Everyone I know In Real Life, and many I don’t, has told me my essays are far too long. Allow me to apologize: if I was smarter and had more time, I’d have written a shorter essay. As a compromise of sorts, I’ve broken this essay into 6 self-contained pieces, which can be easily read in 10-15mins and can be found here: Part I. If you’d prefer to read this all on a single webpage, keep reading! There’s a summary TL;DR here, but it doesn’t include the interesting current affairs stuff.

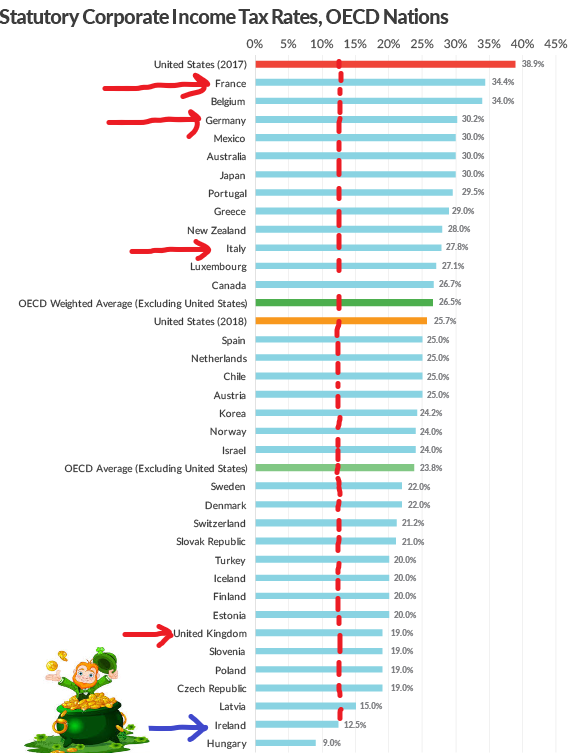

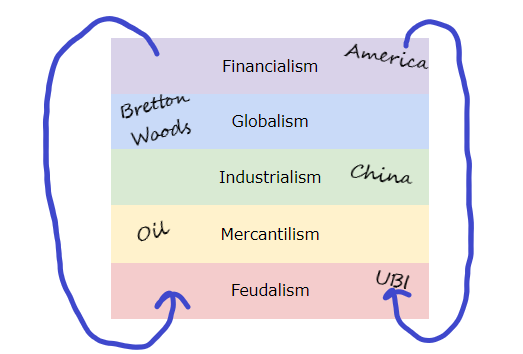

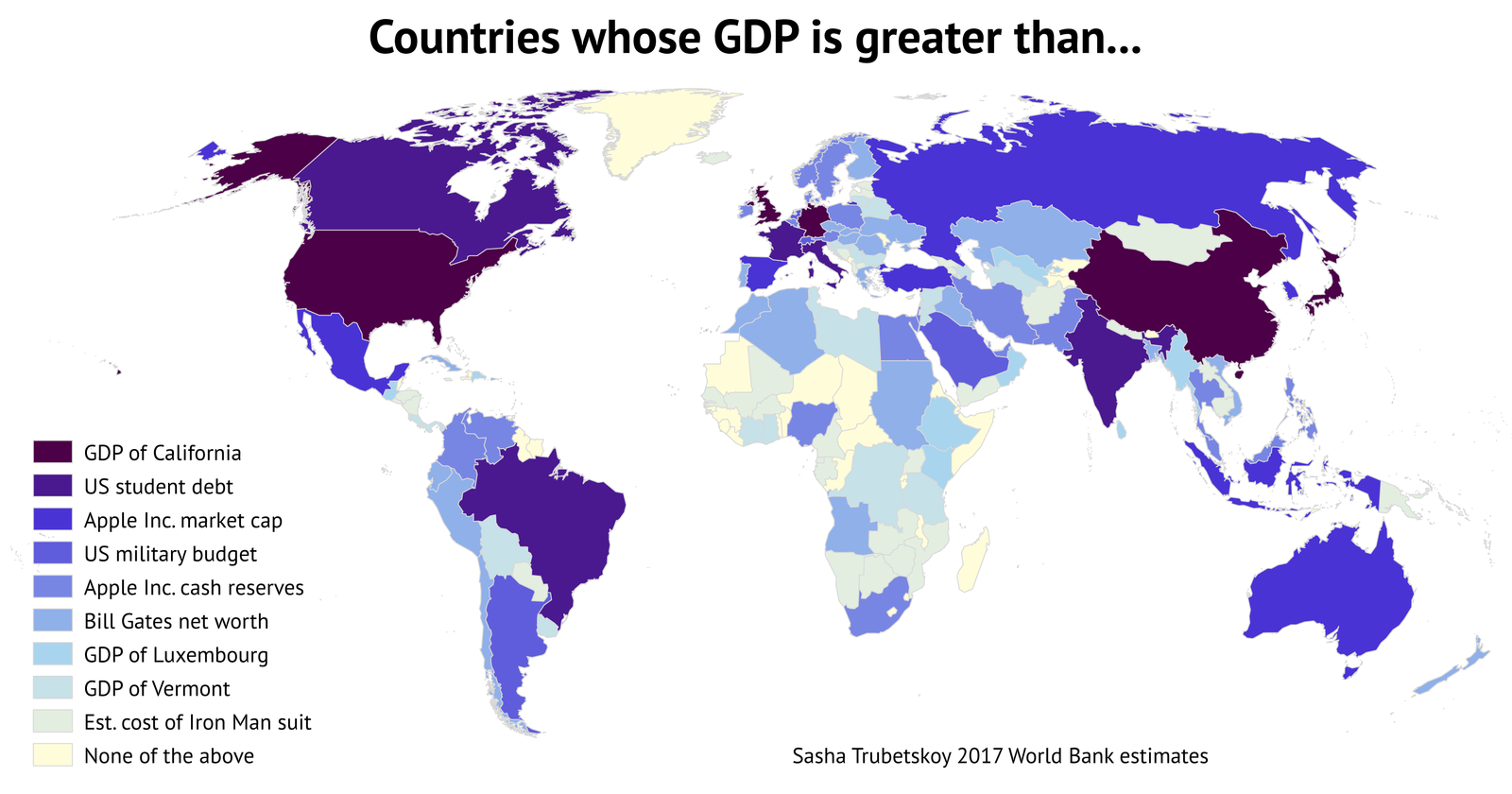

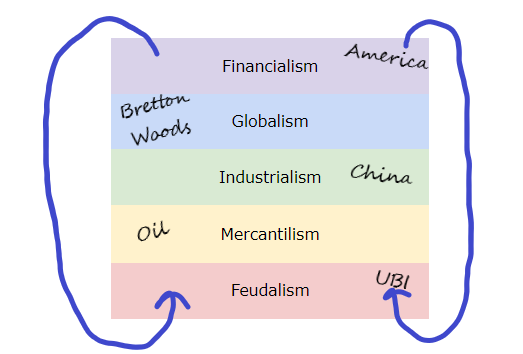

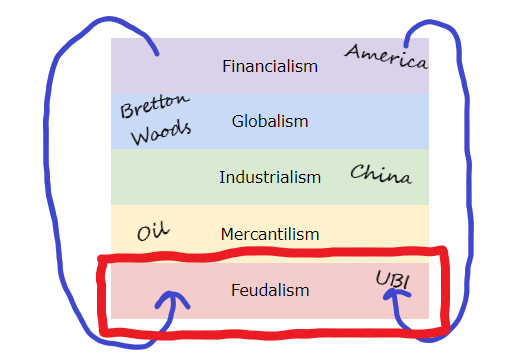

The Full Stack in all its glory. I like to summarize my essays up-top for people with jobs and/or Social-Media-addictions, but they say a picture’s worth a thousand words so I made this instead. Note: UBI = Universal Basic Income

Can You Make A Whole Society Wealthier?

This essay is my attempt to explore that question, and when I find an answer that looks like “Yes!”, to answer the obvious follow up: “How?!” I look at the ways people have been successful in the past, where their societies invested, who actually got to keep the Wealth, and who is trying to copy each strategy today. In many cases, as in real life, the distinction between individual, corporation, and nation blurs. I touch on Politics, Economics, History, Culture, and Technology — a few of my favourite things — and all play a part in building Wealth.

When it comes to Wealth, analysis and advocacy are almost inseparable — in the audience’s mind, if not the author’s. The uncomfortable truth I’ve come to realize is: radically different approaches have worked before to increase the Wealth of a given people. Attempting to understand the necessary conditions & constraints for success under different approaches is made virtually impossible today because there’s a logical chain of inference from each prior system of Wealth-building (analysis) to each current major political position today in your home country (advocacy).

Acknowledging the prior success of a system your political opponents are advocating today would be debate-suicide, whether you’re at your local bar or on a CNN Town Hall. Thus the discomfort.

This is my composite ~30,000ft understanding of successful historical “modes” of Wealth building and how each of them is playing out in the present day, regardless of which team is playing. For my own coarse-grained purposes, I’ve bucketed these “modes” as: Feudalism, Mercantilism, Industrialism, Globalism, and Financialism:

Feudalism: The Bottom of the Stack, Political Solutions to Economic Problems

We start then at the bottom of the Stack: Feudalism represents the ultimate historical Zero-Growth, Zero-Sum world.

Working the land was historically the only reliable source of societal Wealth. Technologies stagnated for centuries, farming and husbandry techniques remained relatively static, and therefore the land’s value stayed constant and easily known. Population growth tracked and consumed any surplus Wealth creation (i.e. food creation) due to slow rates of technological improvement and minimal multipliers on human energy expenditure.

In this world, opportunities for investment of any surplus Wealth you generate are approximately zero: even if you could produce surplus Wealth, the main source of all societal Wealth is land, you don’t even own the land you work, and it’s not for sale, not now, not ever, don’t you dare ask again. Get back to work, your lease is up next month and I’m raising your fee!

Thus any Wealth generated has nowhere productive to go, which means it cannot be compounded. Only consumed.

What’s more, the quantity of land is fixed and it’s been owned and actively farmed by knowledgeable locals for >1,000 years (with domain-specific knowledge in a context where failure => famine => death). Communication and coordination across distances is entirely dependent on access to horses and roads, which means the land you see around you is likely all the land you’ll ever see and all your Great-Great-Great-Grandkids will ever see.

If you’re a Feudal peasant, that’s a depressing thought. There’s no option to “work hard” and “put the kids through college” and then your grandkids will have a great life. It’s just Zero-Surplus subsistence living for ever and ever.

So how can you build Wealth in this Zero Sum world?

Zero-Sum Means Feudal Wealth is Binary: Serfdom or Violence

You take it. Conquer the locals, assert ownership, and forcibly tax any vassals you allow to stay in place. “Feudalism” shares it’s etymology with “Fee” not “Feud”, but damn, what a coincidence.

This is the fundamental reason that the elite, the noble class, in Europe right back to Ancient Sparta and beyond, has historically been the Warrior class. The source of Wealth was fixed, the means of generating it were well-known, and all known sources were already owned.

To advance in Feudal life, to provide a life beyond subsistence for yourself and your family, cost blood and metal. Lives and swords. You’re totally free to morally object to taking up the sword, #killingisbad — I agree! — but not playing the game doesn’t free you from the consequences of others playing. And they will play.

We barely respect the Geneva Conventions today (quick, nobody look at Russia), do you think “Hey! That’s not morally acceptable!” would’ve worked on Caesar? He invaded Gaul to settle his fucking personal debts — that’s not a joke btw — and while collecting revenues, his men killed “one million Gauls” and sold another million into slavery.

There were only about ~5 million Gauls to begin with: that’s 40% of a whole people who got “snapped”, Thanos-style, because of a single Italian’s bad financial management. Vae victis: “woe to the vanquished.” When everything is Zero-Sum, everyone else is a source of Wealth.

Fast-forward 1,000 years after Caesar’s death and the core rules of society are unchanged: watch as the still-Feudal Normans invade the same Wealth-generating-land as Caesar did (England — shoutout to my ancestors).

The result of their conquest Wealth-building excursion: “the Normans owned more than ninety percent of the land.” The remaining 10% of the land was then graciously split between just 2 native Englishmen.

You think Inequality is bad today, wait til you see the Gini coefficient on that.

A rough day at the office in the Year 1066

Nothing about these two examples is particularly distinct from the general pattern of Feudal societal ascent. You’ll find many more everywhere you look in the history books, each with their own quirks and variations and counterpoints…and the same basic structure of Violence in the name of Taxation of Fixed-Wealth-generating resources. Every Feudal Lord’s family dynasty began with a Peasant who picked up a sword and rallied the local lads together after a few beers — all the pretty gold crowns and red robes are just window dressing. Recognizing that only the willingness to pick up the sword separates him from the peasants can fill a Lord with a sense of Noblesse Oblige (“I could have been like them!”) or with disdain for his peasants and a sense of his own justified superiority (“They could have been like me!”).

Blood and iron are expensive. Any group of people — a family, a village, a town, a city, a nation, an empire — that can create a small advantage over their neighbors in combat-trained men (Blood) or tools of combat (Iron) can start to snowball that advantage by using it to Take surrounding land, Tax that land, and spend those Taxes on even more blood and iron.

Generating Wealth in a Feudal World is simple but painful: Take it and Tax it. This applies both to individuals and groups of individuals, lords and nations and serfs alike. Wealth may not be able to be created, but it can certainly be Captured.

Investing in a Feudal World is also simple: more blood and iron. You invest in the means of Taking Wealth from others. There is no other way to compound your Wealth — and for the more ethically-constrained Feudalist, ‘blood and iron’ serves a dual investment purpose as the only way to protect your Wealth from your less ethically-constrained neighbours.

Feudalism Today: Why Silicon Valley Loves Universal Basic Income

I was lucky enough to meet Segment CEO Peter Reinhardt in the fall of 2012, when he came back to MIT to guest-lecture for a (fantastic) class called The Founder’s Journey. A few years later, he wrote an essay that filtered into Silicon Valley’s collective-consciousness:

In the long run there’s always something for people to work on and improve, but the introduction of this software layer makes we worry about mid-term employment 5-20 years out. Drivers are opting into a dichotomous workforce: the worker bees below the software layer have no opportunity for on-the-job training that advances their career, and compassionate social connections don’t pierce the software layer either. The skills they develop in driving are not an investment in their future. Once you introduce the software layer between “management” (Uber’s full-time employees building the app and computer systems) and the human workers below the software layer (Uber’s drivers, Instacart’s delivery people), there’s no obvious path upwards. In fact, there’s a massive gap and no systems in place to bridge it.

…

As the software layer gets thicker, the gap between Below the API jobs and Above the API jobs widens…

Working “Below the API” is the terrifying dystopian endgame vision driving the support in Silicon Valley for redistributive programs like Universal Basic Income, and Sam Altman wrote a prescient essay way back in 2013 about the political tensions of a low-growth Zero-Sum environment. The optimistic take is that “API-based” software businesses provide flexible employment, cash-on-demand-in-exchange-for-elbow-grease, and a way to provide for yourself and your family that didn't exist ~10 years ago.

All true, by the way!

The pessimistic take is that working Below the API closes the path to Wealth for an entire Class of people as labor trends towards Perfect Competition, towards Zero Economic Surplus, towards a world where the serf peasant worker can't afford to purchase the tools she uses to work and must instead rent them from her employer at an ever-increasing-margin, i.e. pay a feu/fee, to be able to feed herself.

“Software is eating the world” doesn’t have a happy ending for everyone, and my smart tech friends out here in San Francisco have not missed the fact that the immense Wealth Creation that occurs here has become oddly decoupled from the wages & bank account balances of the average San Franciscan. Some invoke the spectre of AI as the threat driving their quest for Universal Basic Income, but all progress on AI could hypothetically be halted by Tech’s God Emperor Elon Musk and we’d still be living in an economy where software has pushed the marginal cost of production towards zero.

That’s a fancy way of saying: Software-based Tech Companies don’t need to pay that many humans to build huge businesses.

And if they don’t need to pay a human being then they won’t. They better not — for my 401(k)’s sake. You don’t need much experience running a business to understand how this plays out at the scale of a whole economy and what it does to the Wealth-generating ability of labor. Spoiler: also pushed towards zero. Unless of course you can code — software is the new iron, and programmers in Silicon Valley are the new “warrior” class. #GoWarriors!

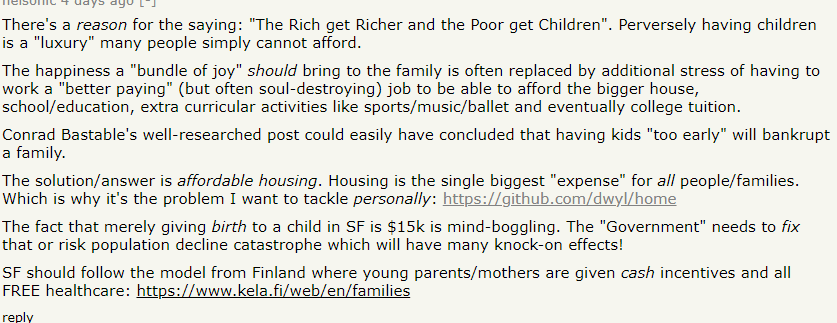

Speaking of the Wealth-generating ability of labor, people on the internet had many different responses to my Bermuda Triangle of Wealth essay on personal Wealth-building:

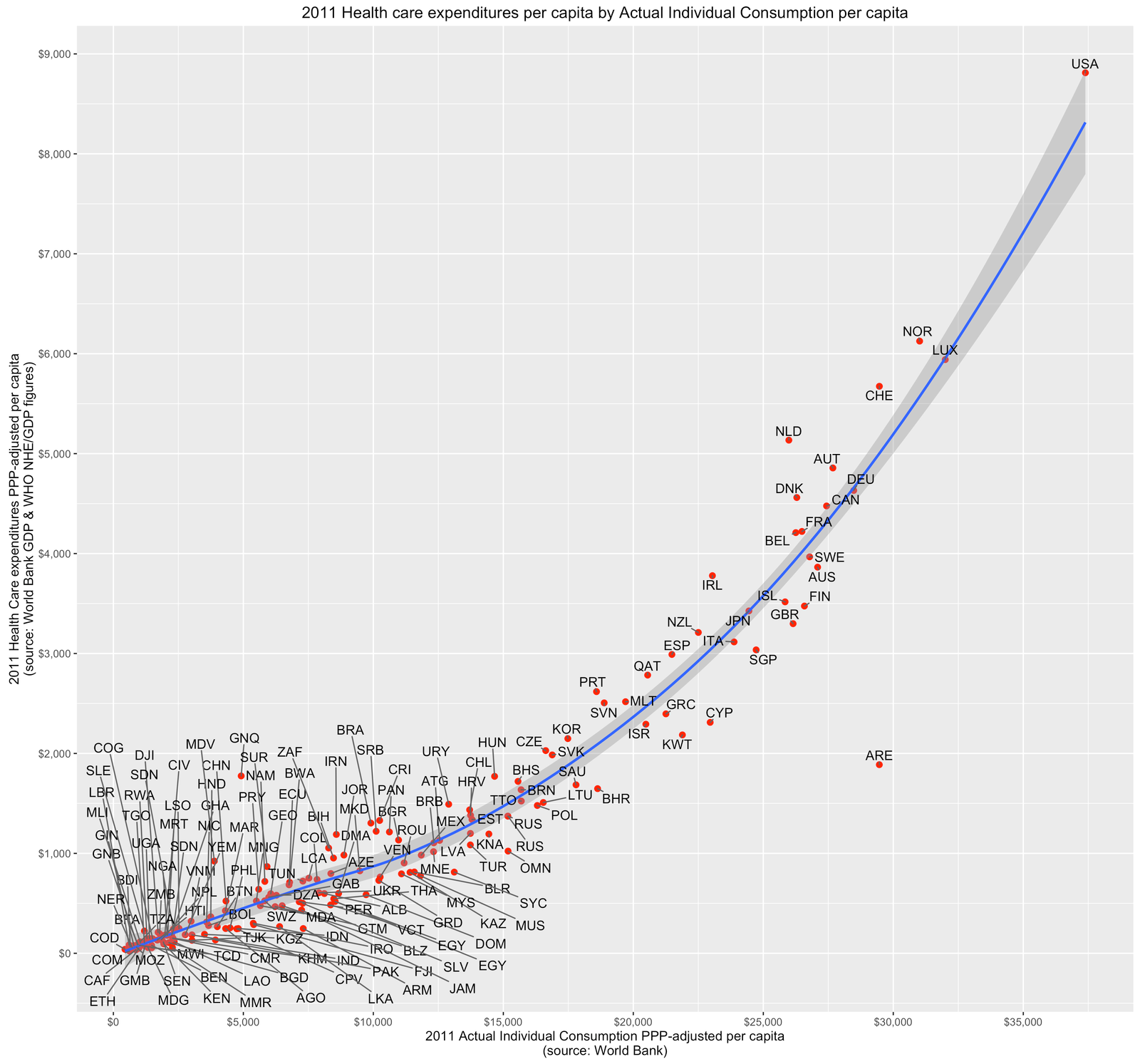

(Click to embiggen) A quick sampling reads, from left-to-right, that: i) government needs to regulate healthcare costs ii) government distortions are actually what caused the cost disease and iii) government needs to limit immigration. All in response to the same essay on building Wealth for yourself.

Forgive me for reducing 3 very different positions, held by very different internet strangers, to essentially the same proposition, but at a low enough resolution all 3 commenters are just advocating solutions to their personal Wealth-building problem.[0] It’s hard to imagine all 3 of these solutions being right, and harder still to imagine these 3 humans calmly debating each other…

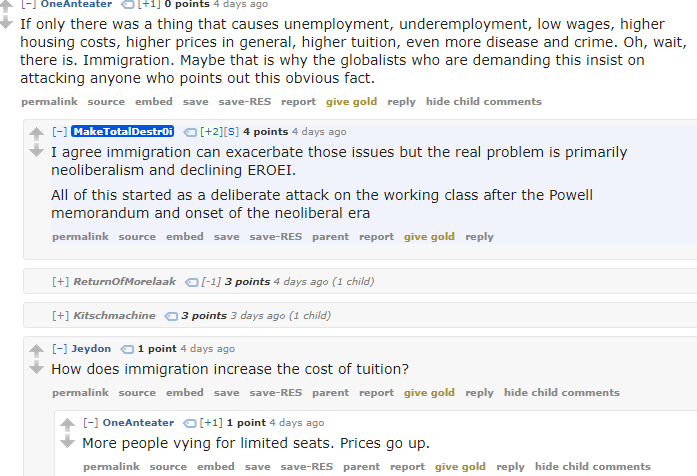

…but there was one other kind of response that I hesitated to include in that composite-image:

This plays as edgy irony to most people Above the API [5 favorites]

And yes, stow the pitchforks, #killingisstillbad, and yes, violence is super bad, Non-Aggression-Principle is good, and no, I definitely don’t condone any of that. But in a Feudal world, history has been pretty clear that things are Zero-Sum and there’s still only one good way to build Wealth — Take it and Tax it. Veni vidi vici etc.. If people look out the window and see nothing but Feudalism and a personal lifetime of serfdom, you can at least understand their instinctive linguistic reaching for violence (while condemning it).

Is there a non-violent solution that people living Below the API can self-effectuate, instead of having to rely on the Noblesse Oblige of Skynet those Above the API?

Perhaps. Another preachy author provides a less bloodthirsty solution that still satisfies history’s fundamental rule of Feudalism:

“When you vote, you are exercising political authority, you're using force. And force, my friends, is violence. The supreme authority from which all other authorities are derived.”

“Go Vote!” doesn’t quite have the same rhetoric weight…

Voting is violence (by proxy), and Democracy marks a difference between the Feudalism of old and Silicon Valley’s envisioned Feudal dystopia. Each vote you cast is an implicit claim on the full force of Uncle Sam. It’s buried beneath layers of civilization, thankfully, but US voters elect Representatives who determine Tax Rates which determine IRS policies which, if you try to fuck around on, will get you violently arrested and sent to jail.

Nowadays you can Take it and Tax it at the ballot box, with the use of force suitably restrained by process and bureaucracy. Which is precisely why so many in Silicon Valley who can see the writing on the wall (eventually all those jobs “Below the API” get replaced by a robot…) are instinctively turning to Political solutions instead of Technological ones to the Wealth-building abilities of their fellow Americans.

“It’s a shame, really, but you can’t fight (technological) progress.”

My point: As long as people who feel abandoned or impoverished or crushed Beneath the API or like they have no obvious path upwards, as long as those people feel that VOTING is a valid way to “Take it and Tax it”, they can peacefully express and effectuate what otherwise must become violence or generational poverty & stagnation.

There’s no other way to build Wealth in a Feudal world — you’re either a Lord or a Serf.

Even if this doesn’t describe you or your company/city/state/country, it’s worth thinking about which of your neighbours this does describe, how it might impact their thought process and actions, and what you can do about that…

Mercantilism: A New Path To Wealth Through Imperfect Competition

These Narratives don’t end with Feudalism! Where “Take and Tax” sufficed for thousands of years, technologies grew, the world shrank, and the realization that Wealth could be created from Trade led to new and more successful ways of building Wealth. (That bold part still manages to confuse many non-economists today)

In the Mercantilist World, the prize was trade routes. Ship-building leapt forward, unlocking new deep-water global trade routes. Sugar and spice and everything nice were going to be changing hands all around the world in a grand game of musical-trading-chairs, and the Mercantilist goal was to be left holding the gold and silver when the music stopped. What were you selling? Whatever you had. No! Whatever could be had. Export everything from everywhere, sell someone’s productive labor outputs into someone else’s consumption, just so long as the money — gold — ends up in your bank account.

A replica 1700s trading ship, used for trading by a private corporation. The red flaps are not decorative: as in nature & Eve Online, “Red Means Dead”

24 cannons had to be mounted to private merchant ships because shipping lanes were the prize. China was violently pried open and sold 40,488,000 pounds of opium because who cares about conquering and taxing a people when you can get them all addicted to your product instead? “On July 8, 1853, the U.S. Navy steamed four warships into the bay at Edo and threatened to attack if Japan did not begin trade with the West.” Subtle — “Fuck you, let us trade!” — but don’t get confused. This wasn’t the same playbook Caesar ran: the demand was trade, not tribute

Mercantilism is not friendlier than Feudalism — history makes that very clear — but voluntary trade creates Wealth, which means the Mercantile system has access to a potentially-larger economy and thus more Wealth than the Feudal system, which makes Mercantilism more effective in both international and intranational competition.

And competing matters. It matters because the Mercantilist world did not replace the Feudal world, it exists on top of it. This is the second layer in the Full Stack of Society, and a core point that I’ll reiterate a few times is that all layers of the Stack can exist at the same time in the same place.

If you fail to compete, Julius Caesar and the Normans and their ilk are always there on or within your borders, Blood and Iron in hand. Invest wisely. Hot-take: the violence and threat-of-violence underlying Colonial Mercantilism was and still is morally heinous.

I know, “Colonialism == bad” is hardly a spicy opinion among Millennials today.

Here’s a spicier one: genocidal terrorist slaver Christopher Columbus, in pursuit of spices, sailed 100 men on 3 medium-size boats made of wood and nails across 3,000 miles of uncharted ocean, over the (scientifically correct) protestations of leading scholars, faced down sabotage and a mutiny, and drove those men onwards into the void, past the point-of-no-return, when more than half their supplies were consumed and land was still unsighted…

I’m not really expected to believe he went through all that just for some great spices, right??

Am I?

Mercantilist Competition Necessitates Predatory Geopolitics

Every schoolkid in America knows “Columbus sailed the ocean blue in 1492.” You know what else happened in 1492? Catholic Monarchs Isabella I and Ferdinand II finally won a 10-year war against the Nasrid dynasty, “ending all Islamic rule on the Iberian peninsula.” (Iberia is Spain + Portugal, for my American readers) Most of modern-day Spain had been under Muslim rule for 700 straight years, since the Umayyad Caliphate began their conquest.

700 years is a long, long time to spend as a conquered people, part of a distant Empire.

Here’s another famous quote from Science Fiction:

He who controls the spice controls the universe

You know who controlled the Spice Trade from the fall of the Roman Empire through to 1492?

Spoiler: the people in the middle. The middlemen. Mercantile literally means “of or relating to trade” — which means you need merchants.

When Isabella & Ferdinand won their little backwater war for Spain, the Ottoman Empire had just conquered Constantinople, i.e. the Byzantine Empire, i.e. the last vestiges of the Holy Roman Empire. The guy who did the conquering was just 21 years old and is still celebrated in Turkey as Mehmed the Conqueror, responsible for converting the world’s largest church into a mosque. We don’t need to ask how the Spanish felt about that one.

Isabella & Ferdinand spent 10 years fighting a grueling war against a fringe-Muslim dynasty just to claw back their own home soil, you think they wanted to bang with the big boys?

And yet. The Spice. He who controls the spices controls the universe. Armies are expensive. Control of the trade routes means control of the global economy, the ability to finance larger military spending, bigger and better equipped armies, the ability to capture more trade routes. It would mean your neighbors couldn’t fuck with you.

A hypothetical Western spice route, if Columbus found it, would take that all away from the Ottomans and shift the global power balance into Spanish hands, all without needing to fight a militarily superior foe. Imagine how that map above would look if America didn’t exist — China and Spain would be right next to each other, and the Ottomans would be irrelevant!

A rough day at the office in the year 1492

So it’s no surprise Columbus sailed into the Abyss. Who knows what his personal reasons were. He wrote a diary, you can read it, he comes across as a diligent Catholic zealot, which is perhaps critical to undertaking such a voyage. But the point is: someone was going to have to go. The future of Spain depended on it.

Thus begins the Mercantilist Era. The eventual victorious hegemon of which — the British — ultimately owned & dominated the very same Spice Trade that sent Colombus to the Americas.

Where do you think all that Spice Opium sold into China was grown? Certainly not on England's green and pleasant land.

Generating Wealth in a Mercantilist World is more complex than in a Feudalist world: your goal is to insert yourself into the global flow of goods and sell someone’s productive labor outputs into someone else’s consumption, so that goods & services leave your hands and gold & currency accumulate in your bank account. By any means necessary.

Investing in a Mercantilist World is also much more complex: you need to procure product to sell, uncover markets to sell into, secure trade routes to transport that product, and pay for blood and iron to defend both of those. None of that comes cheap, and as with Feudalism, positive initial returns on investment compound to build Wealth faster than those around you, allowing you to insert yourself into an ever-greater share of global trade.

Mercantilism Today: Pax Americana Secures Arab Oil

Mercantilism is the second layer in the societal cake, and parts of the world that still deal in High-Value Raw-Materials that can be sold into someone else’s consumption operate in a classically Mercantilist way.

To the extent that other nations and peoples are willing to overcome their Zero-Sum Feudal instincts and engage in Mutually Beneficial 21st Century Free Trade with America, we are ready, willing, and eager to trade back with them — like the British before us, the global naval hegemon encourages laissez-faire value-creation from everyone else and not Mercantilist value-capture. We await our trade partners with open wallets, so long as they submit to our worldview of the right and proper way to conduct global affairs, and we hold the trade routes hostage until they comply.

For everyone who does refuse, there’s Mastercard Commodore Perry a Carrier Strike Group capable of conquering the world twice-over:

This map shows the accurate locations of U.S. Carrier Strike Groups and Amphibious Ready Groups. It’s publicly available and updated weekly, because what’s the point of having a Big Swinging Navy if you don’t tell people about it?

This map puts America in the center, because that’s what any good map-maker does for his home country, but once more, just like the Spice Trade of 500 years ago, the Arab-Muslim world should be in the center of this map. I don’t have to spell it out, you know what their main export today is, black gold, black Spice, the lifeblood of an industrialized economy. Oil.

Try and draw an overseas route on this map, which is current as of October 11th, 2018, to get Spice Oil out of the Arab world and into Russia or China, without passing within obliteration-distance of a publicly-known U.S. Carrier Strike Group or Pearl Harbor. Seriously. Try sketching a route! It takes 10 seconds to realize the impossibility and it taught me something. (If you don't know where the Arab world's Oil actually is, you can start at the small patch of water to the left of "LHD 2")

If you succeed where I failed, Russia or China will pay you a billion dollars and you don’t have to give me any credit. I’ll be moving somewhere rural with good hunting and bad weather quicker than you can say “unstable geopolitical climate.”

Encyclopedia Britannica and Wikipedia will both tell you that Mercantilism was a dominant national economic policy from the 16th to the 18th centuries, "after which it was largely replaced by more laissez-faire policies. Historically, such [Mercantilist] policies frequently led to war,” Wikipedia helpfully adds, without really explaining why. The reader is expected to note the remarkable lack of war in the prior Feudal world (lol jk) and realize the complex international Mercantilist System looks like this:

[Global Trade] → [Requires Access to Products] → [Requires Ownership of Products] → [Requires Access to End Market] → [Creates & Captures Wealth] → [Funds Military] → [Guarantees & Expands Sovereignty] → [Allows for More Trade] [LOOP]

…and note that this is one hell of a fragile system, with many vulnerable international links that could be broken by a hostile power. A fragile system that sits on top of a landscape of nations that don’t trust each other because the base layer of the stack is always Feudal conflict: if you can’t create Wealth, you can always Take it. Vae victis, baby.

Which is to say: the subsequent “rise” of “more laissez-faire policies” looks indistinguishable from a victorious Mercantilist global hegemon. So long as there are other capable nations willing to compete, the possibility of building Wealth through Mercantilist value capture will be too great to resist and laissez-faire will be an impossibility.

I mentioned Pearl Harbor, and it’s fittingly still marked on the official map of US Carrier Strike Forces up above. The brutal Japanese War Machine of the 20th century thought to conquer the rest of Asia, to become the Mercantilist colonizer and not the colonized (Commodore Perry’s 1853 legacy and British actions in China branded imprints that read “How To” on the Japanese Elite). When Western public opinion swung sharply against Japan’s treatment of China, the U.S. used the very same Naval positions in that map above to break the links in Japan’s Mercantilist Wealth-building machine, necessary for the running of their Empire.

No manufactured parts were allowed to be imported to Japan by anyone. Then no machine tools. Then no airplanes. And, eventually, in July 1941: no Oil. 6 months later you get:

A rough day at the Pearl Harbor branch office in the year 1941

How can you run a Global 20th century economy without manufactured parts, machine tools, and Oil? You can’t. Thus: war. “Fuck you, let us trade!” Irony.

The First-level analysis of restricting Trade to punish a bad actor is that Trade is good for economic growth, economic growth funds military expansion, restricting Trade hurts the bad actor (wait but wouldn’t that hurt us too?!?!) and impedes their political goals, and self-interested bad-actors are therefore likely to curb their misbehaviour. Today we mostly call these Trade Sanctions, we use them to influence the behaviour of other nations, and Econ 101 says they impose an equal cost on us. A cost we pay willingly because…

…the Mercantilist Second-level analysis is that the Economic is indistinguishable from the Political and what matters in political conflict is not absolute power level, but relative power level. Since we’re already the biggest kid on the block, the global hegemon, geopolitical stability depends on us maintaining that relative power-gap, and as the imposer of Trade Sanctions we pay a cost — a real economic cost in lost trade, yes, but also a direct military one in its enforcement — to prevent the ascent of another superpower.

In 1941 that ascendant power was Japan, and we happily opted into paying an economic cost to keep them in their place. No prizes for guessing how that ego-blow was/is felt on their national psyche.

There’s a Third-level Mercantilist-Econo-Political analysis possible here too, which is to consider the implications of restricting Trade on the bad actor’s remaining viable strategies for building Wealth in the event that they do not kowtow. Hint: every layer above Feudalism requires Trade.

Snap back to the present — or rather, to 2014…

Shipping Oil by sea is 50 times more economically efficient than shipping it via land. But if you really had to find an over-land route, because you had no other choice, because there’s the most fearsome strikeforce to ever sail the seas parked between you and the Oil, and if your name rhymed with Russia…because it was Russia…which route would you choose?

Excuse my awesome MS paint skills. All the Oil in the world is buried on the shores labeled “Persian Gulf”. Red border = Russian border, black arrow is over Russian land and points towards the shortest route to get the Spice to Moscow

Look, real life is complicated, I get it & I’m not saying these two maps — US Carrier Strike Force and Google Maps — together explain the entire sorry state of affairs in the Middle East, or Putin’s friendships with Iran and his interest in Syria, or his “shocking” invasion annexation excursion to Georgia, birthplace of Joseph Stalin, a few years back, or our interest in Iraq (conveniently situated as the final blocker).

Although I’m not not saying that. Listen to Peter Zeihan if you want to begin to understand geopolitics, and look for mentions of “Oil” and “Sanctions” in the very loud, very public broadcasts we make about the location of our Carrier Strike Forces. Pro-tip: As disappointing as it might be to Israel, Iran is not the superpower America is really worried about.

What I am saying: the reports of Mercantilism’s death are greatly exaggerated. You can’t run a Global Empire without trade, you can’t run a modern Economy without Oil, and we use 11 of these bad boys to hold the metaphorical gas-pump:

Pictured: "…after which it was largely replaced by more laissez-faire policies.”

Sidenote: On “Capturing” Wealth and Imperfect Competition

When I talk with friends and describe “Capturing” Wealth in a Feudal world, most immediately understand what I mean: The Feudal Peasant works all year in the field and generates $[X] of surplus Wealth in agricultural produce.

At the end of the year his local Lord charges him ~$[X] for the privilege of using the land. While there’s some implicit use of force present in this exchange, the vast majority of peasants pay their Fees without complaint (otherwise the Lords would’ve been off threatening and killing their own peasants all day — bad for business!).

The fact that the Lord is able to afford the massive expenses of armed guards, a castle, a house and servants, fine clothes, spices for their food, paintings and churches, tea to drink, and so on, suggests that the Lord is not operating at a subsistence level — he is Capturing the Surpluses of all the peasants working his land.

Even if this hypothetical Feudal world was a Non-Violent Utopian Libertarian Free Market Economy, the supply of peasants in the Feudal Malthusian Trap was far greater than the supply of land, which pushes the price of peasant labor to zero and the price of land to ~infinity.

The end result is that despite laboring all year and actually producing a small Surplus, our poor Peasant is unable to Capture any of that Surplus. He has neither the political means (i.e. swords) nor the economic means (i.e. scarcity) to do so. Thus his Lord takes it all in Rent and Fees, which will always & forever be calculated to be approximately “everything.”

But what does it mean to “Capture” Wealth from Trade in a Mercantilist world?

Mercantilist commodities are valuable because they are scarce — just like land. There’s no Perfect Competition to be found here.

One of my first links in this Mercantilism section explains that voluntary Trade creates Wealth because it only occurs when both parties expect to gain. When your customers purchase your valuable commodity, they do so under the belief that owning it is worth $[Y] to them. The trade usually occurs so long as you price below $[Y].

Therefore you should charge your customers as close to $[Y] — as close to “everything” — as you can get. The degree to which you lower prices and allow your customer to gain further from Trade corresponds to your control over the market and your own borders: i) If you can’t keep competitors out then you’ll have to lower prices to compete, ii) and if you can’t secure your borders adequately then you’ll have to keep prices low enough to satisfy your neighbors. No need to have them getting all Feudal on you.

Trying to maximize the total net payout you get from customers is business as usual to everyone who’s ever run a company or owned a P&L. What’s distinct about the Mercantilist approach is the intentional attempt to INCREASE the “imperfectness” of the market via political measures, such that all Trade flows through you and not a competitor, which allows you to participate in 100% of value-creating global Trade and “Capture” as much of that value as humanly possible.

Under a state of Perfect Competition, no economic profit is possible. So if you want an economic profit, the solution is quite clear.

“Political measures” might mean tariffs, treaties, quotas, subsidies, single-market agreements, unwritten agreements, threats, unequal taxation, blockades, blocking access to financial markets, funding piracy, fomenting rebellion, outright military conquest, etc. etc. — whatever it takes. Sometimes the product is sufficiently scarce that mere ownership is sufficient. For more on why it’s important to Capture the value you create if you care about building Wealth, listen to Stanford’s Startup Class #5: “Competition is for Losers”

Industrialism: Mercantilism, But With Production Brought In-House

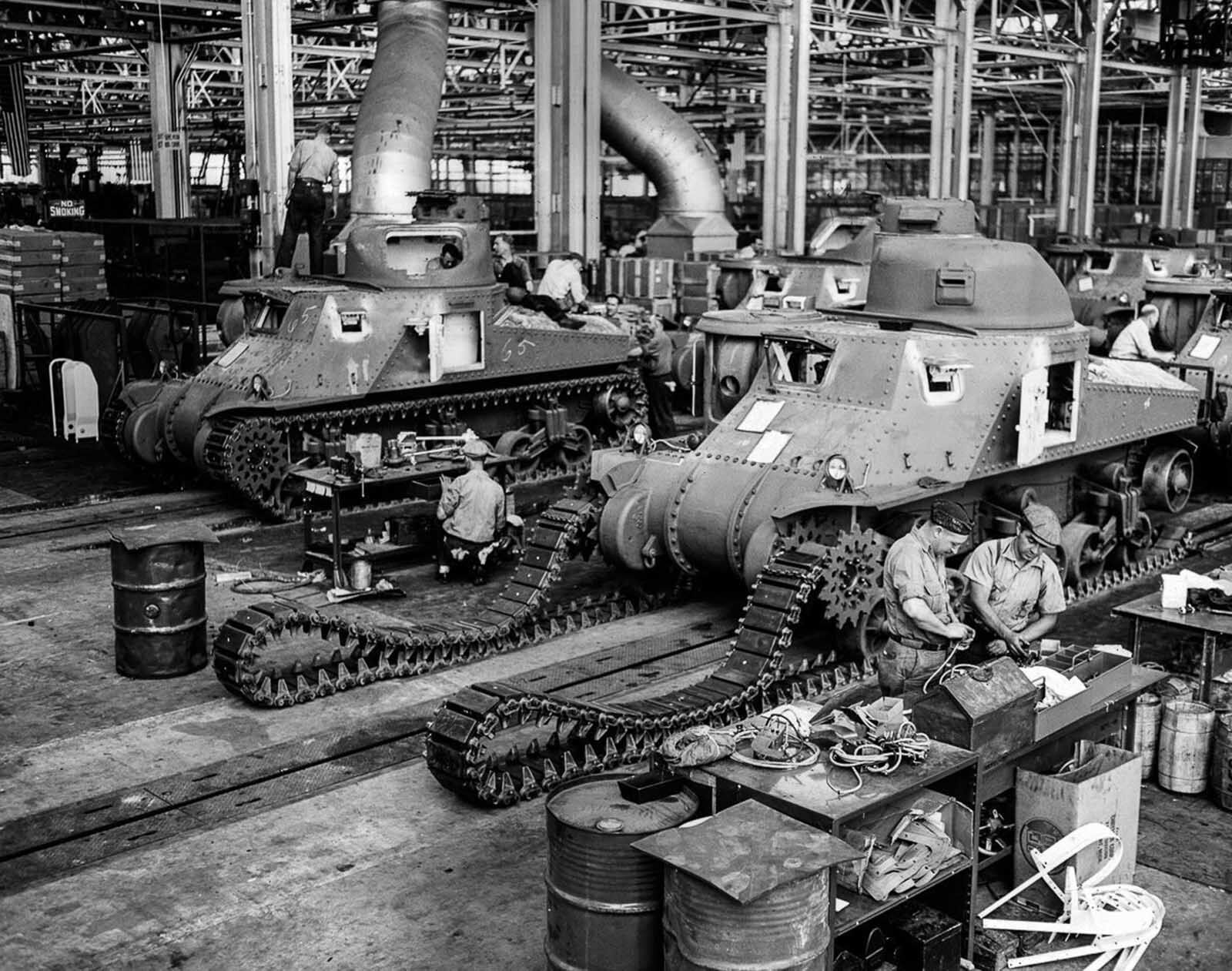

Capitalism, Communism, and Fascism might have been the dominant competing political ideologies in the 20th century, but that argument was about who was going to hold the surplus Wealth, not how it would be generated. Here’s American, Russian, and German Factories:

Can you spot any differences? I can’t.

The Industrial Revolution answered how to generate Wealth too clearly for anyone to argue with: burn Fossil Fuels! Specialization of labor, burning coal, oil, the factory, urbanization, conglomerates, the steam engine, the internal combustion engine, electricity, etc. etc. etc….

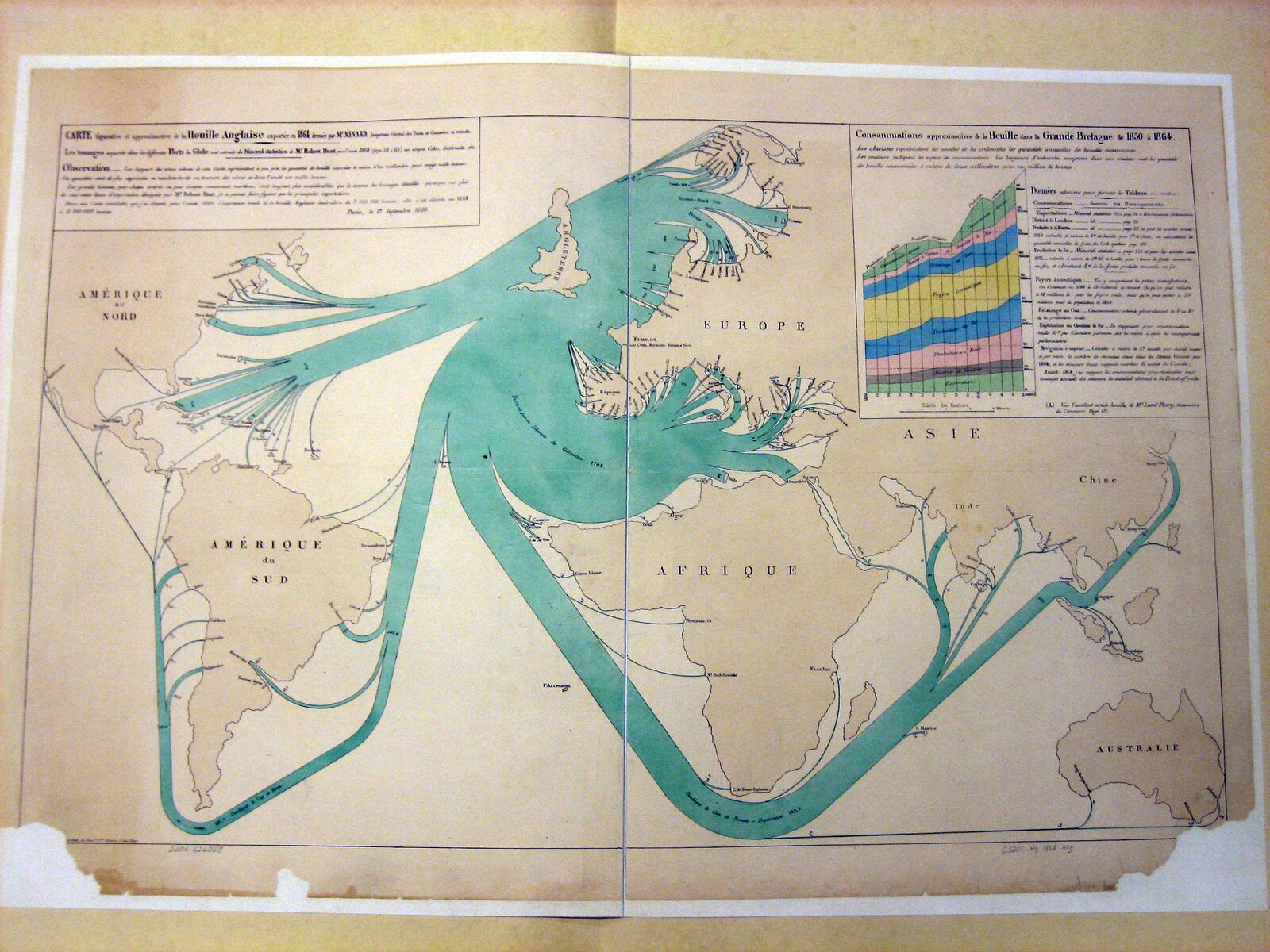

British Coal Exports in the year 1864, 1mm thickness on the blue bars is equal to 20,000 tons — note that the bulk of British Coal was actually consumed in domestic production — this was just the leftovers

The core lesson is simple: for the first time in history, a large group of people could purchase some raw materials, engage in additive and productive domestic labor, and then sell those same materials and generate tremendous surplus Wealth. The distinction between individual, corporation, city, and nation state is intentionally blurred here because the principles of Wealth generation were the same at every level.

No colonization was required — you didn’t have to get the raw materials “for free” to make a profit anymore. No slavery needed — you didn’t need to get the labor “for free” to make money. All this on top of a ready-made, secure, global, interconnected web of Trade routes, thanks to 450 years of European Mercantilism.

That’s basically the end of the lesson on “Industrialism”. You don’t need a fancy education to understand how different this was from what came before, nor how powerful this idea became. You. Could. Create. Wealth. Domestically.

The industrial revolution didn’t displace Mercantilism, it just brought production in-house, moving the production stage moved from Zero-Surplus (colonial) labor to domestic Surplus-Capturing factories[1]: Oil and Coal multiply the output of human labor by 10,000x, so as long as you can purchase fossil fuels on the open market and provide safety and stability for your factories, you can export valuable products into the global market and build surplus Wealth. The more Imperfect you can make that competition, the better.

Investing in an Industrialist World is simple: i) import raw materials and fossil fuels, ii) build factories, iii) attract laborers with higher wages, and iv) export finished products. Surplus Wealth can be spent to buy more of any of the first three parts of that chain, no conflict necessary.

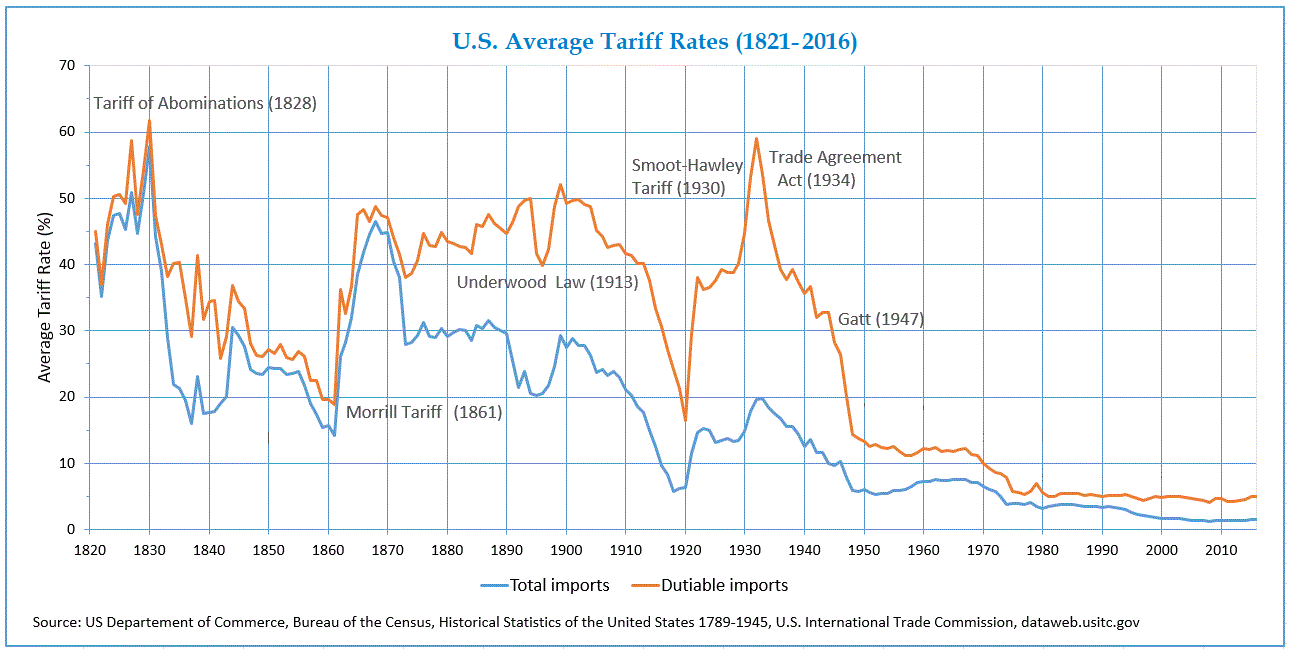

However, importing raw materials & increasing manufactured exports can be difficult when your customers are still running the Zero-Sum Mercantilist playbook. Today we might think of that playbook as including things like Tariffs, Subsidies, Quotas, Price Floors, Targeted Tax Breaks, and other fun goodies, but the British were not above outright criminalizing ownership of foreign-produced cloth for 90 years, contributing in part to the destruction of India’s textile industry and the deindustrialization of that country (yikes). Trying to sell Industrial outputs into Britain was not a fun job, and it’s not like the British were the only ones playing these games.

Some people ask: “Why did the industrial revolution begin in Britain?” A better question might be: “how could the industrial revolution begin anywhere other than the nation which controlled the Global Mercantilist trade routes?” Bringing production in-house is all well and good, but if you can’t sell any of it then you’re running a make-workshop, not a business. The whole point is to sell the stuff, not build it!

But for whatever reason, people do not get distribution. They tend to overlook it. It is the single topic whose importance people understand least. Even if you have an incredibly fantastic product, you still have to get it out to people. — Peter Thiel

Rapid increases in domestic productive output (thanks to fossil fuels and factories) destabilize existing Mercantilist econo-political equilibria, and the “anyone can make anything domestically” nature of Industrialism means that every potential customer is also a potential competitor.

Because Wealth compounds quickly under Industrialism (thanks to myriad investment opportunities and the 10,000x productivity multiplier of fossil fuels), your “customers” today would only need to build a small Industrial advantage over your own factories to begin building Wealth for themselves and “justify” their initial “expense” in Zero-Sum Mercantilist policies, after which the Industrialism pays for itself. Re-routing Global Trade Routes to include your own company/city/nation is painful, in both time and money, and it gets more painful the more goods & services are already in motion.

That pain makes the Trade flows “sticky” by raising the cost of “market entry” for new participants, increasing Imperfect Competition in the market, which enables the dominant players to begin Capturing Wealth from Trade:

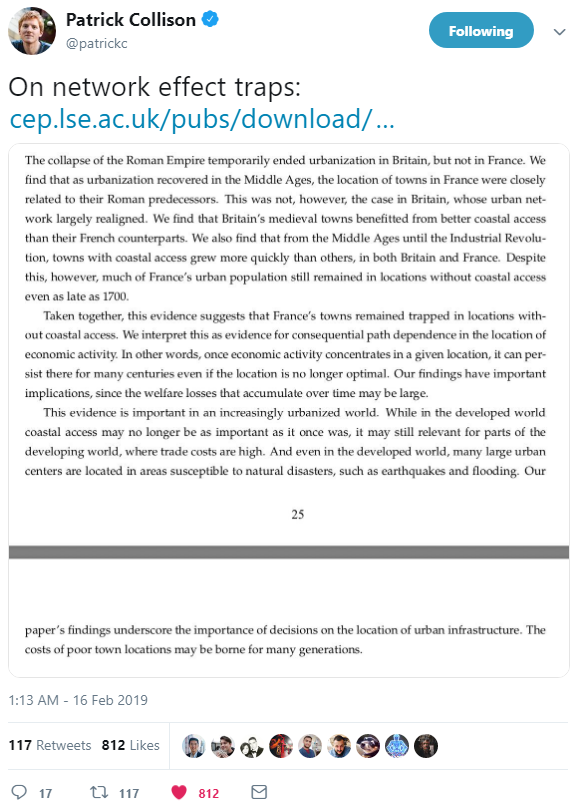

See this tweet from Patrick Collison on the geographic stickiness of Economic Networks established under a Feudal system

“Consequential path dependence in the location of economic activity” isn’t exclusive to Feudal Rome. To spell my point out more clearly: The Town is to Feudalism as the Trade Route is to Industrialism. Sticky, self-perpetuating, network-effect-creating, often a Nash Equilibrium, and increasing of market Imperfection in a way that allows existing-participants to Capture Wealth.

If you run a business, any investment you can make to bring “sticky” (read: low-churn) customers to your business has the potential to pay itself back many times over. Business analysts and strategists will be able to run the numbers for you quite easily: LTV, CAC, Years to Recover CAC, MOIC, IRR. If you run a country, the data sources are sketchier, the numbers are all multiplied by ~[A Trillion], and your options include massive political interventions, but the principles are unchanged.

Industrialism Today: More Billionaires in Communist China than the US?!

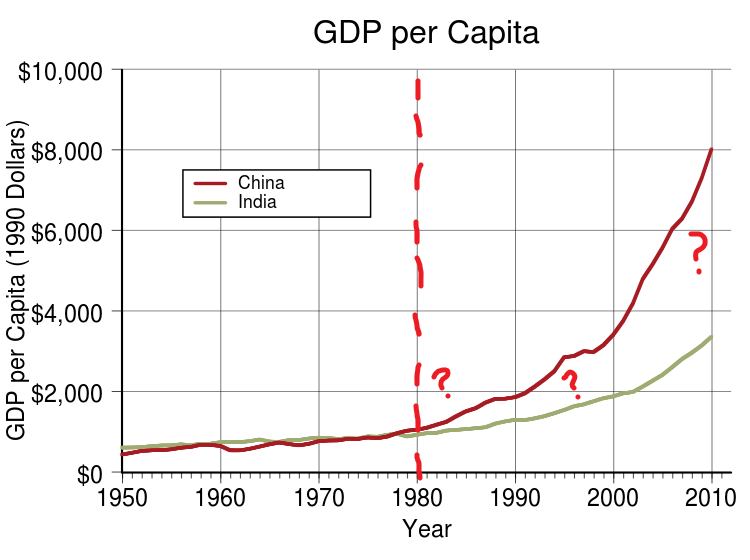

I call this: “A chart that’s interesting to people who want to know how Wealth is built for a whole society.”

We might ask, what — and who — the hell happened to China around 1980?

Enter Industrialism (what) and Deng Xiaoping (who), who coincidentally spent some of his childhood working in French steel mills as part of China’s 1920s Work-Study Movement, where he got to see the European Industrialist machine in action.

China’s Mercantilist policies have been called out frequently by people across the political spectrum, which I think can be confusing for those who remember Mercantilism as a British system based on exploitative colonies and not as the belief that Wealth Created through Trade can be Captured by one of the participants, coupled with State policies explicitly focused on selling productive labor outputs into someone else’s consumption and accumulating “gold” within your borders.

Industrialism as I’m describing it is just Zero-Sum Mercantilism with production brought in-house. For China, these policies include: (i) Currency manipulation of the Chinese Yuan (read link for simple explanation of how this works), (ii) Special Economic Zones to incentivize building of domestic industrial capacity, (iii) a 17% Tariff on all Imported Goods to dissuade foreigners from selling into China, (iv) massive difficulties moving cash out of China for both companies & individuals, (v) and more than $3.6 Trillion of foreign currency reserves, aka “gold” — more than double the next-largest holder.

Translation: raw materials in, finished goods out, dollar-bills in the bank, and if you want to build a business in China then, at least on paper, it better be owned by Chinese nationals.

Remember: the goal of China’s government is to employ & enrich Chinese citizens. To quote Zeihan:

It doesn’t matter if you can make a product, or if you have a business plan, or if it’s a good idea, as long as you’re employing people — that’s the goal of their development model. Because if people have jobs they’re not going to get together in large groups and go on long walks together. Politburo doesn’t like to see that: that’s how they got their jobs.

Currency manipulation, tax discounts, and tariffs on imported goods are all fundamentally competitive measures designed to shift more of the Wealth that is generated globally into China’s economy — and keep it there.

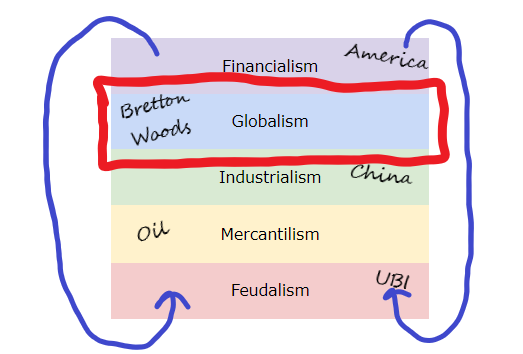

This section might be about China, but apply the points elsewhere and you notice who else is playing the competitive game to boost the Wealth of their Nation. You ever wonder why Ireland is ranked 5 places higher than the US on GDP per capita rankings (28% more GDP/capita)? I’m not suggesting wellbeing in Ireland is really higher than in the US, and I’ll touch on differences in material standards of living later, but this productivity gap is often surprising to people. Do you know where we Americans establish our Tech companies’ European Headquarters? And why?

Source: Red arrows == 4 largest economies in the EU

You ever wonder why the EU gets so mad at Google & friends? Their “Single Market” rules allow any entity headquartered in any member state to Trade in Europe unencumbered by additional taxes and tariffs, but the freedom of member states to set their own corporate tax rates allows for a Zero-Sum competitive game to play out when it comes to the domiciling of non-EU businesses.

This isn’t a major concern to the largest EU members (Germany / UK / France / Italy) when it comes to traditional Industrial companies (automotive, etc.), because non-EU businesses who want to build things in the EU will set up their factories and offices in the nations best suited to actually building things and whose final product-outputs will be closest to its end-market customers.

For the uninformed, that means: Germany, UK, Italy, and France.

But Software? The product “output” is delivered instantaneously over the internet, at almost-zero marginal cost. There’s no reason to favor one EU-member over another when it comes to choosing a country for your European HQ (and therefore whose national budget to pay taxes to).

Which means large EU-member states, encumbered by aging populations, large Welfare states, meaningful military expenses, and a whole host of other cultural-econo-political reasons for having higher tax rates, see a non-EU business provide value to their citizens, profit justly from that free trade, but then go “untaxed” on that profit (to a French official 12.5% might as well be untaxed!). Profiting from the economic activity of French citizens without paying taxes offends the French sense of fraternité. Profiting from German citizens without paying into the EU seems like an inefficient loophole that needs closing to the Germans. Profiting from UK citizens without paying (figurative) tribute to the Queen is a capital offence to the British. Thus all the anger.

(To profit from Italians without paying taxes is called “Business” in Italy).

And all that comes before any of those folks even thought about the second-order-consequences of what this system does for the viability of domestic French or German Technology companies, who have to compete — within their home market — with US-based companies who earn ~20% more on every dollar thanks to Ireland & EU rules.

Of course, the real target of anger should really be Ireland, for playing (and winning at) these games. But the EU isn’t exactly on the firmest footing right now, and “Germany mandates new Tax Rates in Ireland” doesn’t sound so good over the airwaves. Sorry Google & Facebook! The toxoplasma of societal rage chose you as its sacrifice, enjoy the fines!

Back to China:

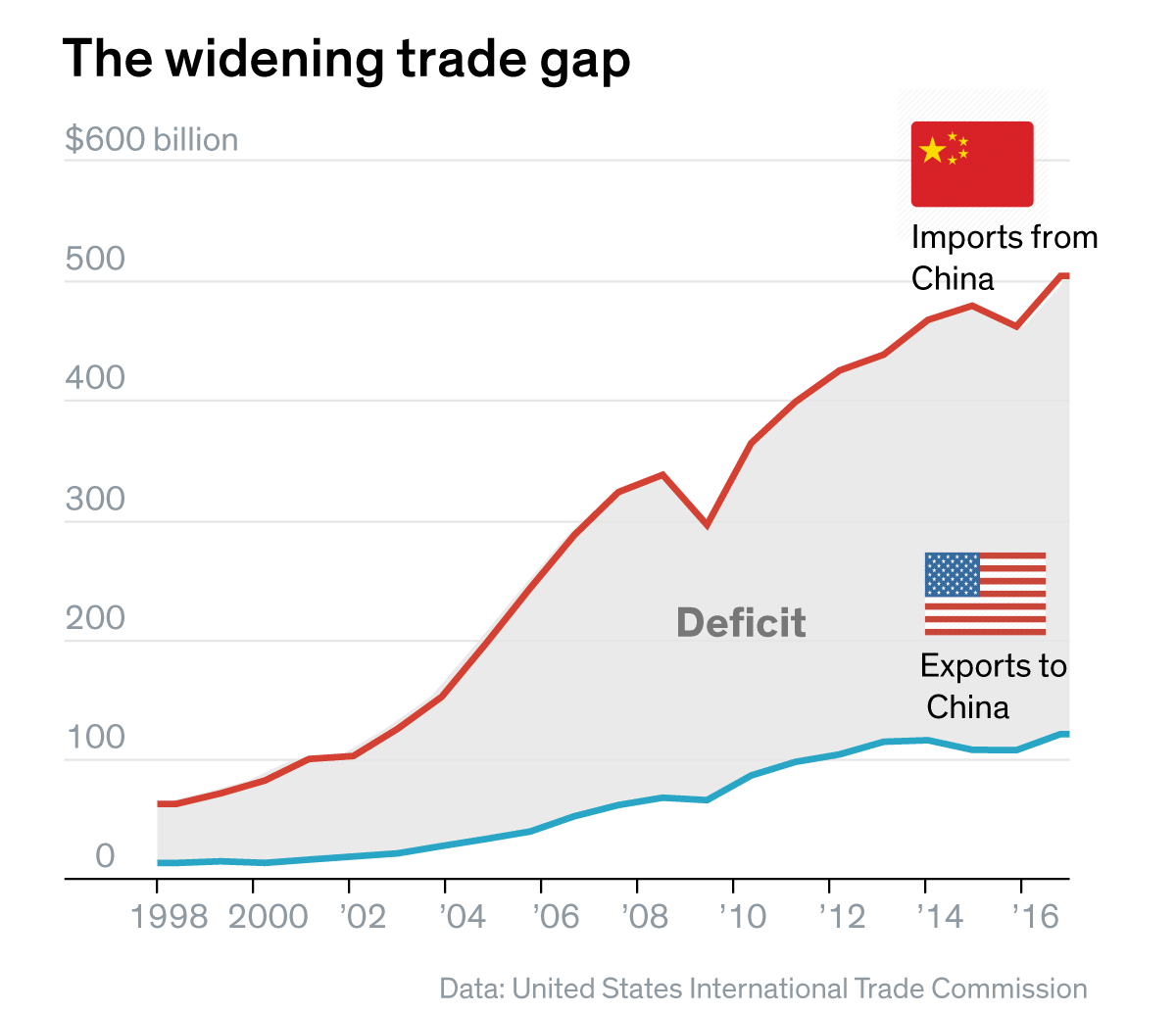

This is the exact inverse of China’s Import-Export balance with Britain during the Mercantilist Era, in which China was relegated to a barely-autonomous Consumption State for British-owned Spices

China’s leadership, beginning with Deng Xiaoping in 1980, “liberalized” their economy to a large degree — by which we mean they allow market price signals to work (most of the time) in order to efficiently reveal which Trades will create Wealth. However, they make clear that the Wealth created must largely flow through Chinese hands — it must be Captured.

If the policies I listed earlier don’t quite work………well. A government representative might drop by for a quick chat with some extra regulations requests. Paraphrasing a friend of mine from Shanghai: “yeah, [the local representative] suggested our firm not make any trades on the public markets tomorrow.” You think he made any trades the next day? Of course not, he knows how to play ball.

China’s exact laws are left intentionally ambiguous to leave the State wiggle room to achieve their desired outcome and to keep everyone else on their toes. Everyone knows about their “Special Economic Zones”, but there’s no detailed book of legal codes laying out the exact letter of the law in those Zones, it’s all left in general terms. They also don’t pretend to separate Company and State, whereas in the West we like to pay homage to such fictions. Say bye bye, Uber — sadly China had 4 million unemployed military veterans and Didi presented a domestic solution to the problem of 4 million jobless men who know how to shoot and have to feed a family. It sounds like a conspiracy theory, and it is I suppose, except basically everyone in Silicon Valley believes it and those links go to Harvard Business Review & The South China Morning Post (i.e. this is mainstream orthodoxy for the elite in both countries).

The cynical view is that China’s Orwellian data-snooping policies intentionally serve a dual purpose of filtering the West’s most valuable companies out of the Chinese market. They know Western Tech companies don’t want to be seen to capitulate to totalitarian regimes — so they wield privacy-violation & censorship requirements as an effective form of self-imposed protectionism.

The bulk of Google’s monopolistic Search-industry profits come from Advertising, not from articles on “Government Corruption” & “Tiananmen Square” — but by requiring the censorship of those topics and the privacy-invasion of “suspected dissidents”, Google must cede all the Advertising profits from China’s rising middle class to Chinese-owned-businesses, and therefore to Chinese nationals, and therefore to the Chinese government.

This is what the game is all about. Pick another country and try to get a more valuable autocompleted list. It’s a fun game. I’ll buy you coffee in SF/Boston if you win.

The non-cynical view is that this is all just plain old boring Orwellian Totalitarianism, exactly what we expect from a “stupid” dictatorial regime, to be condemned vociferously and analyzed only in passing…

Yeah, call me a cynic on this one, chief.

Wikipedia gives a quarterly updated list of the Most Valuable Companies in the world and helpfully includes the national flag of each (to make sure you’re keeping score):

Are we winning if we have more of the top places? Or if the sum total of all our valuations goes up? I know how the Econ professors would answer that question — but what would China say? How about Germany?

Of the US Tech Companies in this list only Apple creates significant material prosperity (jobs & Wealth) for Chinese citizens in the natural process of selling product. (Not-)Coincidentally, all the others have had difficulties shipping product into and out of China, had their IP stolen, had unpleasant regulations imposed, or had competitors propped up directly by the Chinese government.

There’s a reason the “Chinese version of Apple” was historically just Apple — check the Google autocomplete image again.

And so Elon Musk begins work on Tesla’s first non-US factory this year, located in China of course, to the tune of a $5 Billion investment. Smart, smart man.

If you want to make a trillion dollars selling cars…there’s 2 markets you have to capture. By my napkin math, China has room for growth of 2-8x. The question is: would Tesla be allowed to Capture this market without their commitment to invest $5B+ and create jobs & Wealth on the ground? Is that investment even allowed to be majority-owned, on paper, by US citizens?

The use of more-stringent regulations for foreign companies in order to foster a more Imperfectly Competitive Market for domestic ones is not unique to China — they’re just the largest & most successful player of the game in today’s international market.

China did not create this tight-linked mode of Politics (i.e. Capture) and Economy (i.e. Creation). Chinese Exceptionalism makes for a good story — we all like to believe our culture is exceptional — but this is an old, old playbook. It might be the only playbook ever on developing a modern superpower without unique geographic benefits:

China copied and improved South Korean Industrialism (1980)

South Korea copied and improved Japanese Industrialism (1960)

Japan copied and improved German Industrialism (1870)

Germany copied and (significantly) improved British Industrialism (1850)

(See the detailed notes section [2] at the end of the essay for much more info on those bold claims)

And America? Where does today’s Global Hegemon fit into that pattern? Well, the world’s gonna know his name, to quote the musical: “his enemies destroyed his rep, America forgot him”, but he literally wrote the playbook (and even though I linked it there, nobody is gonna read it — it’s too long, too old, too admitting of its own flaws, and far too incisive, and he probably doesn’t have a section dedicated to U.S. manufacturing despite the high cost of domestic labour…right?)

Right. Ctrl-f for “dearness of labour” if you’re curious

It’s not a complicated playbook — if you studied U.S. history in highschool you probably learned about it in a stale, lifeless sort of way, absent the recent context that makes it noteworthy — and China has certainly modernized the tactics. Things have come a long way since the 1800s, but Industrialism still enables large scale Domestic Surplus Wealth production — and with newfound Domestic Power comes increased Domestic (Political) Responsibility.

Many today resent the idea that America engaged in the sort of naked support for specific industries that is common to nations operating Industrialism — and that this actually worked out pretty well for the overall growth of the nation. I know, I know, the sample size is n=1, we’ve got no control group for America — or any other industrial superpower — achieving regional hegemony without these tactics, so we can’t see what the trajectory would’ve looked like without them. I get it. I listened to Milton Friedman’s stuff too.

On the opposite end of today's political spectrum, you often hear: “The Government is in bed with Big [Pharma/Auto/Agri/Military/Education/Finance/Business]” voiced with weary anger, an accusation that’s both a meme and true, whether its General Motors or Solyndra or Raytheon or Pfizer or Harvard.

But today we condemn these all positions, decrying them as an unfortunate-but-perhaps-unavoidable corruption of power, and accepting the mental-framework that State-interference to benefit winners is anti-American.

[Romney] took the line that government support for specific companies discouraged all investment in U.S. industry…

Don’t mistake my analysis for advocacy — I’m not saying Romney’s wrong. We don’t trust our Government as far as we can throw them, and their track record over the last couple of decades has been pretty questionable (that’s British for: “shit”). I don’t know if the Chinese trust their Government or not — would you even believe those polls? Deng Xiaoping, market “liberalizer” in chief responsible for all this Wealth generation, also presided over the exact Tiananmen Square debacle that we all sort-of-kinda-not-really know about:

“Students linked arms but were mown down. APCs then ran over the bodies time and time again to make, quote ‘pie’ unquote, and remains collected by bulldozer.

I’m just saying it reveals as much about Romney’s (and our) opinion of the caliber & self-interest of our Government today and their likely Investment decisions as it does about the pros and cons of “government support for specific companies”. And I’m also saying it was not always this way in America:

Pop Quiz: Why does the US Flag have 13 stripes? Is this not the world’s best ever /r/HailCorporate?

To clarify before my point gets mistaken, my point is that “government support for specific companies” is one possible choice which exists on a spectrum of choices created by the Domestic Wealth-building power of Industrialism, not a simple binary of [Highly Targeted Cronyism] or [YOLO Laissez-Faire]. It is possible for Romney to be entirely correct and “Crony Capitalism” to be an absolute shit show of privatized-gains and socialized-losses (it is), and simultaneously possible that “Consequential path dependence in the location of economic activity” can be deterministically steered to the (dis)advantage of your constituents (it can be).

There’s no Guaranteed Way to open the Pandora’s Box of Political Intervention (“steering”) while protecting yourself from the ever-present excesses of wasteful Cronyism and reduced Total Global Wealth. National Culture and Checks & Balances can help, but no promises. Much like my note in the Mercantilism Recap, the default that Western students are now taught is that opening Pandora’s Box always ends in tears — better safe than sorry. I get it. Judge Governments on their track records. I know how ours looks.

But every one of my European readers should know that deciding where to legally domicile EU Headquarters for US Tech companies is not actually a decision. There is no choice to make. Only one option. And they should consider why that is and what the first, second, and third-order consequences of that decision might be.

And every one of my ~225 Japanese readers should ask why Elon Musk chose to spend $5 Billion building his first non-US factory in China and not Japan, which already has the infrastructure to support everything he needs and is the world’s second largest automotive producer and has a reputation for not stealing all our most valuable IP and ripping it off on a massive scale and then preventing our companies from operating in their country.

Just because you choose not to open Pandora’s Box of Political Intervention, doesn’t mean you’re free from the consequences of others opening the Box. Consequential path dependence plays out whether you like it or not.

The only solution that keeps control of your destiny in your own hands is to Play to Win………or somehow prevent everyone else from playing the Zero-Sum Mercantilist games:

Globalism: Export Industrialism Itself & Share In The Wealth

Wealth-building under Feudalism concluded with an exhortation to “Take it and Tax it!”

Mercantilism with “Take it and Sell it!”

And Industrialism with “Make it and Sell it!”

You can see how the continuity flows from one to the other. There are other viable strategies I haven’t discussed in this essay that exist complementary to these 3 Core layers of the Stack (e.g. Port Cities/Nations which offer non-partisan venues with attractive tax rates for major parties to engage in trade), but it’s rare that those strategies are standalone-viable. Superpowers need a Wealth-generation machine they can compound by themselves, and that goes for Nations (China) and Companies (Amazon) alike.

When you see no investment opportunities, you’ve lost control of your growth. History tends to be unkind to those who stop growing.

So how does an Industrialist economy generate even more Wealth for itself? Industrialism made that simple: just produce & export even more product!

But what happens when there are no new customers to sell to? What happens when all your existing customers can’t afford to purchase any more product? Is that the end game of economic growth?

No! Like Derrick Rose — “we wanna go higher!”

Enter the Mount Washington Grand Hotel, in the White Mountains of New Hampshire. Enter the Bretton Woods Conference of July 1944. If the camera turned around and pointed the other way, it’d be looking at the best ski resort in New Hampshire by the way (I’m a big fan).

Bretton Woods brought a plan for Pegged Foreign Exchange markets for all currencies (tied to gold), the International Monetary Fund (IMF), and the International Bank for Reconstruction and Development (IBRD). Big fancy dry boring sounding institutions, suitable only for high-school History tests. Did you start skim-reading yet? But don’t skim past this conference — this was about overcoming the Prisoner’s Dilemma of Industrialism:

The seminal idea behind the Bretton Woods Conference was the notion of open markets. In his closing remarks at the conference, its president, U.S. Treasury Secretary Henry Morgenthau, stated that the establishment of the IMF and the IBRD marked the end of economic nationalism. This meant countries would maintain their national interest, but trade blocs and economic spheres of influence would no longer be their means. The second idea behind the Bretton Woods Conference was joint management of the Western political-economic order, meaning that the foremost industrial democratic nations must lower barriers to trade and the movement of capital, in addition to their responsibility to govern the system.

Yeah. That paragraph could’ve been printed today in The Financial Times, The New York Times, The Wall St. Journal, The Economist, The Harvard Business Review, or any other reasonable mainstream publication. This conference established the doctrine of Geopolitical Economy, both in theory and practice, for decades to come, and if you paid attention in school or listen to the media, and you’re under 75 years old, this is the system you learned was best for the world: American Capital (carrot) and Military (stick) to keep the Western world cooperating instead of defecting.

And it worked! Like no system before it. This is the system that created the Economic Surpluses Scott Alexander described in his famous essay on Cost Disease:

If some government program found a way to give poor people good health insurance for a few hundred dollars a year, college tuition for about a thousand, and housing for only two-thirds what it costs now, that would be the greatest anti-poverty advance in history. That program is called “having things be as efficient as they were a few decades ago”.

The Stack of Globalism is the simplest of the lot (assuming you understand the prior stacks), the most powerful, the most Wealth-generating, the most morally-virtuous, and the least violent. We got here by asking, out of pure Adam Smith economic self-interest, how can an Industrialist nation increase its Revenues when its Export market is already saturated?

The Bretton Woods answer: make your customers richer.

Take a portion of the Surpluses, the Wealth, generated domestically by our powerful Industrialist system and (i) invest them internationally, (ii) turning those other nations into Industrialist powerhouses in their own right, (iii) that they might then generate Surpluses of their own, (iv) which can then be spent buying even more U.S. Exports!

Our growth becomes a result of the growth of others. Their growth a result of ours. I talk a lot in my essays about the insane power of Compounding, but this is Compounding on a Global Scale. Global companies can Compound themselves across Global Markets. Globalism unlocks Compound Nations. Compound International GDP, a magical ride which wouldn’t end until the entire world was productively producing domestic goods and exporting them back into the supply chain!

U.S. Economic Development Plan, 1944-1971, as brought to you by the Great American J. Z. in my favorite song of his. The placement of the comma before “to me” really ruins the double-entendre…

Globalism Today: Flatlining As China & Germany “Capture” Their Neighbours Exports

Alas, the system was unstable, prone to financial collapses and runaway currency issues, and had to be taken off life-support in 1971 — Fixed Foreign Exchange Rates, Free Capital Movement, and Independent Monetary Policy are sometimes collectively called the Impossible Trinity. Things didn’t work out.

My friends know I like to over use hyperbole, so I’m going to make a bold claim: this Stack of society is basically non-existent today at the International level.

The core strategy of what I call “Globalism” is generating surpluses and investing those surpluses in other nations for the express purpose of developing them as a Wealthy Trade Partner. It’s not just about sending money overseas — the intention is key, and the intention is to grant Power (Wealth leads to self-determination) to others that they might then buy more from you. I get that people use the G-word in many different ways today, often in the context of companies permanently moving whole industries to other nations in order to lower their cost base, but let me stick with my reciprocal definition for a moment and ask: which nations generate large Surpluses today?

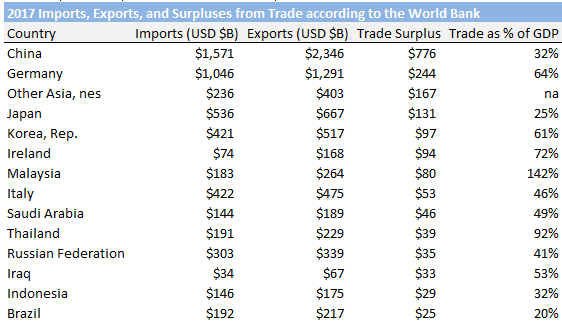

Ranked by GDP (left) & Trade Surplus (right). Email me if you’d like the full Excel file. You can quibble with the sourcing, but I took both data sets raw from the same place (the World Bank) to make sure the numbers were treated the same, no secret adjustments, and all numbers expressed in constant 2017 US Dollars.

Let me briefly go down the list and ask again: where are these nations primarily s(p)ending their Surpluses?

United States:

In a familiar story for my international readers, the US is most preoccupied with itself. Only 6 countries in the World have a lower [Trade as % of GDP] number. Namely: Occupied Palestinian Territories, Cuba, Ethiopia, Rwanda, Burundi, and Chad.

If I narrow my filter to [Exports as % of GDP], my US readers will be pleased to know they rise from 7th lowest to 28th. The nations which run lower [Exports as % of GDP] include the global superpowers: Macao, Nepal, Grenada, Lebanon, Sao Tome, Central African Republic, Andorra, Tonga, Samoa, Afghanistan, Yemen, Djibouti, Cape Verde, Mali, Kenya, Uganda, Barbados, Benin, St. Lucia, Maldivas, Pakistan, and Tanzania. That’s it.

“But the US is a massive Importer, surely!” I hear you say. Which is why when you compare [Imports as % of GDP] a whopping 9 countries have a smaller ratio than the US: Angola, Nigeria, Turkmenistan, Argentina, Japan, Brazil, Cuba, Occupied Palestinian Territories, and Chad.

No offense intended to citizens of those nations, many of which are currently plagued by war or trade sanctions or have a total-land-size of under 15 square miles, but that’s hardly fitting company for the Global Hegemon.

Whichever way you cut the data, any way you pull apart the GDP calculation and slice up Imports and Exports and International Trade and Domestic Production, it becomes abundantly clear that the US just does not Trade that much with the outside World relative to its Domestic Productivity.

Certainly, the US spends some of its domestic Surpluses Importing goods from & Investing in the industrial development of China & Mexico/Canada., and the fact that domestic productivity dwarfs the US’s international trade does not by itself prove that the US is not pursuing a Globalism strategy, but as far as I can see the core reciprocally-compounding nature of Globalism is absent from today’s US Trade & Investment flows with the rest of the World

The new cohort of rising economic powerhouses sit outside the Bretton Woods powerbloc, openly playing Mercantilist/Industrialist games, apparently not much interested in mutual-enrichment

US Dollars work like gold — everyone wants ‘em, nobody wants to spend ‘em. Which means there’s no expectation on our part that China will spend their $3 Trillion in US Dollar reserves buying our exports, which means it’s not compounding, which means that Growth trajectory will be rather more linear

Pictured: America

China:

I already covered China in too much detail in the Industrialism section, but suffice it to re-state that they have no intention of making other nations independently Wealthy (i.e. Powerful). They “tried” that (involuntarily) for ~150 years and it wasn’t fun. Which means investment is kept domestic, factories are kept domestic, companies are owned by Chinese nationals, supply chains are pinned to Chinese waters, and Surpluses are spent domestically.

To the extent that they do invest internationally, it has been and will continue to be in nations which can offer strategic Mercantilist resources to fuel their Industrialist powerhouse, with no expectation of reciprocal Compounding.

Much has been made of China’s investments in Africa, with many hoping that the continent will finally be able to Industrialize properly and “leapfrog” the Western world. Of course, the idea of President Xi Jinping allowing non-Chinese to build Wealth stikes cynical-old-me as deeply incongruent, so I took a look through the list of African countries he’s invested in and the list of African countries by proven-oil-reserves and can’t help but notice certain similarities.

US productivity is such a monster that China is still far from confronting the question of how to grow when your customers cannot afford to buy more of your product. They’ve room to keep their own Exports growing: as always, the American consumer can afford more — per the above, only a tiny fraction of domestic US productivity is actually spent on Imports.

Pictured: China’s Growth Plan

Japan:

Japan is too busy trying to stay solvent and keep its GDP growth above 0. Japan has an aging population, a massive welfare state, an unwilling almost-post-industrial economy that was considered the most technologically-advanced in the world when I was born…but basically missed the post-2000s Software Boom and the post-Steve Jobs Smartphone Boom due to odd quirks of national culture & policy…

…and their nearest neighbour is playing Zero-Sum Capture games on the scale of: “everything Industrial ever made anywhere”

Japan can barely keep Industrialism going domestically, how can we expect them to try and share it?

Pictured: Japan Clinging To Positive GDP Growth

Germany:

The rest of the world continues to miss just how powerful the German Industrial machine is. Which is rather odd — you’d think they’d have learned to pay attention by now. It’s impossible to understand the mess that keeps happening in the EU without understanding the degree to which German Industrialism absolutely dominates the continent. Only China runs a larger trade surplus today. And unlike China, Germany has no customer concentration risk!

They export about the same amount to the US, France, China, the UK, the Netherlands, Italy, Austria, Poland, and Switzerland.

The major risk to Germany is their customers going bankrupt and not paying their bills…which is why Germany is so focused on the short-term financial wellbeing of their neighbours.

They’re not interested in Exporting German Industrialism to the rest of Europe — just in keeping the EU solvent enough to continue consuming German Exports, even if that means financing that consumption with debt

On the face of it, Germany is the one nation that could save Globalism, or at least run some modern version of it. They’ve got the surpluses, the trade partners, the raw materials, the knowledge, & the industrial culture!

What they don’t have is security. 2,000 years of European Feudalism, Mercantilism, and Industrialism have left a lot of distrust, bitterness, and beggar-thy-neighbour in the hearts and minds of Europe & its leaders. And now they’re all locked into a single shared currency with the unbeatable German Industrial Machine, with deficit nations unable to devalue their way into attractive exports and forced to pay for their cars and their mortgages in hard 1:1 German Euros, loaned to them by German Banks.

“Unfortunately, the domestic German debate assumes, wrongly, that the answer is for every member to become like Germany itself. But Germany can be Germany – an economy with fiscal discipline, feeble domestic demand and a huge export surplus – only because others are not.” - That’s a good essay describing the conflict between Industrialism & Globalism in the Economist. They’re still good folks.

The result:

Pictured: Germany negotiating with The Rest of Europe

Editor’s note: I received some questions about Germany & ultimately expanded this section into one of my most popular essays: The Germany Shock: The Largest Economy Nobody Understands.

I’ll stop there and leave the other nations as a thought experiment for the reader. I’m sure there’s a country somewhere that proves an exception to my hyperbole. But as far as my eyes can see, this is not our Grandparents’ Globalism, nobody who’s in charge is secure enough in their own position to enrich their neighbours, no rising would-be-superpower is interested in re-investing back into the productive capacity of those above them on the totem pole, and no current superpower feels comfortable sitting down with their peers and “enforcing” some ground rules to overcome the Prisoner’s Dilemma (see the EU’s tax rate debacle I mentioned in the Industrialism section).

I’m not saying Germany & France SHOULD sit down with Ireland and the rest of the EU and explain exactly why they’re unhappy (Sovereign tax rate competition uses the institutions and systems Germany & France have created to benefit one nation’s citizens over another) and propose a solution — that would be a quick way to have to pronounce more awkward-sounding words ending in “-exit”.

But we now live in a world where these grievances go unspoken, where Google and Facebook take their daily media floggings as emblems of American Imperial Influence and nationalistic distractions from the underlying issue, where no superpower is secure enough to stand up publicly and say “Look, this is our position, this is why we’re unhappy, and this is what we propose to do about it: [Carrot] and [Stick].” — however bad that might make them look on the 24/7 News.

Thus the animosity has no outlet except via quietly playing the exact Wealth-Capturing games that caused it in the first place.

Most of my fellow Europeans still have sore memories of Germany’s [Stick], but what [Carrot] does Germany even have today? They haven’t been industrializing the rest of Europe, so nobody believes their Capital serves any purpose except as a vehicle to purchase German goods on credit…

Ah! And that’s the mud-covered dollar-bill buried at the heart of the matter.

The use and purpose of the Capital as it flows across borders.

Globalism as I’ve pitched it in this essay is an attempt to build more Wealth for yourself by investing in your customers. That investment unlocks 10,000x Surplus Wealth Generation for them (see: Industrialism), some of which can be reciprocally spent buying more of your Exports.

But what if instead of all that complex bullshit you just loaned your customers the cash? Why wait for them to Industrialize and generate massive Surpluses and then become potential competitors? Why not just loan them the money upfront and have them spend THAT, plus the interest you can charge them?

Source — the expansion of debt allows your customers to buy more of your exports without actually needing to build more Surpluses of their own to spend

Of course you’d have to make sure they were good for it. Their currency would have to be solid, you couldn’t have a Sovereign customer just printing money and inflating his way out of Debts he can’t repay. In the very worst case, you’d want to be able to repossess their banks and have what’s left in the coffers be As Good As Gold.

Thank God Cyprus’ citizens kept their savings deposits in Euros!

Negotiations got under way on Sunday amid a hardening of stance by the IMF and Germany, which insisted that depositors must take the hit for bailing out the eurozone's latest crisis economy.

Spoiler alert, tell me if you’ve heard this one before: they took the hit and the bankers who gave them the loans which went bad got to repossess Euros As Good As Gold Euros.

This isn’t Globalism, not anymore. It’s something else. Domestic Industrialism coupled with………something new. Something unlocked by access to Capital, an ultra efficient Financial system, free movement of money, multi-national Reserve Currencies, and diffuse personal risk:

Financialism: You Don’t Need Surpluses If You Can Trade With The Future

J.P. Morgan, Godfather of American Financial Wizardry

I did work on Wall St. after graduating college, but I think Yanis Varoufakis, the former Finance Minister of Greece, former economist-in-residence at Valve, academic, author, and self-described “radical lefty” did a better job than I ever could describing the modern Financial System at a talk he gave in Boston last year:

“The beauty and ugliness of Finance, of Banking, is that it is a Magical process. Because once we moved from the [Feudal] Landlord to Edison and Henry Ford, it became impossible to finance Capitalism simply via the accumulated Wealth of some rich person. There was never enough money in the hands of any financier to provide Edison with the money he needed in order to set up his networked firm. So you needed banks to conjure up money from nothing…

There is a common fallacy in popular culture that banks operate like vaults. Whereby you and I put our savings in, and somebody else borrows money that comes from our savings. And that the banker makes money from the difference between the Interest rate that he pays us for depositing our money into his vault, and the Interest rate he charges the borrower.

That is not what is going on.

If you go to a bank tomorrow morning and you get a loan, the money is going to come out of thin air. The bank will create it out of nothing. It’s really very simple. You get $100,000…what will happen is someone just types $100,000 into your bank account….the hope of the banker is: you are going to use this money productively, earn money from the loan, and then you will give the banker back the money that will tie up that lose end. With Interest.

To the extent that this works, it really works magnificently.

It’s a bit like a banker being a specially gifted Magician who has a very long arm and can push that arm through the timeline. He pushes his hand into the future, grabs value that has not been created yet, snatches it from the future, brings it to the Present, and hopefully you do productive things, and you create the value that will repay the Future.

But once they learn the beauty — the glory — of doing this, they are in a privileged spot. Because they can take value from the Future, bring it to the Present…and because they are the mediators between Future and Present value they are ultra rich and central in societal processes. Political processes.

If you do this and it works, why not do more of this?

Keep snatching more value from the Future, and more, and more! At some point the Present can no longer produce the value that it needs to produce in order to repay the Present. At that point, those of us who have borrowed money have no capacity to repay it, a recession beings, people that work for us lose their jobs, they cannot repay their own loans, and then suddenly the book of the bank is full of loans that are “non-performing”.

At that point, if you and I, or those of us who have some money in the bank, realize that this is happening, we panic, we rush to the bank — this is a bank run — we ask for the cash — the cash is not there! And then you have the financial crises that we had in this country and in Europe from the 1840s onwards.”

I think the word “Capitalism” in the first paragraph should be replaced by “Industrialism”, but otherwise this is spot-on. If you want to make stuff — any kind of stuff — you have to understand this “magnificent system.“

And you have to understand that for people and groups of people who can deliver above the median, this magnificent system multiplies their power and Wealth by a huge factor. That’s why they call it Leverage.

Sidenote: How to Become a Magician

Varoufakis might like to disparage Wizards by saying they “don’t do any work”, which is true to the extent that “work” == manual labor. But that doesn’t mean it’s easy being a Wizard. There’s one immensely difficult problem that all Schools of Wizardry attempt to solve: