Slopes Diaries #29: A Disappearing Trick

Slopes Diaries is my ongoing journey to turn my indie app into a more sustainable part of my business. First time reading? Catch up on the journey so far.

What is Slopes? Think Nike+, Runkeeper, Strava, MapMyRun, etc for skiers and snowboarders.

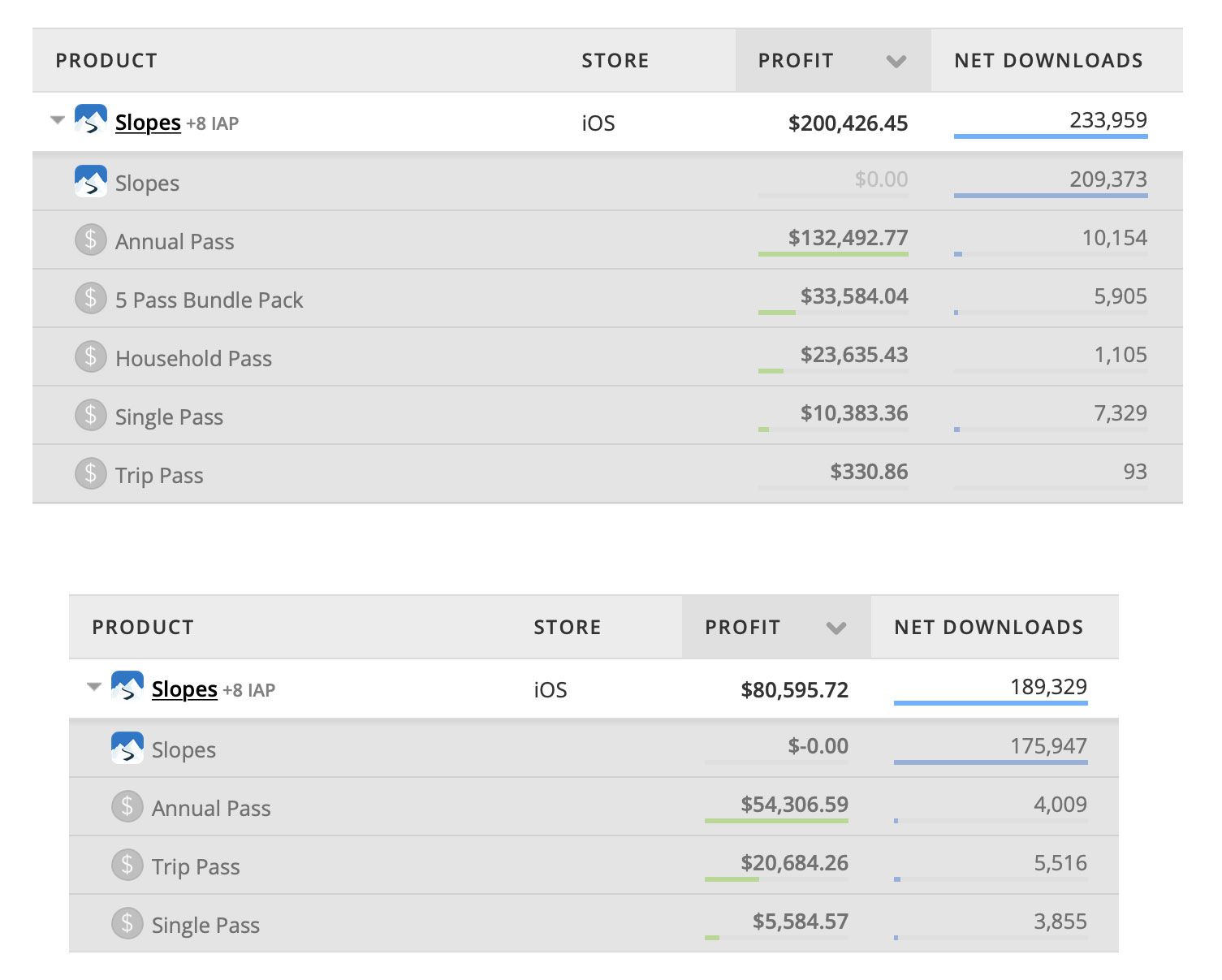

This season began with an ambitious changes to my IAP lineup: I killed the old Trip Pass in favor of a new 5-day Bundle, and I added a Family Pass. I've been busy with a lot of other stuff since those launched, like partnering with Strava, releasing a new (😍) premium winter map theme, a complete redesign of my history screen, and more. But while I'm about to break ground on my next ambitious feature, I wanted to take a step back and review how the new IAP lineup faired, because the change in the lineup was bound to be what would affect this season's revenue the most.

There's about a month left in the season, so I can get a pretty good picture of the effect the the new IAPs had:

The household pass has been a nice boost to my subscription revenue, and is greatly appreciated by skiers and boarders that ride together as a family (the average household in Slopes is 2.75 people, which is an average savings of $25/yr per family). It is only used by ~1/10th of my subscribers, and I have no idea what the average industry use of family plans are, but that seems like a good number? I'll call it a success. 👍

The 5-Day Bundle, however, I'm a lot less sure about.

Looking at the sales numbers it has been bought the same number of times as the Trip Pass had been by this time last year, whereas everything else has seen 2x growth or more in terms of number of sales. So that's a little weird; this category (my mid-tier IAP) didn't grow in usage when everything else did.

So first, what happened to the people that bought the Trip Pass last year? Digging into those ~5,000 people: ~1,000 have bought the bundles this year instead, ~775 people have moved up to subscriptions, and less than 200 moved down to only using day passes.

That leaves 62% of 2017/18 Trip Pass purchasers not purchasing again this season, which is actually down from last season where where Trip Pass purchasers (from 2016/17) had a 66% chance of not purchasing anything last year. So that's good? People migrating from Trip -> single-day tickets went from 2% to 3% year over year (so I didn't really push them down market en masse), and those moving from Trip -> subscriptions doubled from 7.2% to 14.9% (nice!).

(Aside: my worry about the bundle cannibalizing my annual passes sales didn't become a reality as only 30 people who got a Season Pass last year moved down to a bundle this year, nice!)

OK, so a similar drop-off rate year over year. Seems like I didn't scare away a disproportionate number of Trip Pass users. But I don't want to move on just yet, what can I learn though about that 62% drop-off? After all it is a pretty big gap of ~3,200 people who didn't buy anything again this year after having bought a Trip Pass last year. Where'd they go?

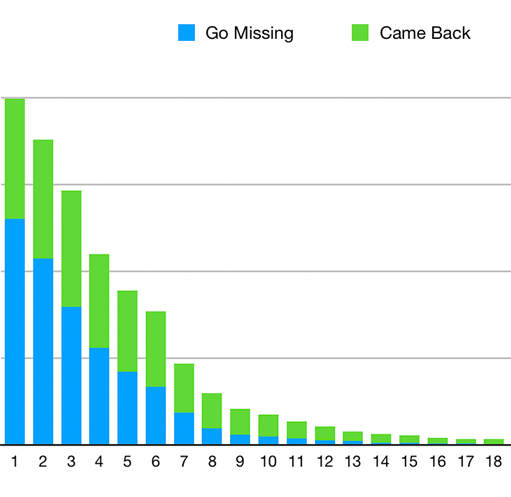

Of those, 80% didn't even record anything this year at all ... which actually sheds some light on the situation. That disappearing act isn't unique to the Trip Pass. While people could easily have abandoned Slopes for another app due to the IAP change or some other thing Slopes did to annoy them, they are actually just as likely to have not gotten a chance to ride this year (possibly all east coast riders who have had to suffer through this terrible excuse for a winter?).

This is where more "fun" of running a ski app comes into play: when looking at the category of skiers that might only go on one trip a year or go twice a year to their local hill on snow days, the odds of them even hitting the slopes year after year consistently can be quite low. It's something they occasionally do; they might not get out for one year but go again the next. And I see this in my account numbers: the more a person tries to get out on the slopes in a season, the more likely they are to be back next season. A user buying something increases their likelihood of coming back the following year (especially annual plan holders), but that correlation still holds true regardless.

I'm not only fighting churn caused by my product itself, I'm also fighting the yearly ebb and flow of the industry I'm in. Fun times.

(Aside: I really need to figure out a way to separate this "industry churn" vs my churn. Anecdotally, when I entered year 2 of my season passes being a thing, I emailed some people who didn't renew. A lot of people ignore the email, but all that replied said they just hadn't been able to ski this year. So it is a thing. I just don't know how the heck to measure it.)

The 5-day Bundle was meant to appeal to the skiers that are recording less than 6 days a season, which are also those that are at the highest risk of not returning next year. So I'd expect my mid-tier IAP would have a higher number of users not be back the next year vs say my annual pass. But that earlier 80% disappearance rate is a lot higher than the overall average I'd expect for users in the range of 1 - 5 total days recorded (I'd expect ~55%).

So I kept digging, looking for a new angle to get a good picture of what might be going on. And yeah, unfortunately I can't hand-wave and imply that this is all due to the industry.

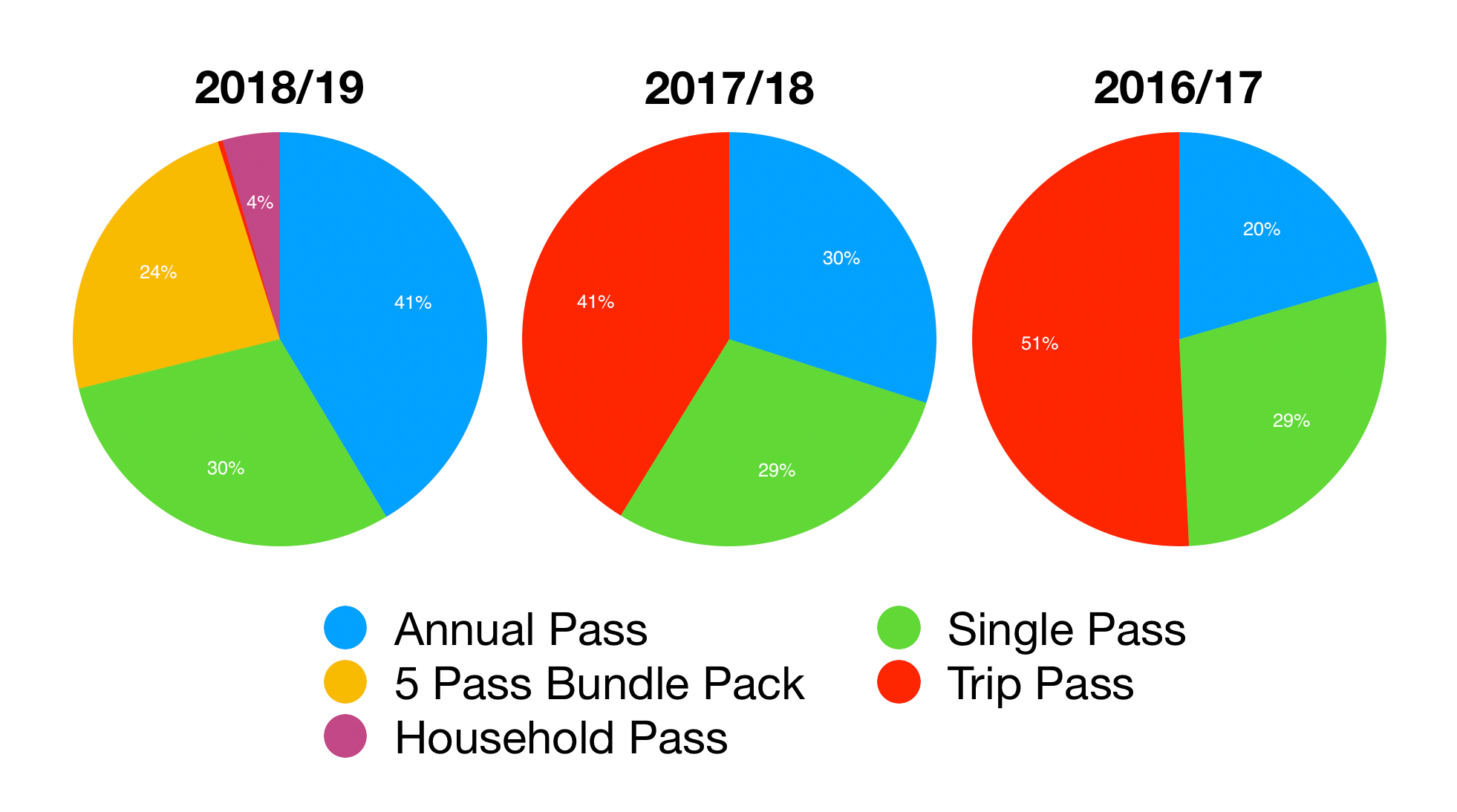

A breakdown of my sales distribution really shows that it's not industry-specific, it is something to do with the changes I made.

The bundle isn't a flop, but it clearly caused a shift away from my mid-tier IAP. I was really hoping the bundle would entice more free users to give premium a shot, and it didn't seem to do that. My goal was to make Premium more accessible, not less. 🤦♂️

But if anything, I'm glad I error this way instead of having the bundle sell like gangbusters. The higher price helped make sure I didn't cannibalize my annual pass sales (which actually increased from 30% last year to 41%, or 45% when you count family passes too) which was a big concern of mine.

Hopefully I don't have to re-think the entire bundle idea, I really liked it.

But for now, that's a problem for another day. Time to get back to work in wrapping up my work on fully supporting Dynamic Type, so I can hopefully get one more major feature in this season...

Slopes's take on "Social" (🤫).

Aside: I'm very appreciative of Apple's work on making sure users have informed consent for subscriptions. When I was doing the research for this post I noticed that zero users who had an annual pass last year, and didn't record at all this year, had their subscription renew! I'm very happy to know I'm not building a business that relies on users forgetting to cancel their annual pass if they're not going to use it.

Apple's subscription stuff still needs work, especially to weed out bad actors during app review, but I'm glad to see that at least for us good actors we can let Apple handle some of the annoying aspects of subscriptions (trying to re-charge declined credit cards, asking people to keep card up to date, easy switching between subscription tiers) while also being respectful to our customers (upcoming renewal reminders, easy opt-out of auto-renew).