In Online Travel, Repeat Bookers Are Elusive, Except for Airbnb

- Published:

- April 2017

- Analyst:

- Cathy Walsh

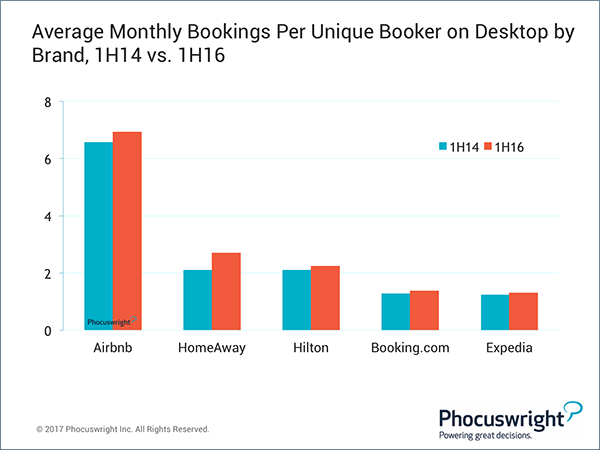

The cost of customer acquisition is high and getting higher, making traveler loyalty a crucial, but often elusive, goal for travel brands. But Airbnb, with its hip brand, unique market positioning and devoted customer base, is smoking its competitors on repeat booking.

(Click image to view a larger version.)

Airbnb's desktop repeat booking rate in 1H16 was roughly five times that of Booking.com and Expedia, and roughly three times that of the top hotel brands. Private accommodation repeat rates aren't directly comparable to other channels, since a portion of private accommodation bookings are "on request," and nearly half of on-request bookings are rejected. Yet Airbnb's repeat rate was also more than double that of private accommodation competitors HomeAway and VRBO in 1H16.

With accommodation shoppers increasingly considering private accommodation alongside hotels when planning travel, Airbnb's loyalty mojo is now a competitive threat to private accommodation players as well as hotels and OTAs.

Do you subscribe to Phocuswright research? If so, great! Click here to dig deeper into these insights in get a comprehensive view of trends on online accommodation with U.S. Accommodation: Clickstream & Conversion 2014-2016 (Series).

Not a subscriber? You can still get highlights of this important research from this free report. Download it now!

(Get information about our subscriptions here.)

* This research was conducted in partnership with Jumpshot, and is based on an analysis of traffic, conversion and clickstream data for the U.S. websites of major hotel, OTA, metasearch and private accommodation brands between 2014 and 2016.

.png)

.jpg)