Technology

AIoT: When Artificial Intelligence Meets the Internet of Things

AIoT: When AI Meets the Internet of Things

The Internet of Things (IoT) is a technology helping us to reimagine daily life, but artificial intelligence (AI) is the real driving force behind the IoT’s full potential.

From its most basic applications of tracking our fitness levels, to its wide-reaching potential across industries and urban planning, the growing partnership between AI and the IoT means that a smarter future could occur sooner than we think.

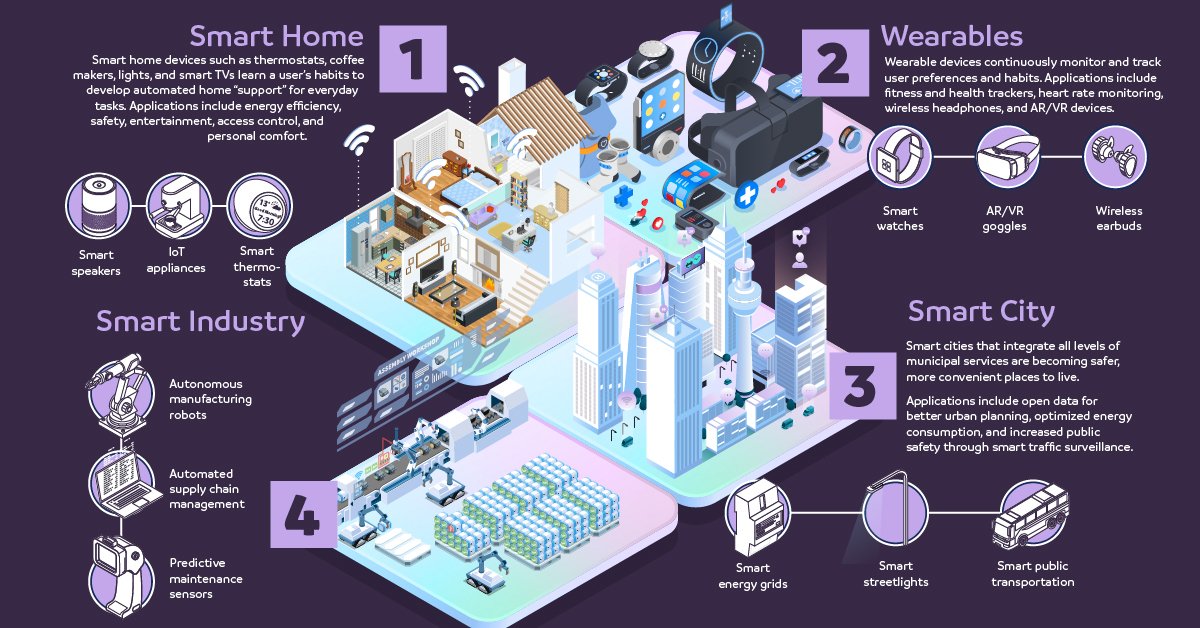

This infographic by TSMC highlights the breakthrough technologies and trends making that shift possible, and how we’re continuing to push the boundaries.

AI + IoT = Superpowers of Innovation

IoT devices use the internet to communicate, collect, and exchange information about our online activities. Every day, they generate 1 billion GB of data.

By 2025, there’s projected to be 42 billion IoT-connected devices globally. It’s only natural that as these device numbers grow, the swaths of data will too. That’s where AI steps in—lending its learning capabilities to the connectivity of the IoT.

The IoT is empowered by three key emerging technologies:

- Artificial Intelligence (AI)

Programmable functions and systems that enable devices to learn, reason, and process information like humans. - 5G Networks

Fifth generation mobile networks with high-speed, near-zero lag for real time data processing. - Big Data

Enormous volumes of data processed from numerous internet-connected sources.

Together, these interconnected devices are transforming the way we interact with our devices at home and at work, creating the AIoT (“Artificial Intelligence of Things”) in the process.

The Major AIoT Segments

So where are AI and the IoT headed together?

There are four major segments in which the AIoT is making an impact: wearables, smart home, smart city, and smart industry:

1. Wearables

Wearable devices such as smartwatches continuously monitor and track user preferences and habits. Not only has this led to impactful applications in the healthtech sector, it also works well for sports and fitness. According to leading tech research firm Gartner, the global wearable device market is estimated to see more than $87 billion in revenue by 2023.

2. Smart Home

Houses that respond to your every request are no longer restricted to science fiction. Smart homes are able to leverage appliances, lighting, electronic devices and more, learning a homeowner’s habits and developing automated “support.”

This seamless access also brings about additional perks of improved energy efficiency. As a result, the smart home market could see a compound annual growth rate (CAGR) of 25% between 2020-2025, to reach $246 billion.

3. Smart City

As more and more people flock from rural to urban areas, cities are evolving into safer, more convenient places to live. Smart city innovations are keeping pace, with investments going towards improving public safety, transport, and energy efficiency.

The practical applications of AI in traffic control are already becoming clear. In New Delhi, home to some of the world’s most traffic-congested roads, an Intelligent Transport Management System (ITMS) is in use to make ‘real time dynamic decisions on traffic flows’.

4. Smart Industry

Last but not least, industries from manufacturing to mining rely on digital transformation to become more efficient and reduce human error.

From real-time data analytics to supply-chain sensors, smart devices help prevent costly errors in industry. In fact, Gartner also estimates that over 80% of enterprise IoT projects will incorporate AI by 2022.

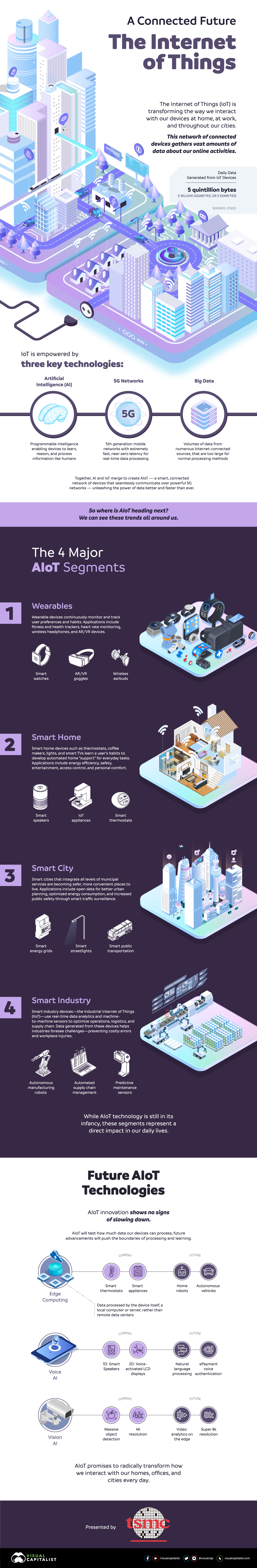

The Untapped Potential of AI & IoT

AIoT innovation is only accelerating, and promises to lead us into a more connected future.

| Category | Today | Tomorrow |

|---|---|---|

| Edge computing | Smart thermostats Smart appliances | Home robots Autonomous vehicles |

| Voice AI | Smart speakers | Natural language processing (NLP) ePayment voice authentication |

| Vision AI | Massive object detection | Video analytics on the edge Super 8K resolution |

The AIoT fusion is increasingly becoming more mainstream, as it continues to push the boundaries of data processing and intelligent learning for years to come.

Just like any company that blissfully ignored the Internet at the turn of the century, the ones that dismiss the Internet of Things risk getting left behind.

—Jared Newman, Technology Analyst

Technology

Ranked: Semiconductor Companies by Industry Revenue Share

Nvidia is coming for Intel’s crown. Samsung is losing ground. AI is transforming the space. We break down revenue for semiconductor companies.

Semiconductor Companies by Industry Revenue Share

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Did you know that some computer chips are now retailing for the price of a new BMW?

As computers invade nearly every sphere of life, so too have the chips that power them, raising the revenues of the businesses dedicated to designing them.

But how did various chipmakers measure against each other last year?

We rank the biggest semiconductor companies by their percentage share of the industry’s revenues in 2023, using data from Omdia research.

Which Chip Company Made the Most Money in 2023?

Market leader and industry-defining veteran Intel still holds the crown for the most revenue in the sector, crossing $50 billion in 2023, or 10% of the broader industry’s topline.

All is not well at Intel, however, with the company’s stock price down over 20% year-to-date after it revealed billion-dollar losses in its foundry business.

| Rank | Company | 2023 Revenue | % of Industry Revenue |

|---|---|---|---|

| 1 | Intel | $51B | 9.4% |

| 2 | NVIDIA | $49B | 9.0% |

| 3 | Samsung Electronics | $44B | 8.1% |

| 4 | Qualcomm | $31B | 5.7% |

| 5 | Broadcom | $28B | 5.2% |

| 6 | SK Hynix | $24B | 4.4% |

| 7 | AMD | $22B | 4.1% |

| 8 | Apple | $19B | 3.4% |

| 9 | Infineon Tech | $17B | 3.2% |

| 10 | STMicroelectronics | $17B | 3.2% |

| 11 | Texas Instruments | $17B | 3.1% |

| 12 | Micron Technology | $16B | 2.9% |

| 13 | MediaTek | $14B | 2.6% |

| 14 | NXP | $13B | 2.4% |

| 15 | Analog Devices | $12B | 2.2% |

| 16 | Renesas Electronics Corporation | $11B | 1.9% |

| 17 | Sony Semiconductor Solutions Corporation | $10B | 1.9% |

| 18 | Microchip Technology | $8B | 1.5% |

| 19 | Onsemi | $8B | 1.4% |

| 20 | KIOXIA Corporation | $7B | 1.3% |

| N/A | Others | $126B | 23.2% |

| N/A | Total | $545B | 100% |

Note: Figures are rounded. Totals and percentages may not sum to 100.

Meanwhile, Nvidia is very close to overtaking Intel, after declaring $49 billion of topline revenue for 2023. This is more than double its 2022 revenue ($21 billion), increasing its share of industry revenues to 9%.

Nvidia’s meteoric rise has gotten a huge thumbs-up from investors. It became a trillion dollar stock last year, and broke the single-day gain record for market capitalization this year.

Other chipmakers haven’t been as successful. Out of the top 20 semiconductor companies by revenue, 12 did not match their 2022 revenues, including big names like Intel, Samsung, and AMD.

The Many Different Types of Chipmakers

All of these companies may belong to the same industry, but they don’t focus on the same niche.

According to Investopedia, there are four major types of chips, depending on their functionality: microprocessors, memory chips, standard chips, and complex systems on a chip.

Nvidia’s core business was once GPUs for computers (graphics processing units), but in recent years this has drastically shifted towards microprocessors for analytics and AI.

These specialized chips seem to be where the majority of growth is occurring within the sector. For example, companies that are largely in the memory segment—Samsung, SK Hynix, and Micron Technology—saw peak revenues in the mid-2010s.

-

Technology2 weeks ago

Technology2 weeks agoRanked: The Most Popular Smartphone Brands in the U.S.

-

Automotive1 week ago

Automotive1 week agoAlmost Every EV Stock is Down After Q1 2024

-

Money1 week ago

Money1 week agoWhere Does One U.S. Tax Dollar Go?

-

Green2 weeks ago

Green2 weeks agoRanked: Top Countries by Total Forest Loss Since 2001

-

Real Estate2 weeks ago

Real Estate2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Maps2 weeks ago

Maps2 weeks agoMapped: Average Wages Across Europe

-

Mining2 weeks ago

Mining2 weeks agoCharted: The Value Gap Between the Gold Price and Gold Miners

-

Demographics2 weeks ago

Demographics2 weeks agoVisualizing the Size of the Global Senior Population