A startup is overvalued when its price is not rational. Through Equidam’s data, we see that a recognition of increased potential is driving valuations higher. If digital will turn out to be what everybody expects it to be, and delivers on this potential, there is no reason to fear the ‘startup bubble’.

Despite wreaking havoc on the health system, Covid-19 had a disproportionately small impact on the economy. Governments reacted quickly with the excuse of Modern Monetary Theory and injected unprecedented amounts of cash in the economy. At the same time, due to incredible uncertainty, spending was hitting lower and lower lows.

As a result, all of this newly minted cash got invested into assets, driving the price of pretty much everything skywards.

Following the same trend, startup valuations (which have been increasing ever since the tech bubble of 2000) have also made headlines. The last two years produced an acceleration in the creation of VC-backed tech unicorns, with the count going from 100 at the end of 2019 to more than 200 already at the end of 2021 according to the State of European Tech report. Total funding across Europe smashed records, with founders pulling in $121 billion from investors who are closing deals faster and at ever high valuations.

So what is driving this increase? Is it justified? What does it even mean for a startup to be overvalued? What can we learn from our data?

A startup is overvalued when investors are overpaying for the risk/reward ratio they are getting

In the competitive supermarket of investment opportunities, everything is judged on its risk/return ratio. Startups are high risk investments and they are competitive only if their return is also higher than other assets.

Hype, strong demand, collective delusion or other behavioural biases, might lead to an increase in price that is not justified by an increase in return or a decrease in risk.

An increase in valuation is legitimate if the risk is lower or the return is higher

To answer this question (‘Are increasing startup valuations justifiable?’) we analysed Equidam’s data on over 31,000 companies across the EU.

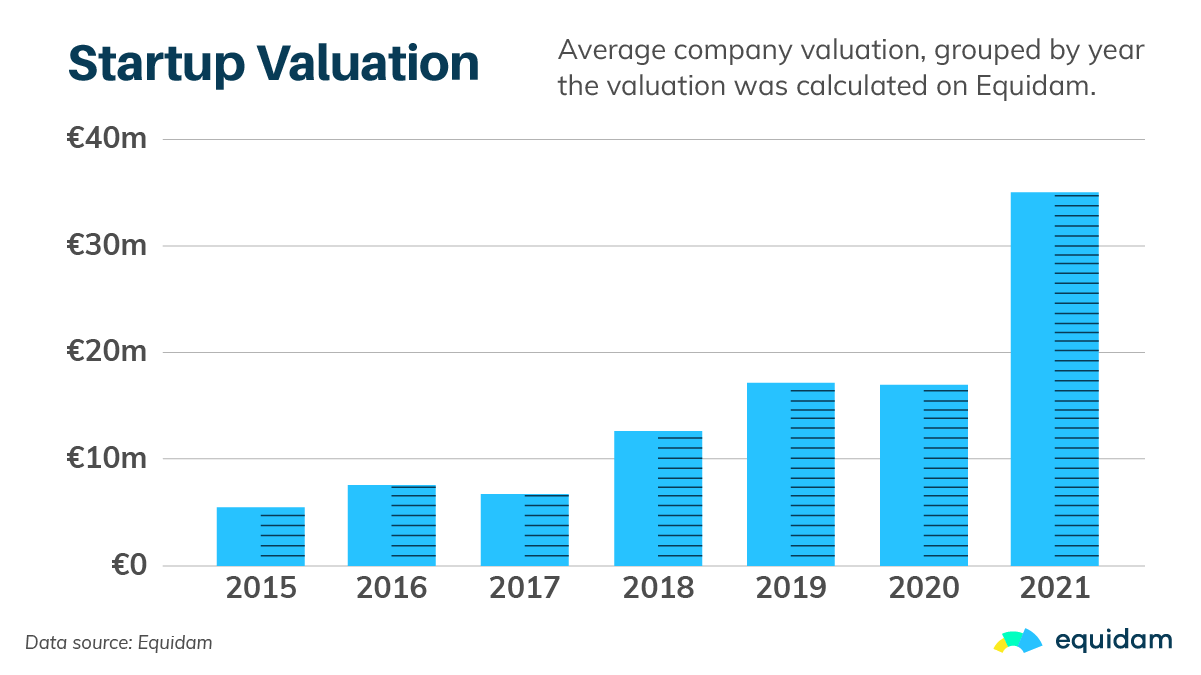

Average valuations have been rising steadily and this is confirmed in the data. 2020 represents an obvious break in this trend – and we know why – but 2021 has quickly corrected course.

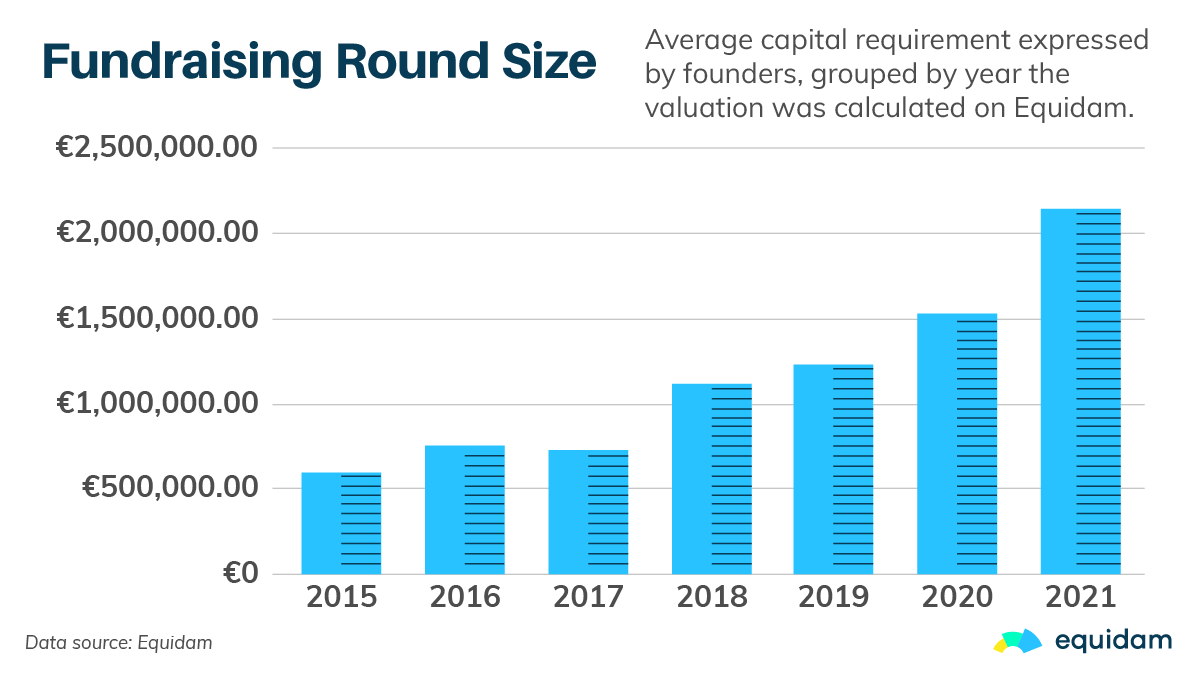

In line with external sources, the investment that founders have been seeking has also been steadily on the rise:

In line with external sources, the investment that founders have been seeking has also been steadily on the rise:

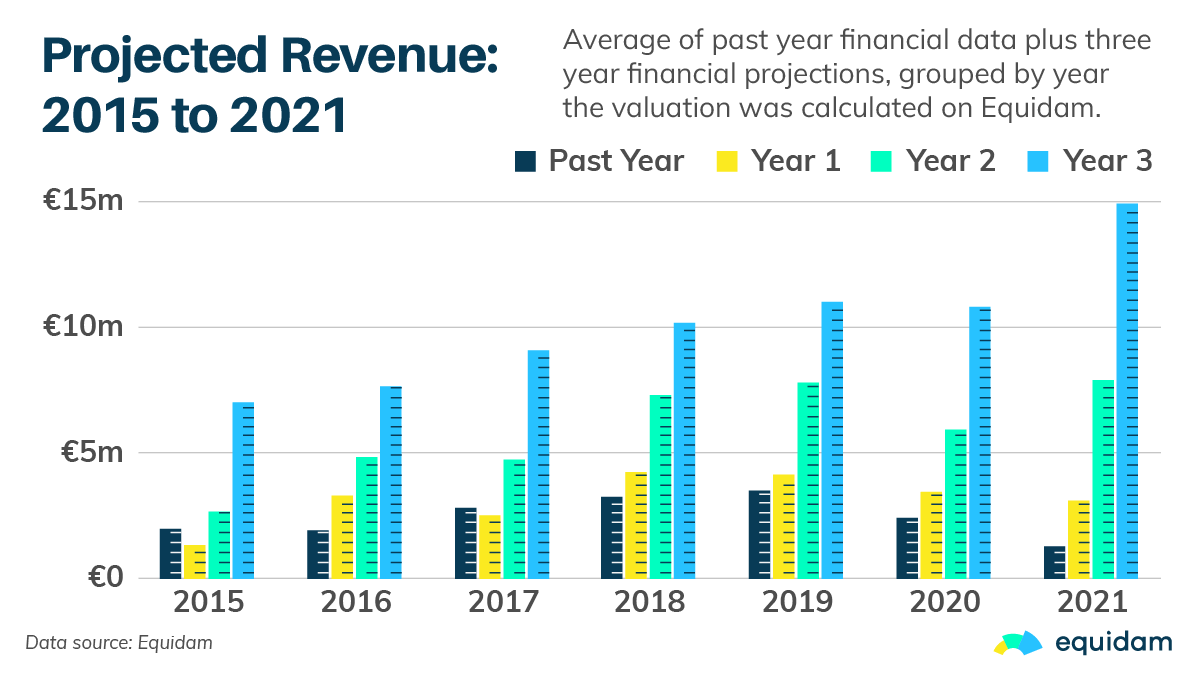

The most interesting finding is shown in the following chart: Projected revenue growth has been accelerated too. Startups in 2021 are much more likely to report aggressive growth projections which begin with past year revenues roughly half of 2015’s, and with third year projected revenue roughly doubled.

The most interesting finding is shown in the following chart: Projected revenue growth has been accelerated too. Startups in 2021 are much more likely to report aggressive growth projections which begin with past year revenues roughly half of 2015’s, and with third year projected revenue roughly doubled.

Startups and investors have higher expectations about the future and that is what is driving valuations higher

If these valuations were merely the result of more capital availability or greater hype, founders would not commit to higher revenue projections. They would increase their required multiples, they would raise capital without rationalising valuations. The fact that they are doing that by increasing expectations and setting clear revenue goals means that they are seeing a real shift in their future potential.

The fact that they are raising more capital, and raising sooner, also tells us that investors are understanding and agreeing with this new game; they also expect the higher potential to be realized.

Is the increase in potential justified?

We believe there are five central factors which have boosted the future potential of the startup category:

- Greater digitalisation – A greater number of customers are now more easily reachable through scalable digital channels, accelerated by Covid-19.

- Proliferation of knowledge – The strategies and techniques for growing a digital business are much more widely publicised and discussed.

- Lower costs – Building and growing companies in the digital age requires far less up-front capital, with plenty of competition keeping platform and service prices low.

- Capital availability – Startup investment is more borderless and diverse than ever; a greater number of options exist for founders to raise capital.

- Talent availability – In addition to the new generation of technical enthusiasts entering the job market, Covid-19 also encouraged companies to at remotely sourced talent.

On the other hand, almost no factor is lowering digital startup potential, as opposed to other industries that might see their future curbed because of e.g. strong public scrutiny on sustainability or increasing labour costs.

Digital startups are the builders of our new digital future. This future got an extreme boost due to Covid and has catapulted us in a world where digital technology is not only the gimmick, or the house entertainment, but is a foundational component of our economies and our lives.

This is the view that these startups and investors are adopting, and can we really contradict them?