Comment

- Yahoo Finance – Depositors yank another $126 billion from US banks

Depositors drained another $126 billion from U.S. banks during the week ending March 22, according to new Federal Reserve data. This time the outflow came from the nation’s largest institutions. The biggest 25 banks lost $90 billion on a seasonally adjusted basis, according to the Fed. The smaller banks, which suffered massive withdrawals the previous week as regulators seized regional lenders Silicon Valley Bank and Signature Bank, were able to stabilize their outflows. They actually gained back $6 billion on a seasonally adjusted basis.

- Bloomberg – US Bank Deposits and Lending Both Dropped Last Week Amid Turmoil

Deposits fell nearly $126 billion, while bank loans retreated

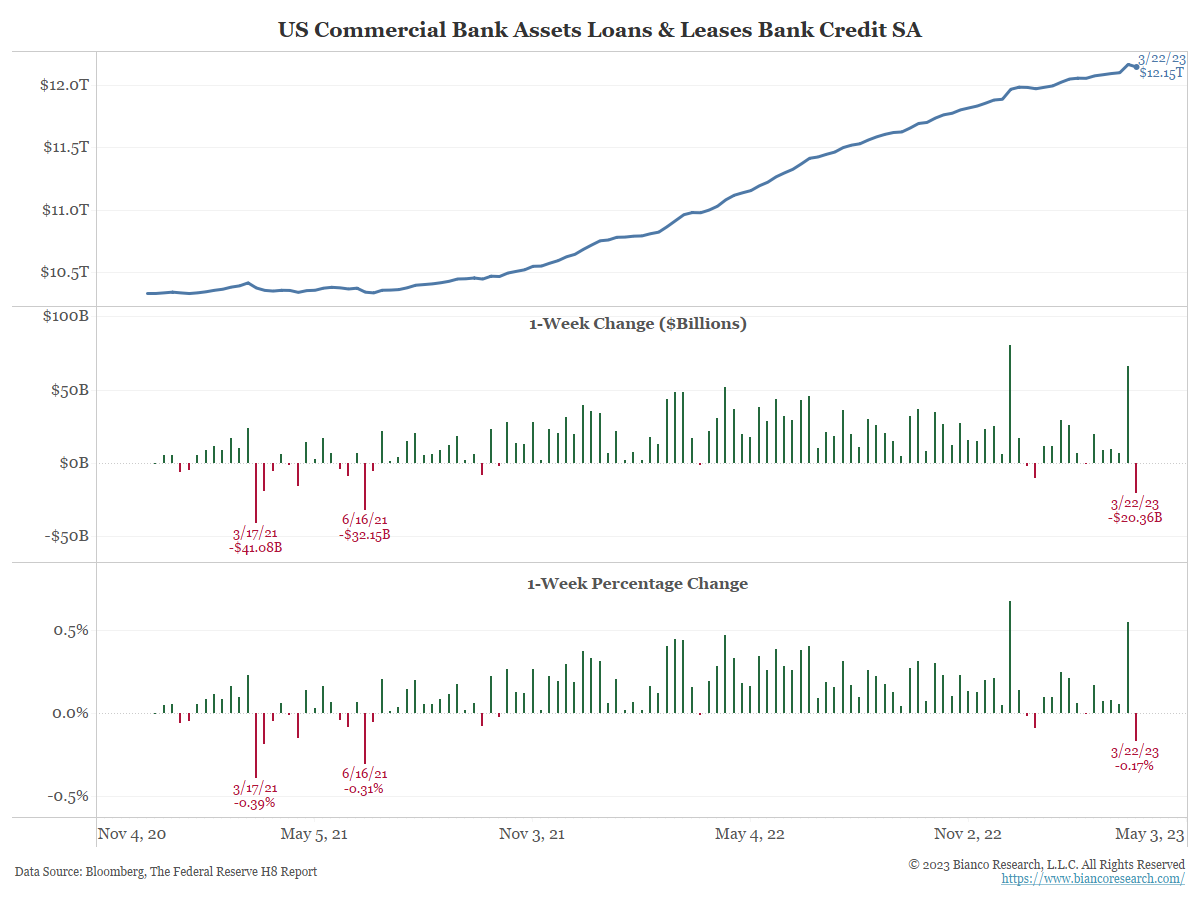

Decrease in overall lending was largest since June 2021

Overall lending fell by $20.4 billion, the most since June 2021 and due to a decline in commercial and industrial loans. Residential and commercial real estate loans, as well as consumer lending, increased from the prior week.

Summary

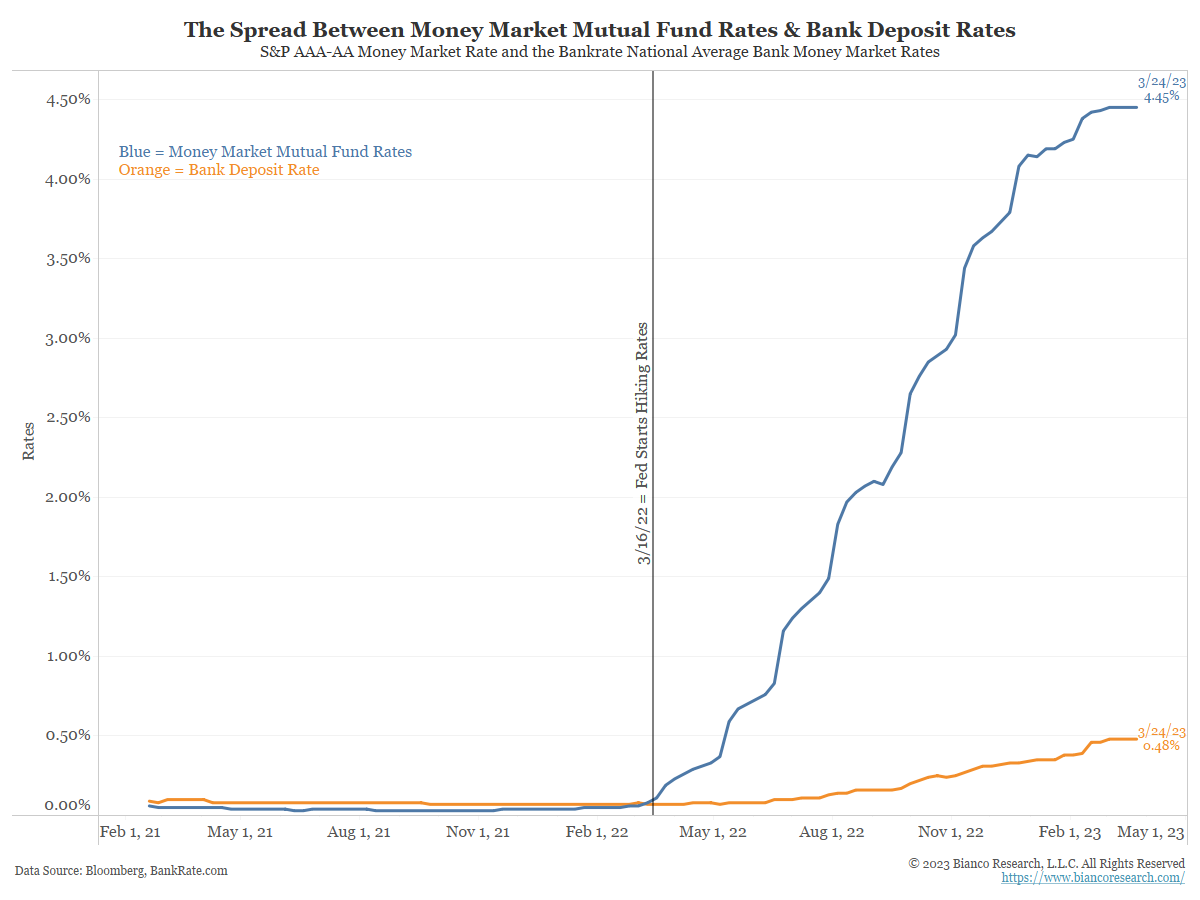

We keep returning to the issue of depositors withdrawing funds from banks for higher-yielding alternatives. This is a liquidity crisis impacting the liability of side of the banks’ balance sheets. Banking data released late last week show the problems are not yet over.

Comment

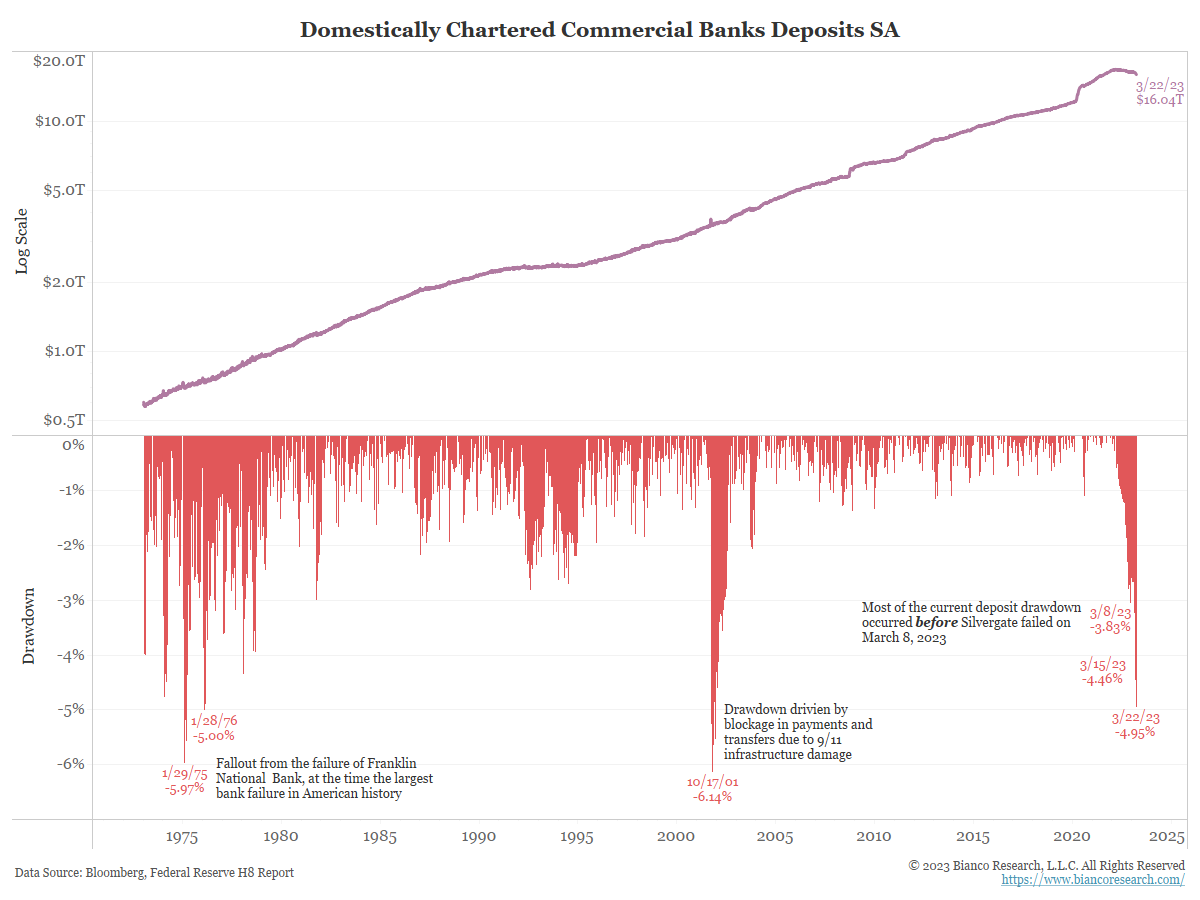

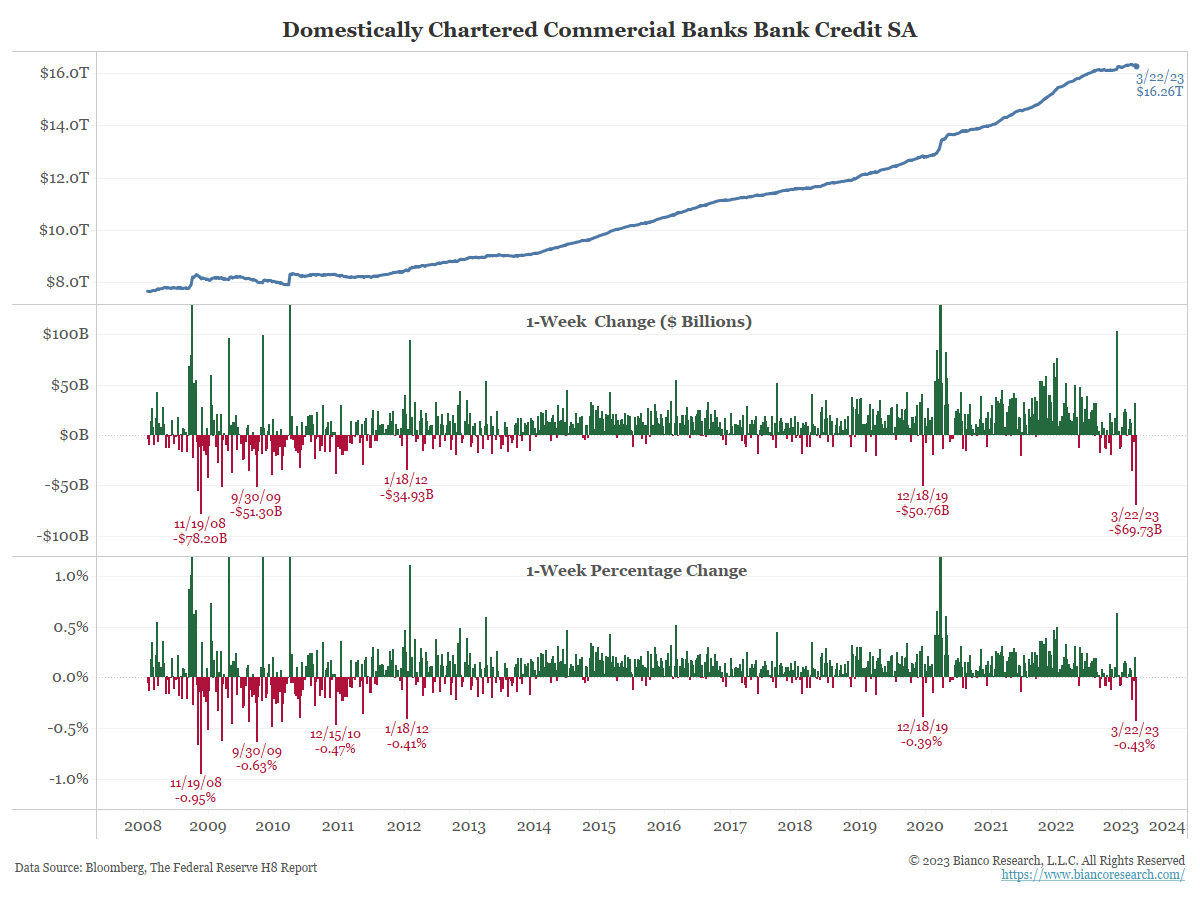

The chart below shows deposits in domestically chartered banks (top panel) and the drawdown in those deposits (bottom panel). Why did deposits see their biggest drawdown in almost 50 years? And why did most deposit withdrawals occur before Silvergate failed on March 8?

(We exclude October 2001 from this discussion as that was an infrastructure issue from the fall of the World Trade Center.)

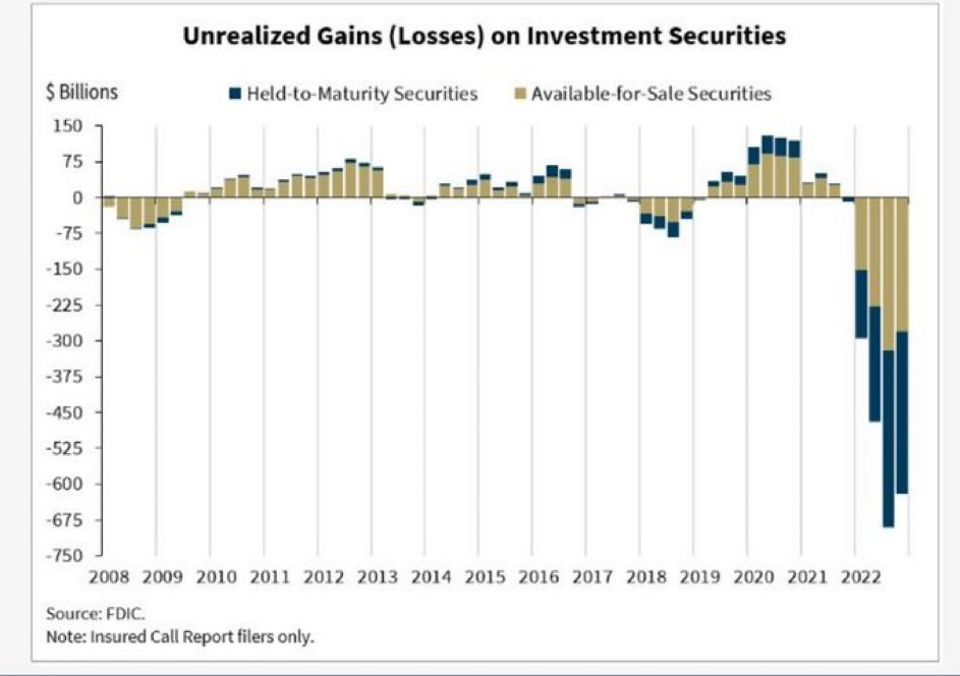

The historic losses in the bond market last year would not have been a problem for banks under normal circumstances. Despite a duration mismatch between assets and liabilities, banks are able to categorize assets as ‘held-to-maturity’ (HTM) or ‘available-for-sale’ (AVS) for accounting purposes. HTM securities mature at par, so banks suffer no realized loss. Only AVS securities must be marked to market.

The duration mismatch became a concern as depositors began withdrawing funds from banks. Banks were forced to sell or pledge their Treasury assets to give depositors their money back. In other words, banks became forced sellers of an asset that just underwent one of its worst yearly returns on record.

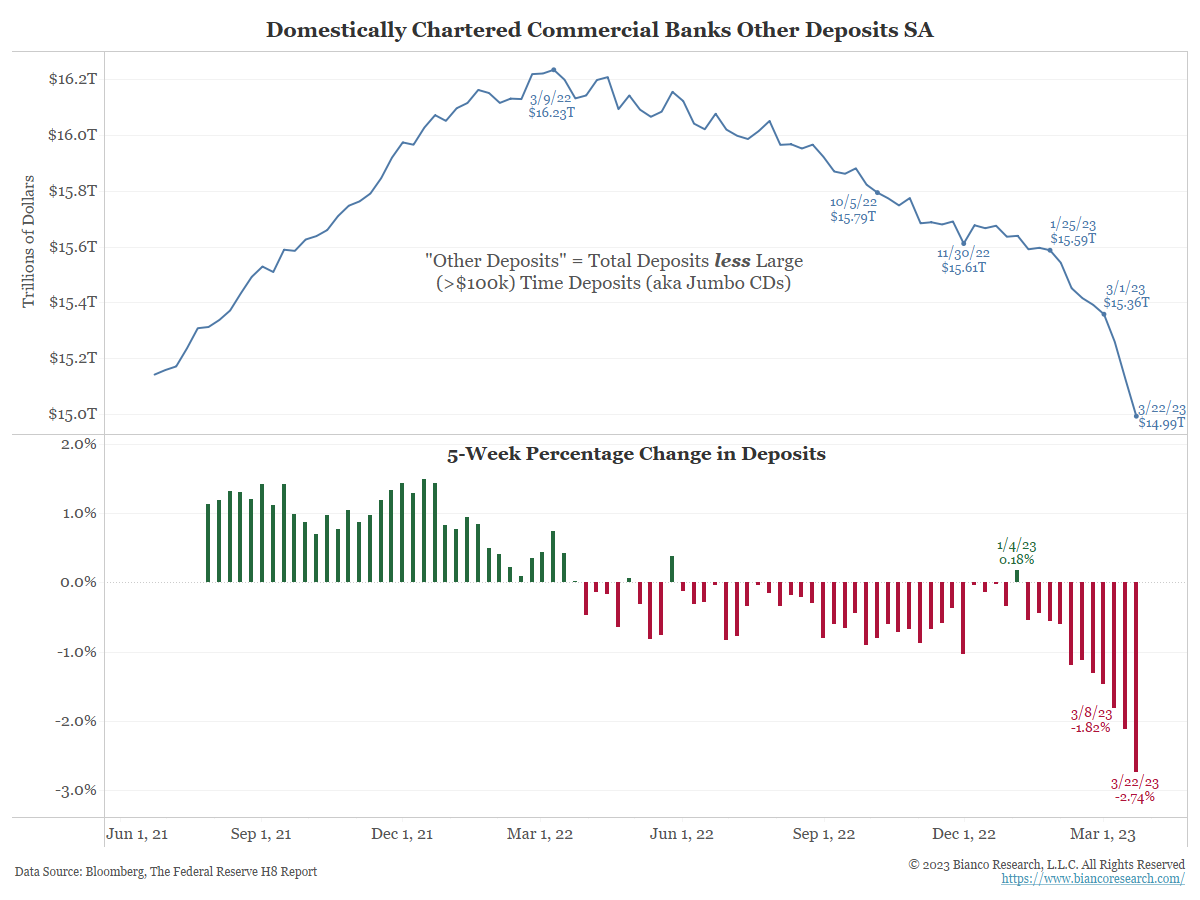

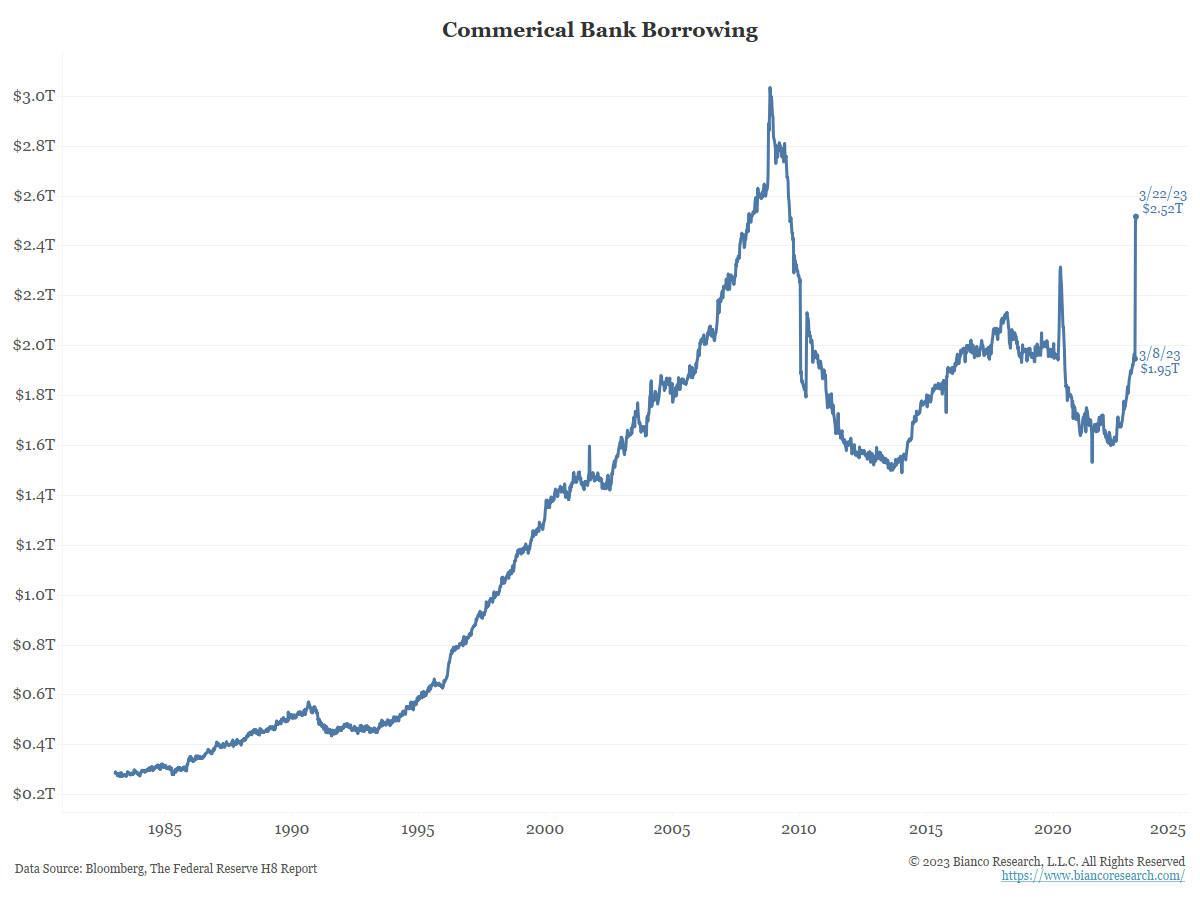

The following chart shows just how quickly these deposits began leaving banks. While the chart focuses on more recent history, this is the fastest flight of deposits over five weeks since this data series began in 2009.

What did banks do with all this borrowing? Some of this was obviously used to meet deposit withdrawals. However, as the next chart shows, about $320 billion of the money borrowed in the past two weeks remains on banks’ balance sheets in the form of increased cash holdings. This is presumably a war chest for future withdrawal requests.

Just Banks Behaving Badly?

We understand it is in the interest of regulators and banks to promote the narrative that this crisis was due to a few bad actors behaving irresponsibly and is not representative of a larger systemic issue or regulatory failure. Regulators have already started playing the blame game:

- The New York Times – (March 16, 2023) Fed Blocked Mention of Regulatory Flaws in Silicon Valley Bank Rescue

As U.S. regulators prepared to announce an extraordinary government rescue of depositors at Silicon Valley Bank and Signature Bank on Sunday, officials from the Biden administration pushed to formally spotlight shortcomings in financial regulation that they blamed for the banks’ rapid descent to insolvency, according to several people involved in or close to the discussions. But Jerome H. Powell, the chair of the Federal Reserve, blocked efforts to include a phrase mentioning regulatory failures in the joint statement released early Sunday evening by the Fed, the Treasury Department and the Federal Deposit Insurance Corporation.

- The New York Times – (March 28, 2023) Federal Regulators Criticize Bank Executives and Pledge Reviews

A top regulator at the Federal Reserve on Tuesday blamed Silicon Valley Bank’s executives for its collapse and provided little explanation for why supervisors had failed to stop its demise, saying that the central bank was examining what went wrong. Michael S. Barr, the Fed’s vice chair for supervision, testified for more than two hours before the Senate Banking Committee

However, persistent deposit withdrawals are a systemic problem that should concern broader financial markets and policymakers.

Deposit Behavior Changed!

Roughly four months ago, Liberty Street Economics (the New York Fed’s blog) wrote about bank deposits’ response to monetary policy:

- Liberty Street Economics – (November 21, 2022) How Do Deposit Rates Respond to Monetary Policy?

In this post, we evaluate the pass through of the fed funds rate to deposit rates (that is, deposit betas) over the past several interest rate cycles and discuss factors that affect deposit rates…Since the 1990s, the response of deposits to monetary policy has been attenuated. This can be explained by the growth in deposits over the post-crisis period relative to investment opportunities. Understanding deposit pricing dynamics requires thinking about the quantities of various funding sources and the presence (or lack thereof) of competing products. Taken together, current deposit betas are lower and slower given banks significant supply of deposit funding. However, going forward the rapid increase in the fed funds rate suggests that the deposit gap will be higher than recent rate cycles, causing depositors to look elsewhere and deposit rates to rise in response.

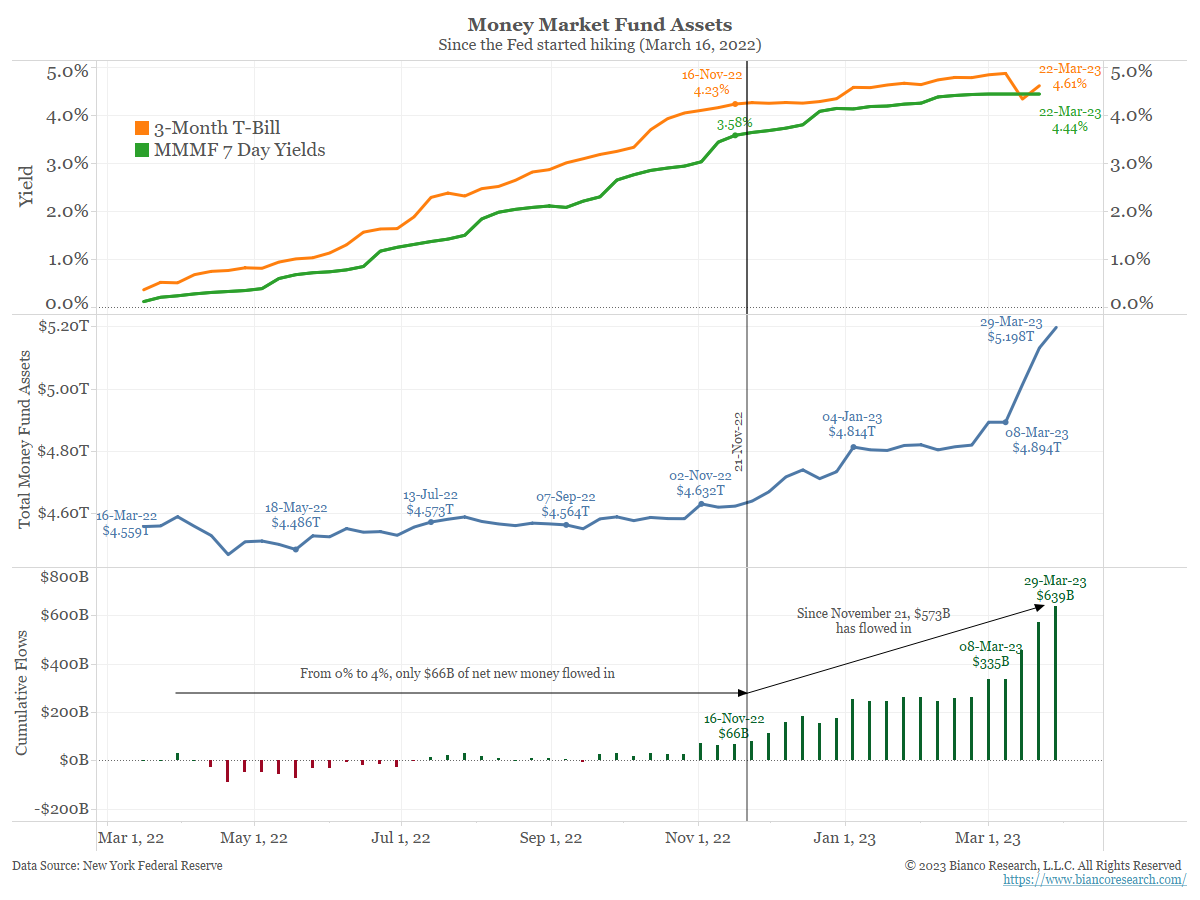

The next chart shows:

- Market rates in the top panel

- Total assets in money market mutual funds in the middle panel

- Cumulative flows into money market mutual funds since the Fed started hiking on March 16, 2022, in the bottom panel

The vertical line above denotes November 21, 2022, the day of the Liberty Street Economics blog post. The characterizations in the post were accurate at the time. “Deposit betas” were “attenuated” or “lower and slower.” People simply did not move money around while rates remained low.

But notice what happened right after November 21, 2022. Deposit behavior changed!

Flows into products offering market-based rates, like money market mutual funds, started increasing. Over half a trillion dollars flowed into money market funds in the four months since the New York Fed blog post.

Change Is Hard

What prompted depositors to begin moving funds out of banks? This coincided with market-based rates exceeding 4%, labeled on the top panel above. Compared to zero-yielding savings or checking accounts, this was a big enough incentive for the public to pull out their phone and move their money.

We don’t fault the New York Fed for the blog post. It was correct the day it was written. But make no mistake; we are now in a world where deposits respond to deposit rates.

How long will it take bankers and regulators to understand deposit betas have truly changed? We hope they already get it and are making the appropriate changes to their business models/regulations. But we fear it might still take them years to truly understand this change.

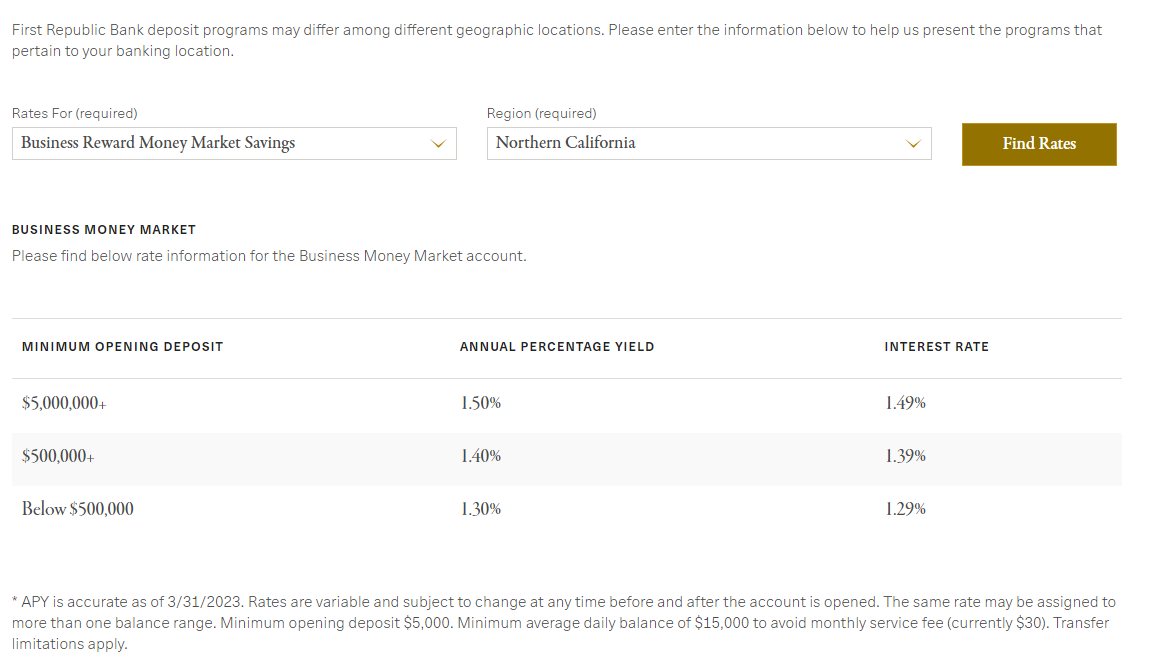

1.50%!

The image below is from First Republic’s website on Friday. A business account with more than $5 million in deposits yields 1.50%!

Compare this to market-based rates as of Friday:

- 3-month T-bills yield 4.69%

- 6-month T-bills yield 4.85%

- The average money market account (per S&P) yields 4.62%

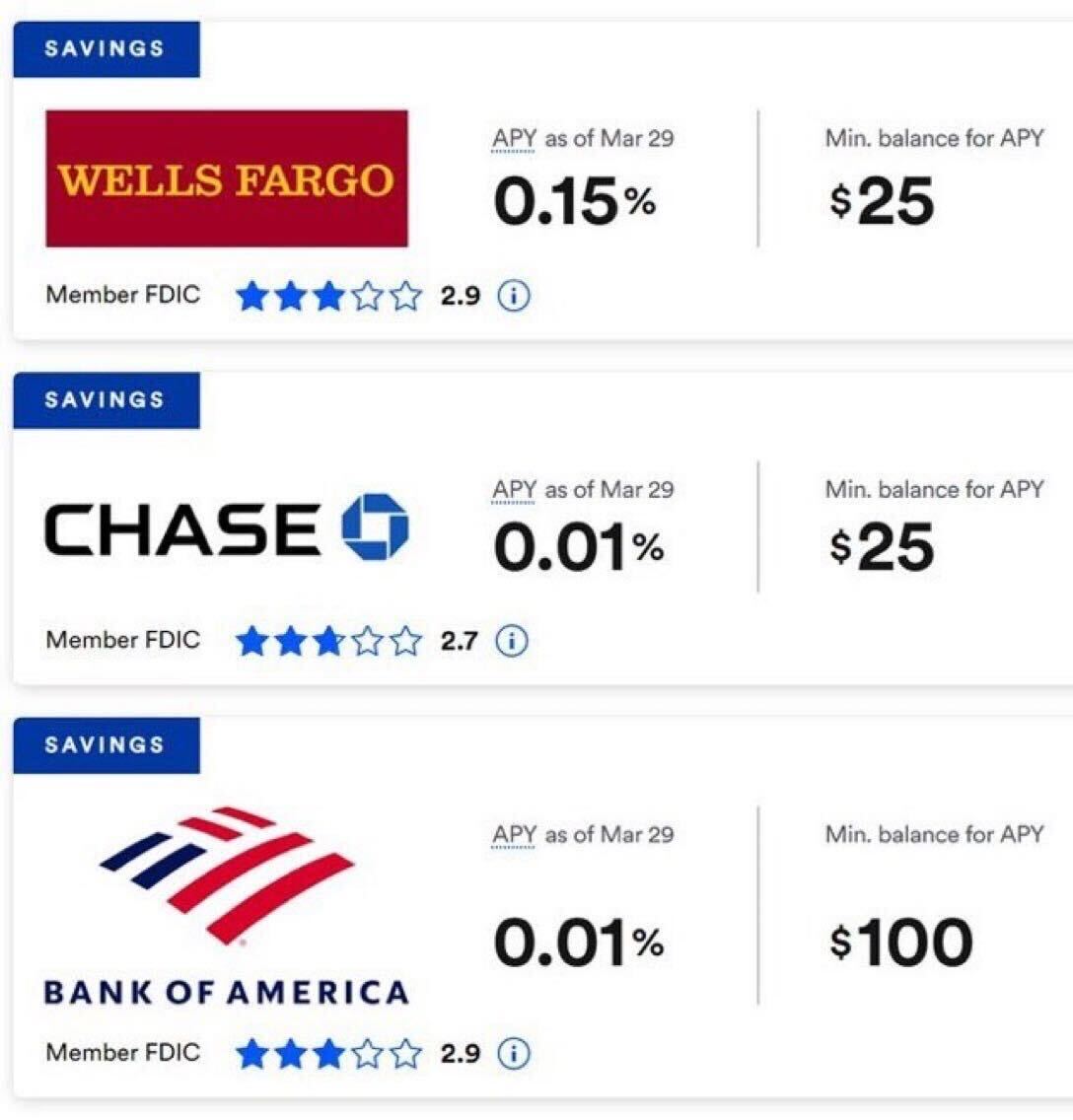

Note that First Republic bank is not alone with this “pre-November 21” thinking. Below are the savings rates from the largest “too-big-to-fail” banks this past week.

They are still essentially zero.

Consider:

- $5 million at First Republic would earn $75,000/year at 1.50%.

- $5 million in the average money market fund would earn $231,000/year at 4.62%.

Is a yield of 1.50% enough to attract depositors to First Republic? This rate has been offered for weeks, and their stock was down 88% in March alone. They lost $70 billion in deposits in a month, equal to half their deposit base. 1.50% is not attracting depositors when higher market-based rates and continued liquidity fears dominate.

That said, First Republic is not alone. The inability to understand “deposit betas” has changed in the last four months is why banks continue to let the spread between these two series continue to widen.

Why Does This Matter?

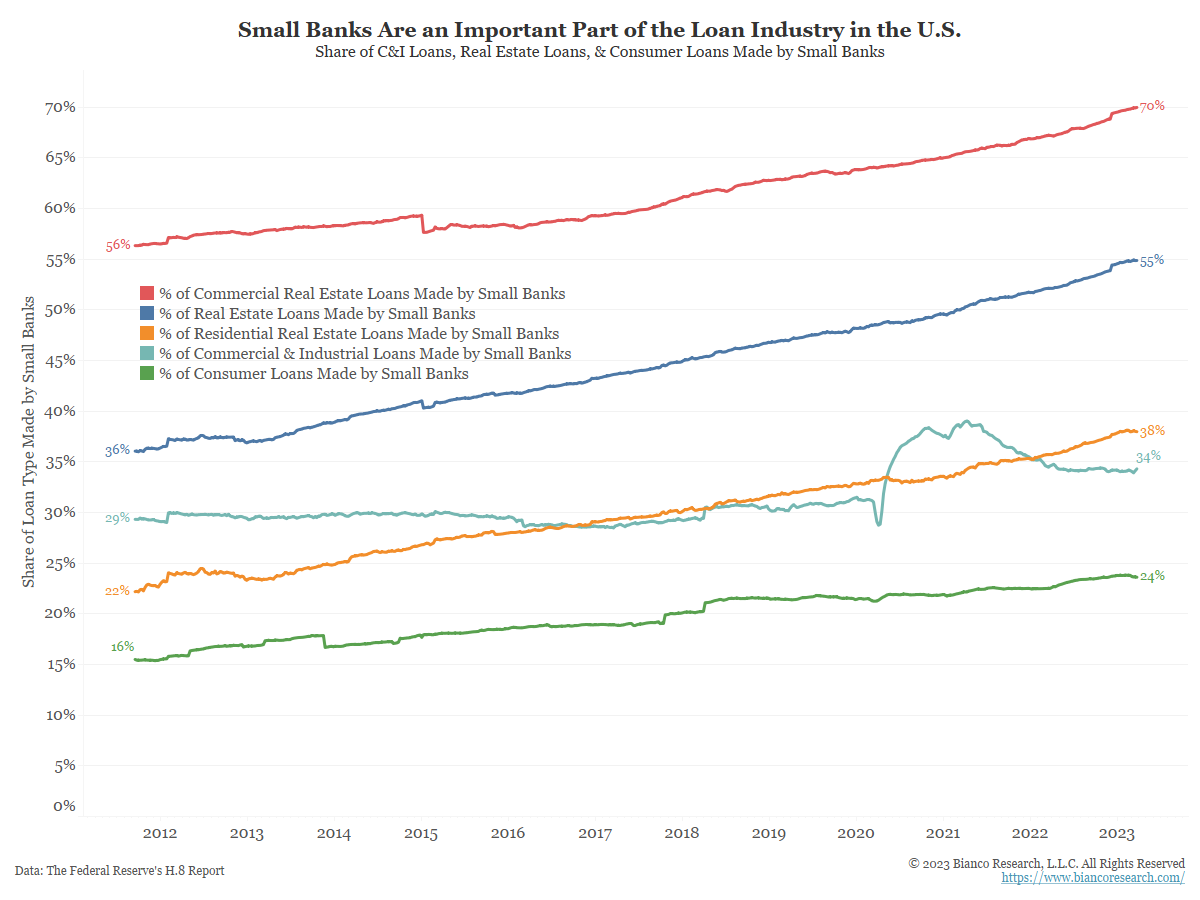

A bank is more than a “money warehouse” where we store our dollars for returns. It is also the primary transmission mechanism for lending, the economy’s lifeblood.

The chart below shows small banks (those outside the top 25) make up a considerable portion of various types of loans. If these banks are unsure about their deposit base, it stands to reason they might slow their lending.

This process might have already started. See what happened to total bank credit (total assets) at domestically chartered commercial banks last week (bottom two panels). On a dollar basis, bank assets declined nearly $70 billion last week, their biggest weekly decline since the middle of the financial crisis in November 2008. The chart near the top of this post shows $20.4 billion of this decline was due to a drop in loans and leases. The rest was due to a reduction in securities. In other words, they were likely forced to realize losses to meet deposit requests.

The decline in bank assets is just as dramatic on a percentage of assets (bottom panel). Last week bank assets declined 0.43%, the largest weekly percentage decline since December 2010.

If banks lose deposits (liabilities), they have to shrink assets. As this chart shows, it happened in a big way last week.

Mind the Gap

One way to close the deposit-to-market-rate gap is for the Fed to cut rates. But the Fed is worried about inflation, not a credit crunch:

- The Wall Street Journal – (March 30, 2023) Boston Fed’s Susan Collins Sees Modest Further Tightening by Central Bank

Federal Reserve Bank of Boston President Susan Collins said she expects the U.S. central bank to tighten policy a bit more to bring down inflation before holding interest rates steady through the end of the year. Recent stress in the financial sector has increased uncertainty about the direction of monetary policy, but the Fed must still address persistently high inflation, Ms. Collins added Thursday at a National Association for Business Economics conference in Washington.

In our opinion, the Fed only cuts rates if the economy crashes. They will not cut rates because of a fear that it might crash.

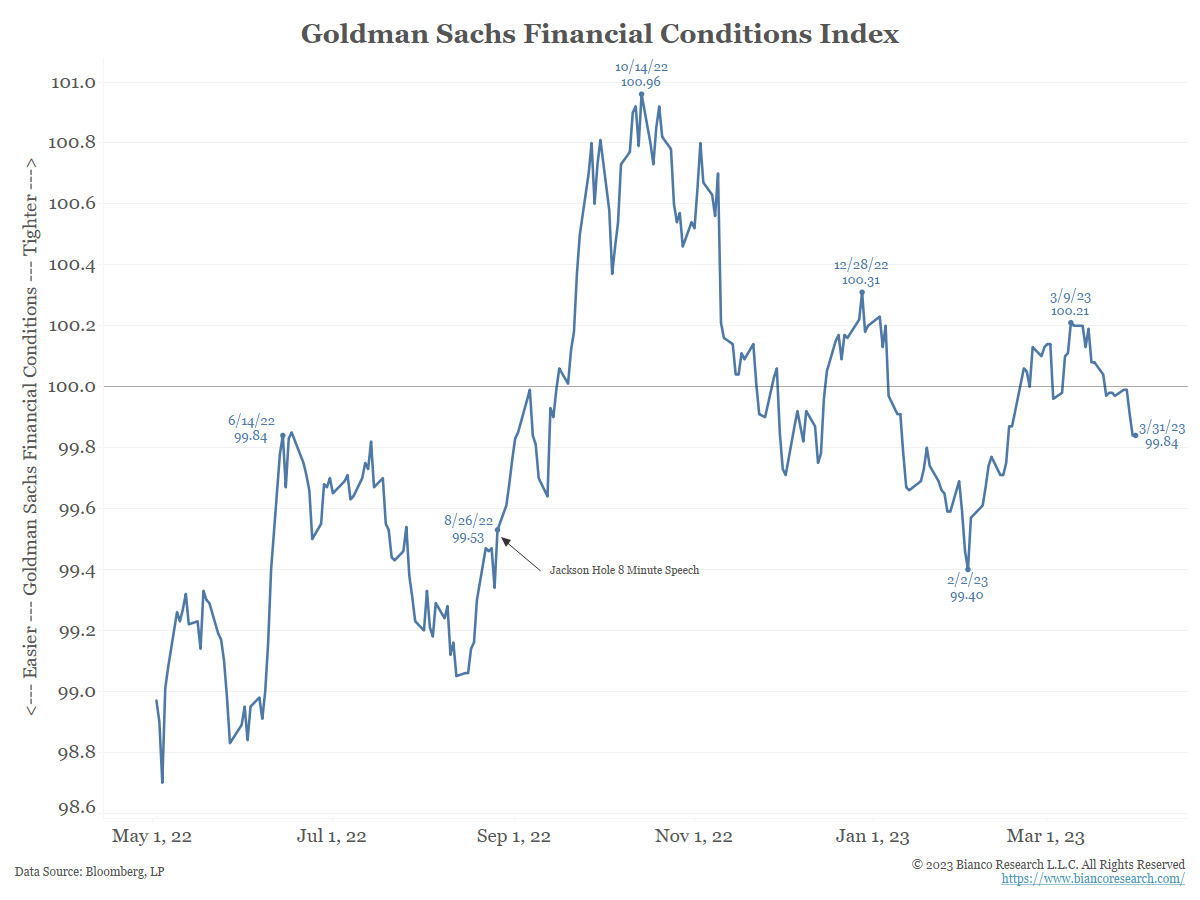

If the economy crashes, financial conditions would dramatically tighten. This is a fancy way of saying the stock market would tank.

But stocks have been going up 1% daily, and rates are falling. So, financial conditions have eased since the bank failures began (March 8).

Raise Deposit Rates

If the Fed is unlikely to start cutting rates without a real economic crash, banks could close the gap to market-based rates by raising their own rates. Sadly, this kills net interest margins, and profits collapse.

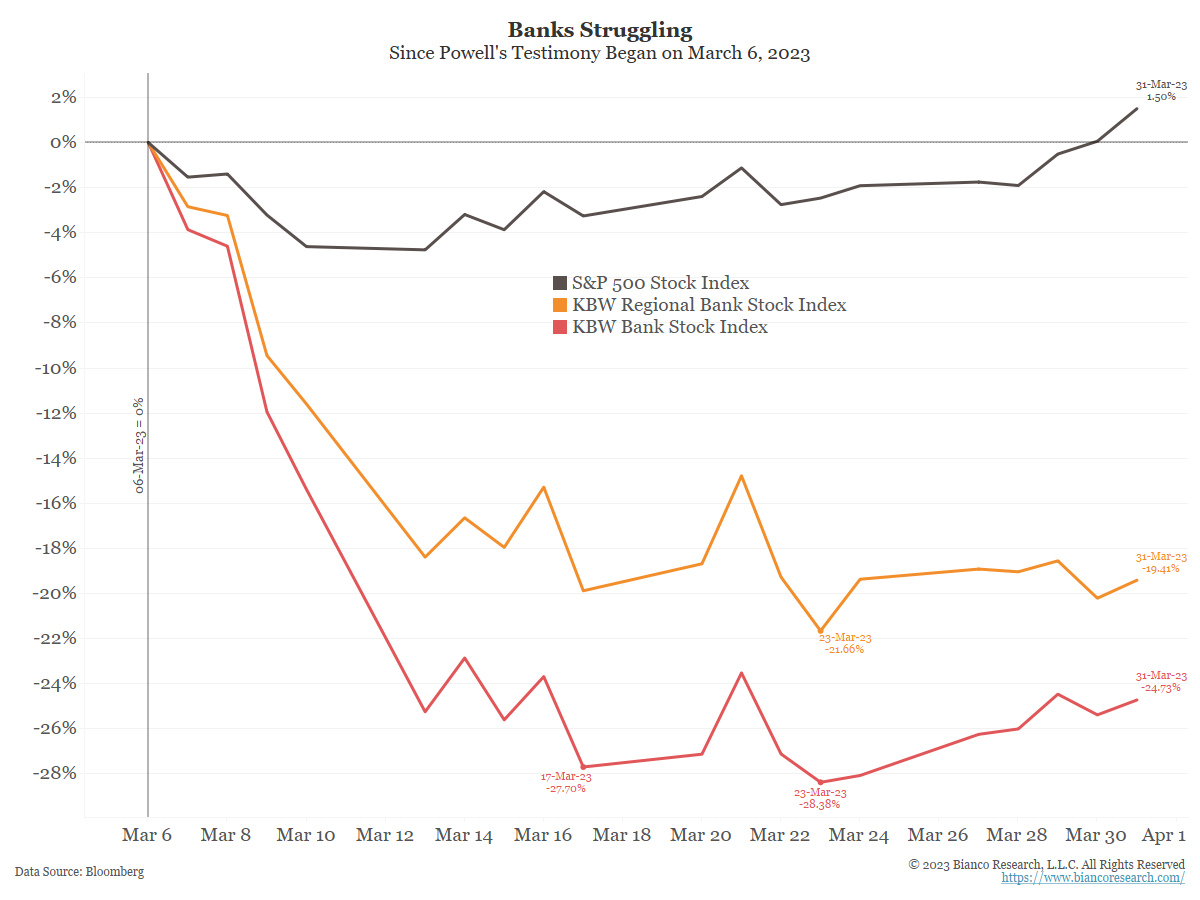

The market knows banks are facing a no-win situation. The chart below shows that bank stocks (red and orange) have trailed the S&P 500 by more than 20% since Powell’s testimony on March 6.

Further bank failures are the real concern. Bank stocks are still on the floor because profits are about to get squeezed as they will be forced to raise savings and checking rates.

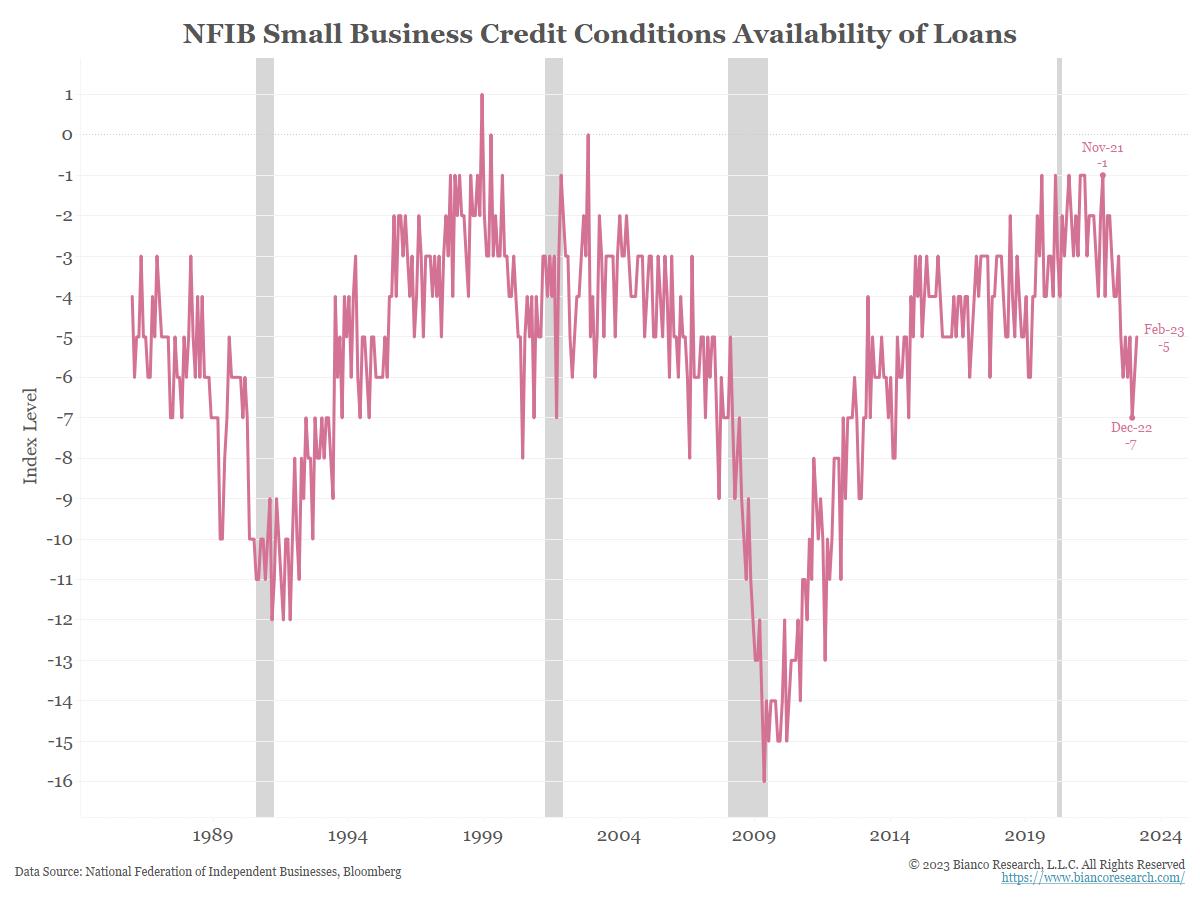

Availability of Loans

As the final chart shows, small businesses say credit availability deteriorated before recent bank failures accelerated deposit outflows. This measure is back to eight or nine-year lows.

Note the data below is only through February. It would stand to reason this measure will be considerably lower once March’s data is revealed.

Unless something changes and deposits stabilize at banks without severely restricting profitability, conversations between business borrowers and regional banks in the coming months will reflect a challenging environment.