Markets for ether, the cryptocurrency linked to the ethereum distributed computing platform, were rocked yesterday by a huge flash crash that saw prices fall from over $365 down to as low as 10 cents on one exchange before bouncing back shortly afterwards—an event that is mildly worrying for anyone concerned about cryptocurrency volatility, but has had devastating consequences for some professional traders who have seen their holdings wiped out.

Advertisement

The crash occurred at about 3:30pm ET Thursday, when a huge sale of ether was made on the GDAX exchange, an extension of the popular Coinbase exchange and cryptocurrency wallet geared towards professional traders. According to GDAX's official statement, a single and as yet unknown actor sold millions of dollars worth of ether across a range of positions from $317 down to $224, meaning that ether was effectively trading at the lower end of this range. The consequence of this initial drop in trading value was to trigger a number of stop loss orders—mechanisms by which a trader's holdings will automatically be sold when the price dips below a certain marker. In turn, these new sales drove the price lower, triggering additional stop loss order in a cascading effect. At its lowest point, ether was trading for $0.10 per unit.The process was even more painful for the many traders who were engaged in margin trading, a feature that GDAX has only permitted on the exchange since March. In margin trading, traders are permitted to place buy and sell orders for larger sums than they have in their accounts, multiplying the potential size of both gains and losses. According to the support documents on the site, GDAX offered margin traders up to 3x leverage for the USD/ETH trading pair, meaning that someone with only a $1,000 account balance could buy or sell up to $3,000 of ether.But as a precautionary measure, margin trading accounts are set to automatically liquidate in order to make up the money borrowed (i.e. sell all ether as quickly as possible) if losses exceeded a certain amount, a process called "margin calling." With the crash happening so fast, traders were margin called almost instantly, and in some cases saw their entire holdings sold off at very low prices before they could react—selling, say, 100 ETH at $2 to cover just a few hundred dollars' loss, right before the market bounced back to almost $300/ETH again.

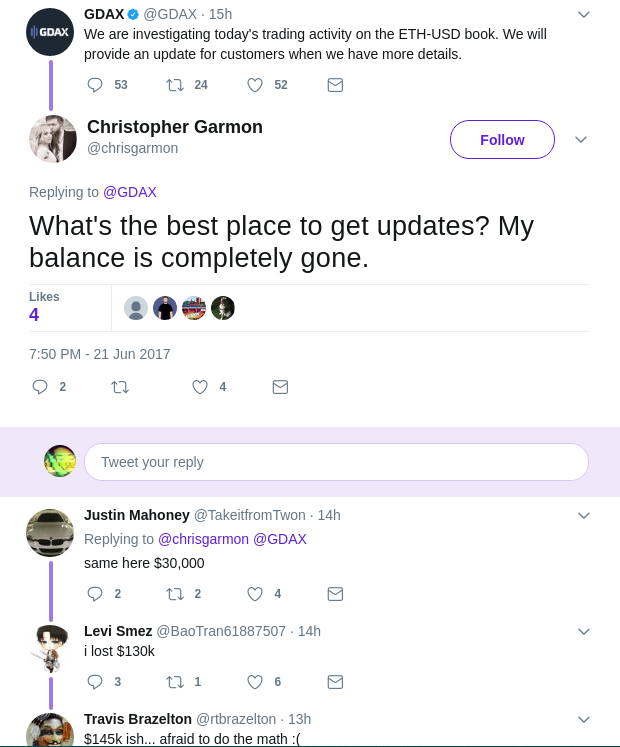

Understandably, with huge sums having been lost (and in some cases gained) in the blink of an eye, pointed questions are being asked about the sell which first triggered the process and whether it was an attempt at market manipulation. GDAX's blog post stated that it will be conducting a "thorough investigation" into events, but in the meantime the cryptocurrency trading community will be looking for answers wherever they can find them. Some of the affected individuals have already started to organize via a Telegram group with the intention of filing a class action lawsuit against the exchange, but at present GDAX's position is that all margin trades are final, and terms were outlined in advance.Get six of our favorite Motherboard stories every day by signing up for our newsletter.