|

|

|

Inside: Five trends to watch in 2020. Banks plans to go green still include oil and gas. The worst-case scenario for climate change doesn't look that realistic anymore.The machine silencing #MeToo on Wall Street. — Emily Chasan What to Watch in Sustainable Finance in 20201) Going Green. Really Green.

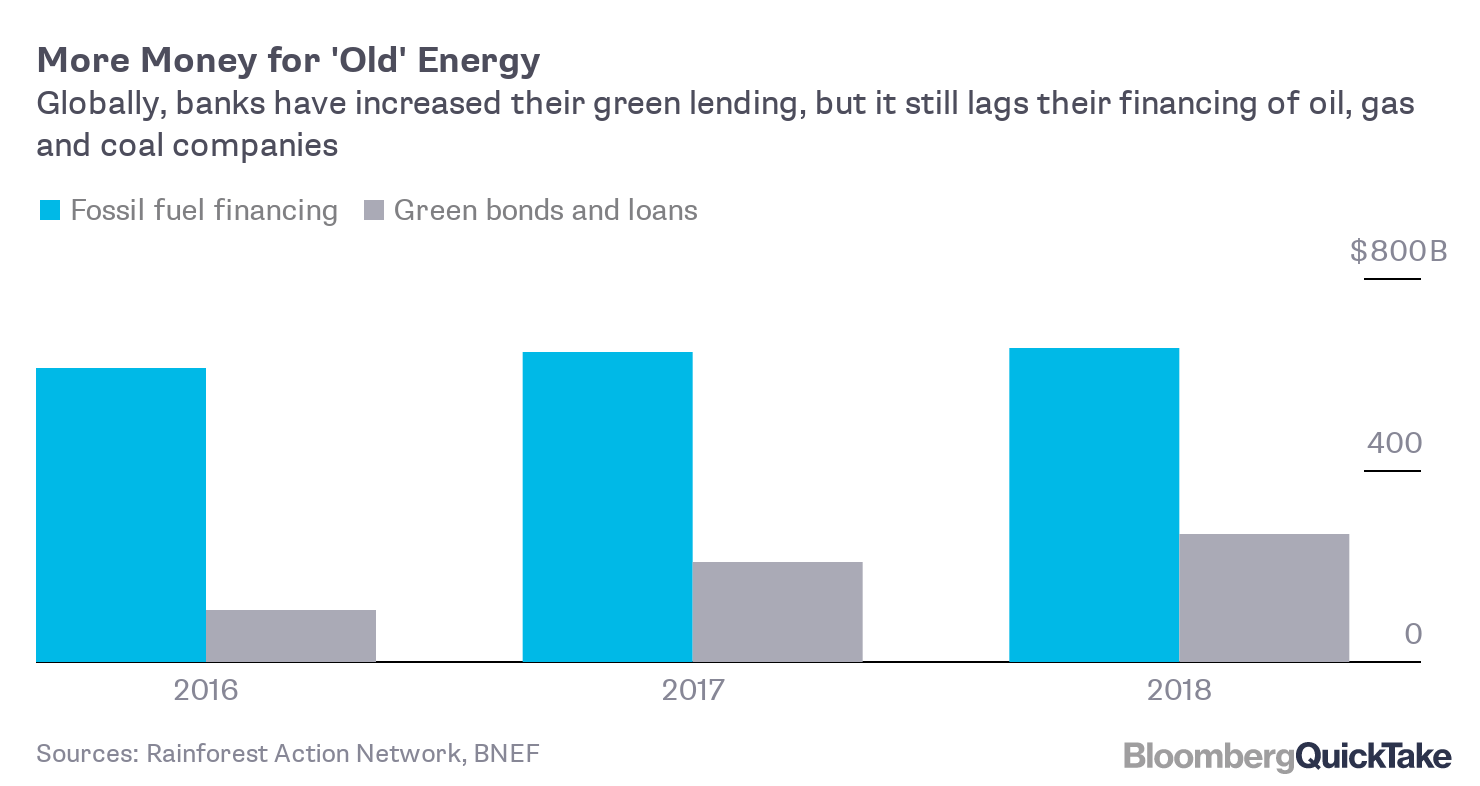

2) Shareholder Proposal Shakeout It might be the last hurrah for shareholder proposals as we know them. The U.S. Securities and Exchange Commission is pushing a plan to overhaul the proxy-advisory system and make it tougher for small shareholders to submit proposals. Investors hurried in a lot of new proposals before the end of the year under the old rules, and will push large investors like BlackRock and Vanguard to clarify their voting policies. This comes as environmental and social proposals have become the majority of proposals filed by investors, and in an election year when proposals on issues like political contributions disclosure typically spike. It's unclear how many will reach a vote. The SEC is already siding more this year with companies that want to keep proposals off the ballot. "In the U.S. the stewardship theme will be climate and the world's largest asset managers are likely to make some big bold public decisions that catapult the industry really quickly this year," says John Hoeppner, head of U.S. stewardship and sustainable investments at Legal & General Investment Management America

3) Impact Investing for Everyone

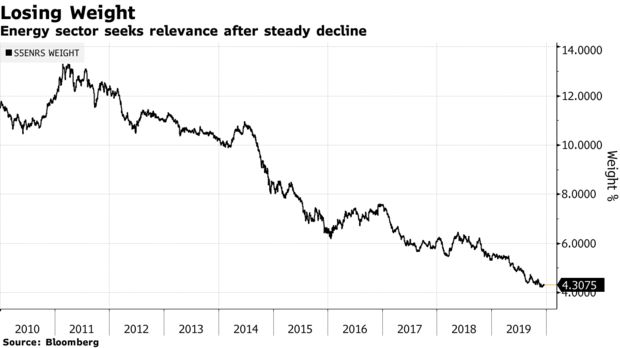

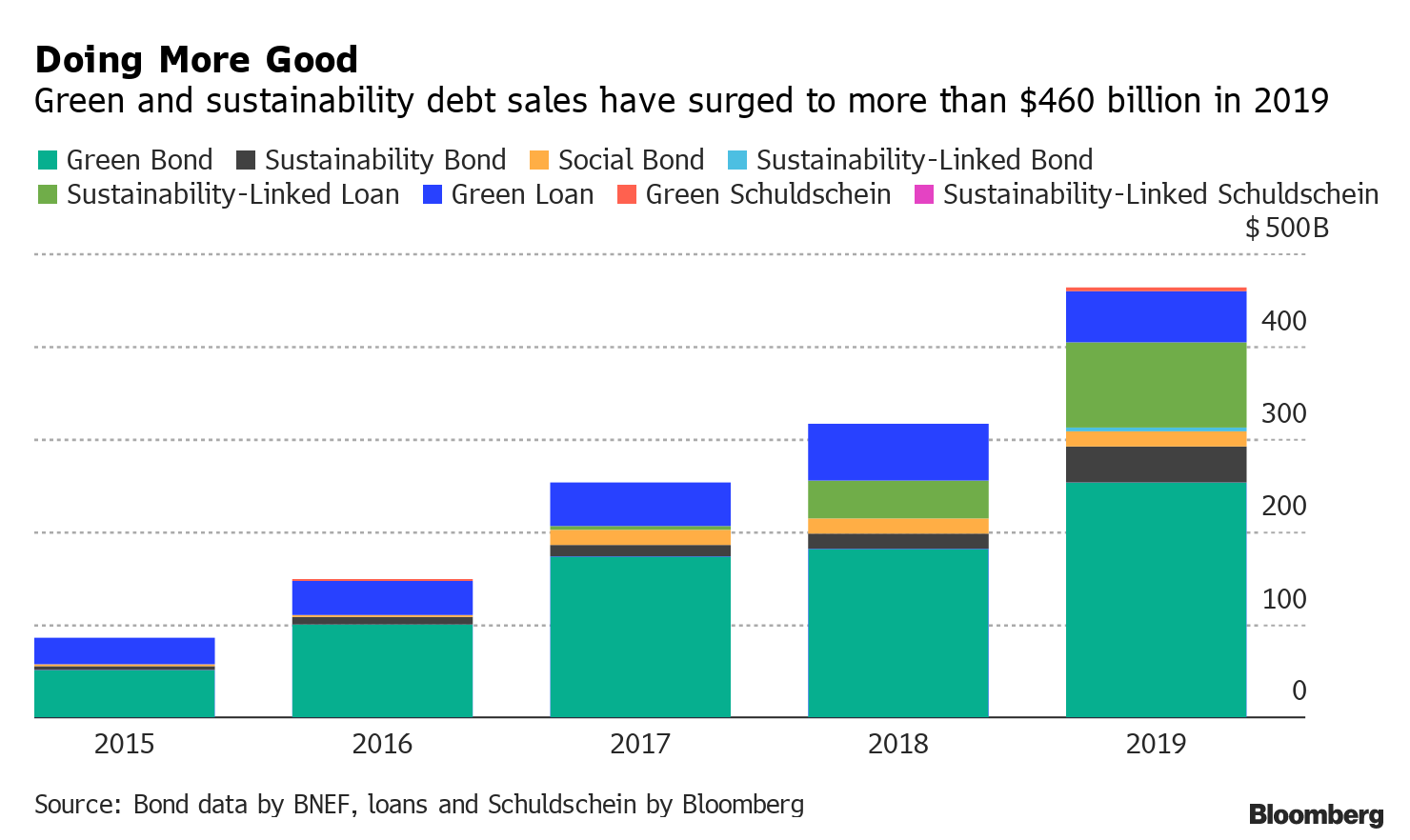

4) Focus on Lending Financial firms are likely to face more pressure over climate risk in their lending portfolios, which is partially behind the surge in green- and sustainability-linked loans in 2019 and 2018. Companies borrowed $78 billion in green loans in 2019, up from $60.5 billion in 2018. Sumitomo Mitsui Financial was the top arranger of global green loans for the year. Banks like Goldman Sachs are strengthening rules about what type of fossil fuel financing is allowed. And in a sign that green and sustainable lending will focus more on industries that are big users of fossil fuels, the first green-financed aircraft was delivered last week for a plane designed to reduce emissions. "There's this idea around transparency and alignment that's been gaining traction," said Legal & General's Hoeppner. "If you're going to finance sustainable solutions there will be questions about whether you are not financing coal companies and that consistency question will be at the heart of the issue."

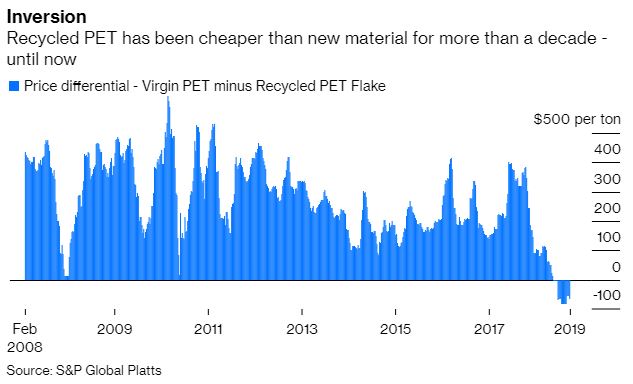

5) Circularity Beyond Plastics

Sustainable FinanceElectric truck maker Rivian raised $1.3 billion from investors led by T.Rowe Price. Amazon, Ford Motor and funds managed by BlackRock also participated in the round. Hong Kong-listed companies will need to start divulging greater details on their ESG issues starting in July, including mandatory disclosures, a board statement on consideration of ESG matters and a report on significant climate-related issues. Global banks' plans to go green still include a lot of oil and gas lending, writes Bloomberg's Saijel Kishan.

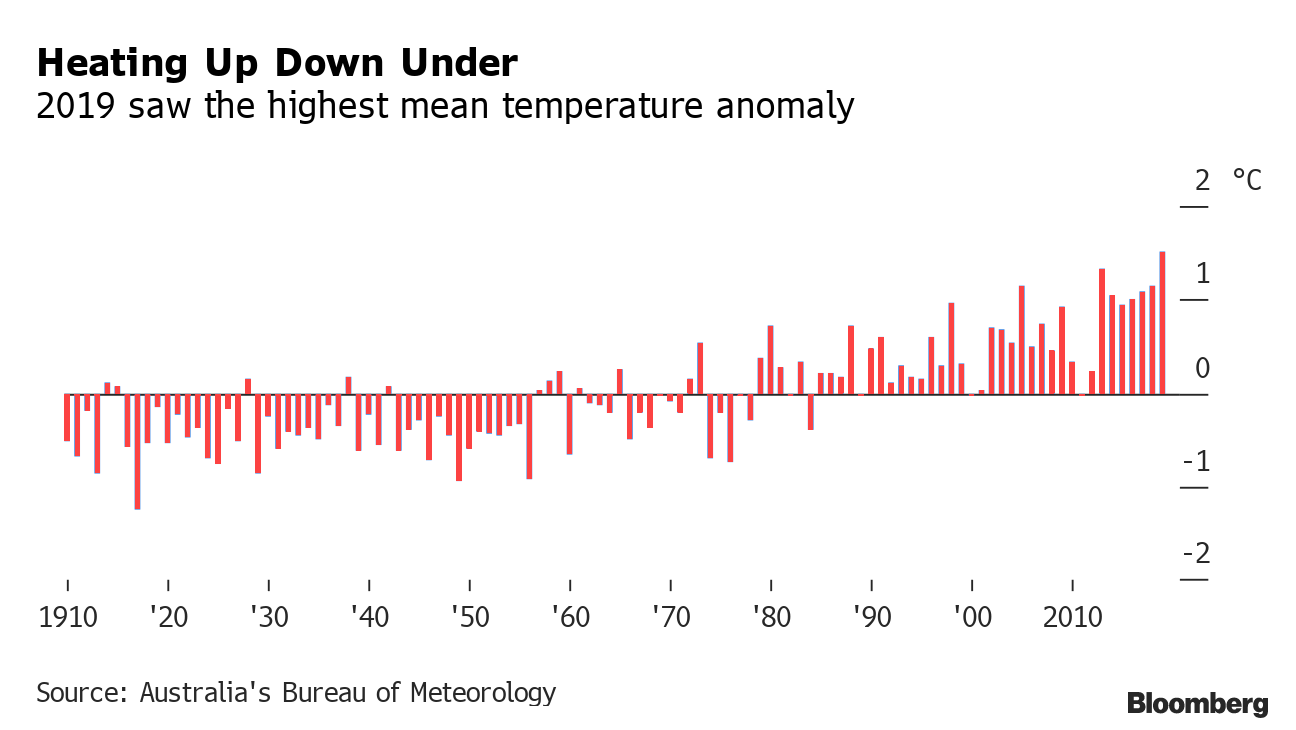

EnvironmentThe worst case scenario for climate change doesn't look realistic anymore. The doomsday scenario might not require a complete overhaul of capitalism, but 2.5 degrees of warming would still be devastating for people all over the world.

SocialThere's a machine silencing #MeToo on Wall Street. The financial industry's mastery of forced arbitration, captive human resources departments, high priced lawyers and a culture of fear have prevented the revolution of the past two years from really touching the industry, write Bloomberg's Max Abelson and Katia Porzecanski. GovernanceJapan's female share of corporate board seats is just 5.3% — the lowest of the Group of Seven nations. Here's what it's like to be the first woman on a century-old firm's board in the world's second-largest developed economy. Brazil has no law that allows the equivalent of U.S. class action lawsuits. The Brazilian government is sending Congress a bill that could allow minority shareholders to seek compensation from the courts in the event of misconduct by corporate boards.

Note: Please send tips, suggestions and feedback to Emily Chasan at echasan1@bloomberg.net. New subscribers can sign up here. To see this on the web, click here. |

|

FOLLOW US |

SEND TO A FRIEND |

| You received this message because you are subscribed to Bloomberg's Good Business newsletter. |

| Unsubscribe | Bloomberg.com | Contact Us |

| Bloomberg L.P. 731 Lexington, New York, NY, 10022 |