise during Q3 2022’s mad scramble for capital before the doors slammed shut.

With Europe and Africa both seeing the most significant Q1 2023 recovery in valuation, it’s no surprise that those startups are also seeing the greatest increase in round size. Europe saw a rally of almost 60% in round size, while Africa saw a rocketing 500% increase as startups prepared for the potential capital scarcity to come.

Cautious optimism is the theme for the second half of 2023

There are many different perspectives on the shifting sands of early-stage investment, but we’ve seen H2 2022/H1 2023 as a correction in terms of deal pace and the top percentile of valuations, while for many founders the main challenge is simply finding early stage investors that aren’t inundated with pitches.

If we’re right about the amount of dry powder (and not everyone agrees there), then we should continue to see strong performance at the earliest stages. Whether that is true for Series A and beyond may depend more on where the economy heads over the next few months.

The main difference between 2023’s market and the pre-2020 market is probably simply that there are more startups trying to raise (plenty will have been born during the boom-times, especially with lockdown and optimism for digital) and that generally speaking they are trying to raise more. This has produced the bid-ask imbalance and the high rate of rejections.

If founders can temper their fundraising strategy, focus a bit more on proving business viability and workable unit economics, there is still hope for closing a round on good terms – especially as we get further into the year.