Can Banks Find Growth Through Bitcoin?

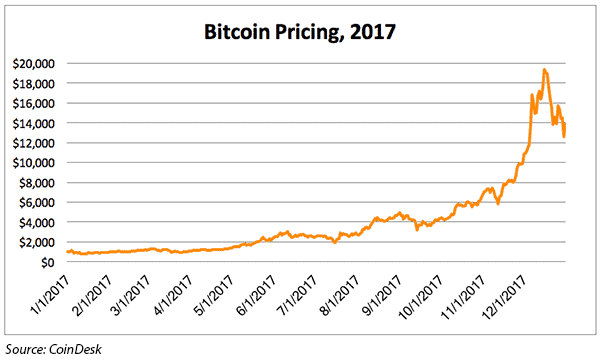

Investor speculation in the cryptocurrency market hit a fever pitch in 2017, setting one record high after another over the course of the year. Bitcoin—the most prominent and highly valued cryptocurrency—was valued at $998 on January 1, 2017, according to the cryptocurrency news source CoinDesk. By mid-December, it was closing in on $20,000. Bitcoin fell to $13,860 at the end of the year, but these gains are still remarkable. Other cryptocurrencies—notably Ethereum and Litecoin—saw similar gains in 2017, albeit at a lower price point.

Investor speculation in the cryptocurrency market hit a fever pitch in 2017, setting one record high after another over the course of the year. Bitcoin—the most prominent and highly valued cryptocurrency—was valued at $998 on January 1, 2017, according to the cryptocurrency news source CoinDesk. By mid-December, it was closing in on $20,000. Bitcoin fell to $13,860 at the end of the year, but these gains are still remarkable. Other cryptocurrencies—notably Ethereum and Litecoin—saw similar gains in 2017, albeit at a lower price point.

Alan Lane, the chief executive of Silvergate Bank, bought his first Bitcoin in 2013. The $1.2 billion asset bank based in La Jolla, California, was seeking deposit niches to fund its loan growth, and the more he explored the cryptocurrency space, the more he realized that these companies were flush with venture capital cash but lacked banks willing to provide deposit accounts to these companies. Early on, Lane brought in a potential client in the cryptocurrency space to speak with a few members of his team about how cryptocurrency works, and the challenges these firms face in establishing banking relationships. In 2014, the bank started building deposit relationships with cryptocurrency and other financial technology firms. “It’s become a major line of business for us,” Lane says.

The bank developed a program to build these deposits while staying in the right lanes for regulatory compliance. The bank established an early dialogue with its regulators. “We invited our regulators in to walk through how we were approaching this [and] the kinds of analysis we were doing in terms of vetting the appropriate [regulations] as related to a particular customer that we might choose to bank,” says Lane. “That early dialogue with the regulators has continued.” He dismisses concerns that cryptocurrency businesses are inherently dangerous. “There are regulations on the books, and it’s up to us to figure out how those regulations apply and how we can do things in a safe and sound manner,” he says.

Cross River Bank, with $877 million in assets in Teaneck, New Jersey, provides settlement and treasury management services for the cryptocurrency exchange Coinbase—an active business, given Bitcoin’s rise. “We have a strong appetite for those kinds of relationships,” says Cross River CEO Gilles Gade. Due diligence for these relationships is rigorous. Clients must have an executive on staff dedicated to BSA/AML, and systems equipped to comply with the Bank Secrecy Act and related rules. Cross River has the internal expertise to monitor these transactions as well, and Gade characterizes the bank’s risk limits as conservative.

Cross River Bank has developed APIs to facilitate cryptocurrency transactions, allowing the bank to quickly access the accounts of Coinbase users. “We never actually touch Bitcoin,” says Gade. Money is pulled from the Coinbase user’s bank account and deposited in a dedicated Coinbase account at Cross River. Coinbase then issues the desired cryptocurrency to the user. When the user wants to sell, the reverse of this process occurs, with the money in U.S. dollars landing in the user’s traditional bank account.

The banking industry has focused more attention on the potential of the underlying technology behind bitcoin—blockchain, a digital ledger by which participants can transfer assets without a centralized authority. “The underlying technology is where the real value is,” particularly for the banking industry, says Brent McCauley, a partner at the law firm Barack Ferrazzano. Blockchain could help the financial sector create efficiencies in several areas, from cross-border transactions to authenticating customer identities. And banks are actively testing concepts and working with the technology. “The blockchain is a technology which is a good technology. We actually use it. It will be useful in a lot of different things,” said Chase CEO Jamie Dimon last October, who has harshly criticized Bitcoin. “God bless the blockchain.”

Bitcoin has captured the attention of investors looking to cash in on the crypto-boom, but the volatility shown by Bitcoin and its crypto-brethren makes it an undesirable way pay for goods and services in the United States, or any other country with a stable currency. “The price has been skyrocketing, but for the most part, people are not using it for financial transactions,” says Jim Sinegal, an equity analyst with Morningstar. What seller wants to lose thousands of dollars if Bitcoin crashes, and what buyer is comfortable paying significantly more than an object is worth when the currency fluctuates?

As a result, few retailers accept Bitcoin as a method of payment. But as the payments landscape continues to evolve, bank boards and management teams would benefit from understanding cryptocurrency. Bitcoin transactions are public and traceable, for example. “Everybody can see the chain of title for Bitcoin, so it does provide some advantages that fungible currency doesn’t provide,” says McCauley. Central banks are exploring their own options for digital currency, and there are several cryptocurrency competitors to Bitcoin. Even if it doesn’t become a common form of currency in its own right, Bitcoin has blown the lid off the payments space. It would behoove directors serving on bank boards to consider what this means for their own institutions, and whether there’s a way to make a profit in this evolving space.

Disclosure: The writer owns a small stake in Bitcoin, Ethereum and Litecoin and manages her investment through her Coinbase account.