The biggest misconception with regard to gold

“The comparison to gold mined, scrap, central bank sales, etc., is particularly irrelevant. Mine supply adds a small increment each year to the total supply, but most of the gold (or any other asset) traded in the world is not the incremental new supply; it is shifting among the holders of the existing base of supply.”

Robert Blumen

From our point of view, the gold sector is riddled with an elementary misunderstanding. Many gold investors and analysts operate on an erroneous assumption: they attach too much importance to annual production and annual demand. We often read that the gold price cannot drop below production costs. We would like to discuss this misconception in the following and would also like to highly recommend the articles by Robert Blumen on this subject[1].

Every gramme of gold that is held for a variety of reasons is for sale at a certain price. Many owners would sell at a price slightly above spot, others would only sell at a substantially higher price. If, due to favourable prices, a private individual wants to sell his gold holdings that he acquired decades ago, it will not reduce the overall supply of gold. All that happens is the transfer from one private portfolio to another private portfolio. To the buyer, it makes no difference whether the gold was produced three weeks or three millennia ago.

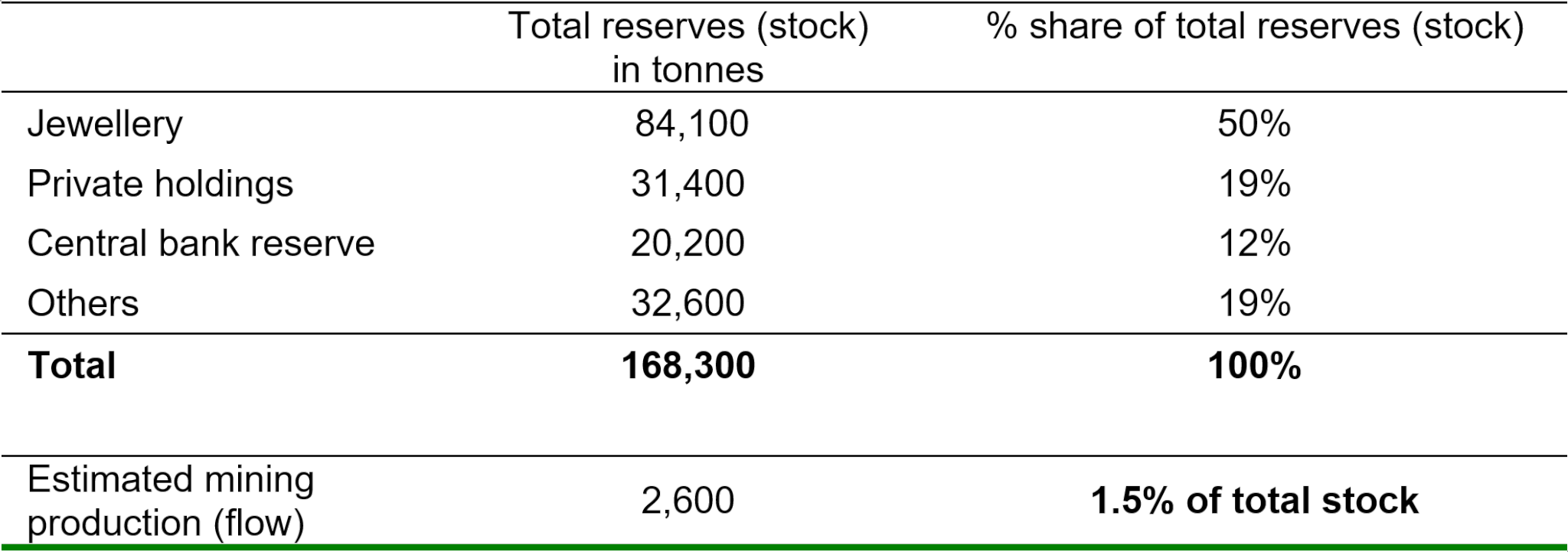

This means the annual gold production of close to 2,600 tonnes is of relatively little significance to the pricing process. Rather, the supply side consists of all the gold that has ever been produced. The recycling of existing gold accounts for a much larger share of supply than is the case for other commodities. Paradoxically, gold is not in short supply– the opposite is the case: it is one of the most widely dispersed goods in the world. Given that its industrial use is limited, the majority of all gold ever produced is still available.

„..neither is recent central bank buying a major factor in determining the gold price, nor are big investors like Soros or Paulson. The amounts involved are nothing but drops in the daily ocean of gold trading. Gold is not a normal commodity, it is the money commodity. It must be analyzed like a currency. With the total available supply at roughly 165,000 tons, how can buying and selling of a few hundred tons make any difference? More than those few hundred tons trade on the LBMA alone every single trading day… The decisive factor in determining the gold price is the reservation demand of the current owners of the extant gold supply.” www.acting-man.com

Much like an increase in the money supply dilutes the purchasing power of existing money, and the issue of new stock dilutes the existing share holders’ equity per share, an increase in the supply of gold should be understood as a dilution of the existing supply. A one-percent increase in supply can be absorbed by the market via a 1% price drop, with total demand remaining the same in nominal terms.

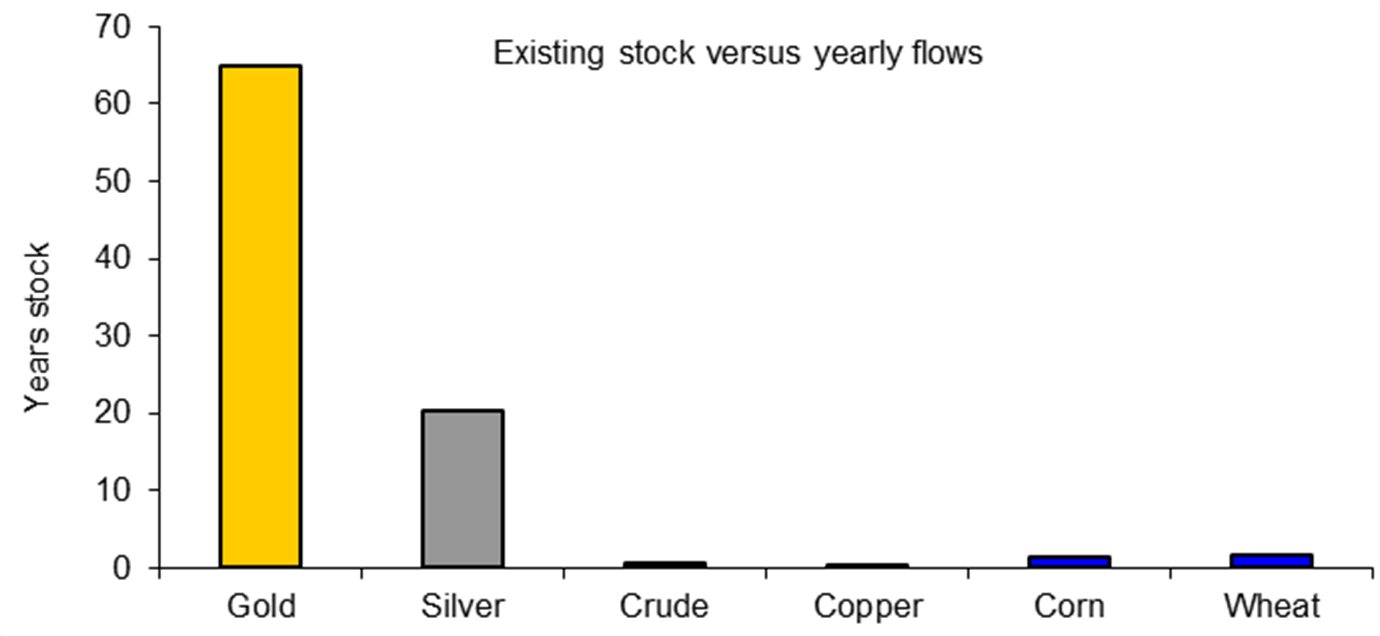

High stock-to-flow ratio is the most important characteristic of gold

In contrast to other commodities, the discrepancy between annual production and total available supply (i.e. the stock) for gold and silver is enormous. This is called a high stock-to-flow ratio. As already discussed last year[2], we believe that this is the single most important distinctive feature of gold (and silver). The aggregate volume of all the gold ever produced comes to about 170,000 tonnes. This is the stock. Annual production was close to 2,600 tonnes in 2011. That is the flow. Dividing the former by the latter, we receive the stock-to-flow ratio of 65 years.

Source: CLSA Asia-Pacific Markets, World Gold Council

Gold reserves grow by about 1.5% every year, and thus at a much slower rate than any of the money supply aggregates around the world. The growth rate is vaguely in line with population growth. Trust in the current and future purchasing power of money or any means of payment not only depends on how much is available now, but also on how the quantity is expected to change over time.

What does that mean in numbers? If annual mine production were to double (which is highly unlikely), this would translate into an annual increase of only 3% in the supply of gold. This is still a very minor inflation of total gold reserves, especially compared to current rates of dilution of paper currencies. This fact creates a sense of security as far as availability is concerned and prevents natural inflation. If production were down for a year, this would also have little effect on the total stock and on pricing. On the other hand, if a significant part of oil production were to be disrupted for an extended period of time, stocks would be exhausted after only a few weeks. This means it is much easier for gold to absorb any form of significant production expansions or shortages.

Many gold market analysts attach great importance to the rate of change of mine production (increasing mine production being bearish; decreasing: bullish). The change in production from one year to the next is an increment on top of an increment and is really of miniscule importance to the supply situation.

We therefore believe that gold is not precious because it is scarce, but because the opposite is true: gold is precious because the annual production is so low relative to the stock. Gold has acquired this feature over centuries, and cannot lose it anymore. This stability and safety is a crucial prerequisite for the creation of trust. And it is what clearly differentiates gold and silver as monetary metals from commodities and the other precious metals. Commodities are consumed, whereas gold is hoarded. This also explains why traditional supply/demand models are only of limited use for the gold market.

“Contrary to the consumption model, the price of gold does clear the supply of recently mined gold against coin buyers; it clears all buyers against all sellers and holders. The amount of gold available at any price depends largely on the preferences of existing gold owners, because they own most of the gold.”

Robert Blumen

In the case of a good that is consumed, a rising supply/demand deficit would of course trigger higher prices until a new equilibrium price has been restored. This is not so for goods that are hoarded. Therefore a simple consumption model only works for goods that are actually consumed and whose annual production in relation to the existing stock is relatively high (i.e. low stock-to-flow ratio).

This means that the production costs are also of limited significance when it comes to the pricing. They are mainly relevant for the performance of gold shares. From our point of view, analyses claiming that the gold price cannot drop below production costs are therefore based on a fundamental misunderstanding. While from a certain price onwards the production would turn unprofitable for mining companies, the trade of already produced gold would not suffer. The mining sector therefore has little influence on the gold price. However, the opposite is not true: the gold price has a substantial impact on mining and its profitability[3].

There is no single cost of mining gold – the cost depends on the characteristics of the deposit and the mine. The cost of extracting each ounce within the same mine will vary. The price of gold, relative to mine labor and mining capital goods prices, determines which mines are profitable and which are not, and which ounces within a given mine can be profitably extracted. As the gold price rises relative to mining costs, formerly uneconomic deposits become profitable to mine.

The demand side is made up of investors, the jewellery industry, central banks, and the industrial sector. But this is still only a fraction of total demand. Reservation demand accounts for the largest part of demand. This term describes gold owners who do not want to sell gold at the current price level. By refusing to sell, they are responsible for the price remaining at the same level[4].

This means that the decision not to sell at current prices is as important as the decision to buy gold. In net terms, the effect on the price is the same. The gold supply is therefore always high. At a price of USD 5,000, the supply of recycled gold would exceed annual production several times. This also explains why the often-quoted gold deficit is a fairy tale.

“Gold is an asset. Supply and demand should be understood in the same way that we understand the shares of a company. Every time shares change hands, the shares are demanded by a buyer and supplied by a seller. For each and every transaction, supply equals demand. Adding up all of the transactions that occur on a particular exchange, over the course of a month or a year, tells you absolutely nothing…If you said that buyers in China had bought 100 million shares of Microsoft but ‘no supplier could supply that many shares,’ nor was the company issuing enough new shares to meet the demand, you would readily see the error in that statement…Everyone understands that new shares only dilute the value of the existing shareholders, that it is not required for a company to issue new shares for the price to go up or down and that most trading of shares consists of existing shareholders selling to people who have dollars”

Robert Blumen

Stock-to-flow ratio as most important reason for monetary relevance of gold and silver

Source: The Gold Standard Institute, Sharelynx.com, Erste Group Research

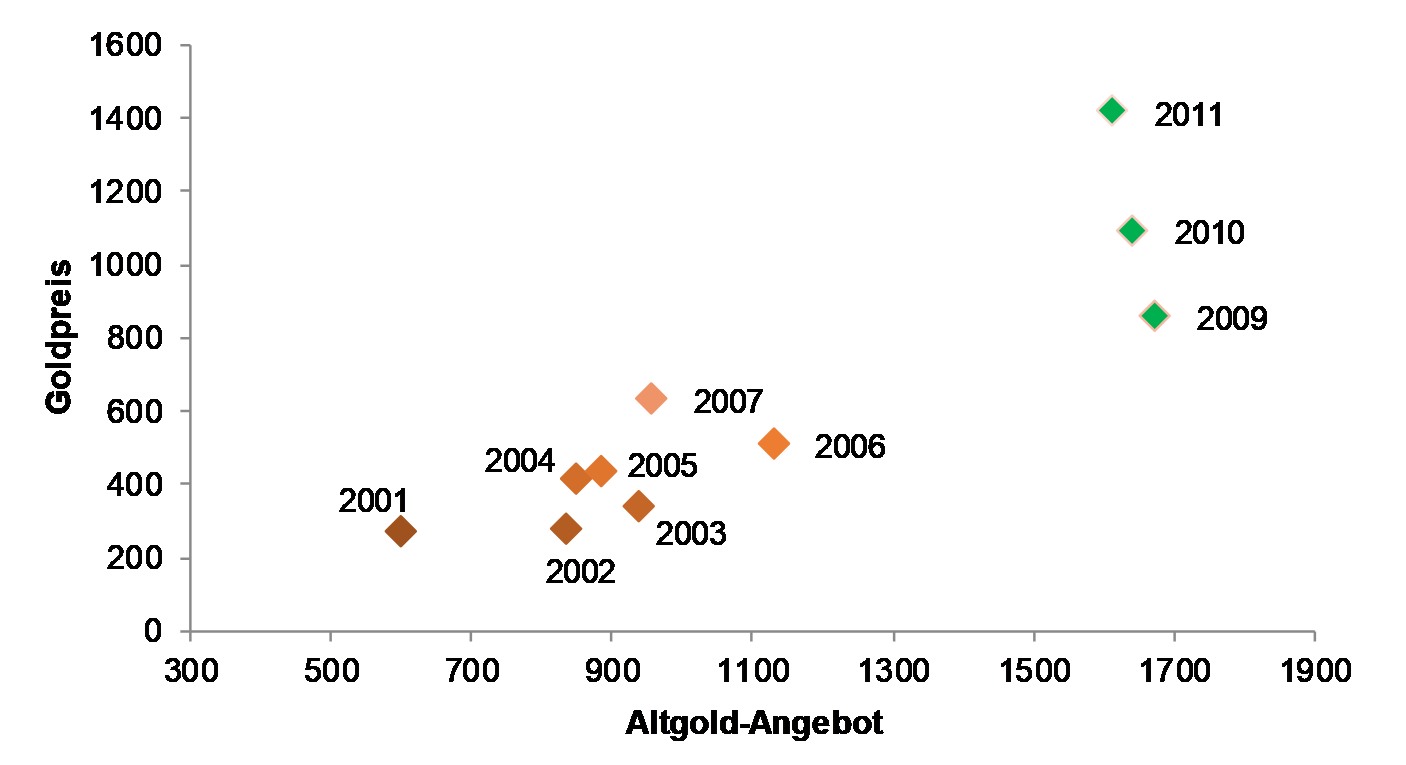

Of course the supply of recycled gold has increased significantly throughout the bull market. But it strikes us as interesting that the supply has only increased marginally since 2009, in spite of a drastic increase in the price. This could mean that the market has gotten used to a higher price, to the extent that new sellers will only come forward at substantially higher prices. This distribution indicates that gold holdings are gradually moving from weak to strong hands.

Recycled (scrap) gold supply vs. gold price since 2001

Source: World Gold Council, Bloomberg

But what is the implication of that? Whenever a seller sells, that means that gold has hit their reservation price, so they sell to a buyer – who inherently has a higher reservation price demonstrated by his willingness to buy at that price. This means that large sales improve the market structure.

Conclusion

The gold market should therefore be seen as an integrated market. We believe that the segregation into annual production and total reserves is incorrect and leads many analysts to the wrong conclusion. All sources of supply are equivalent, given that every available ounce of gold is in direct competition with other ounces, regardless of whether this specific ounce was produced 3,000 years ago or three months ago or consists of recycled dental gold. The annual gold production of close to 2,600 tonnes is therefore of no significant relevance to the pricing.

[1] For further reading we recommend the highly interesting articles by Robert Blumen, especially “Does Gold Mining Matter?”, “The Myth of the Gold Supply Deficit” and “If gold supplies are rising, why aren’t prices falling”, all available at mises.org

[2] Please refer to In Gold We Trust report 2011

[3] Please refer to “Does Gold Mining Matter?”, Robert Blumen

[4] Please refer to “WSJ does not understand how the gold price is formed”, Mises Economics Blog, Robert Blumen