Skift Take

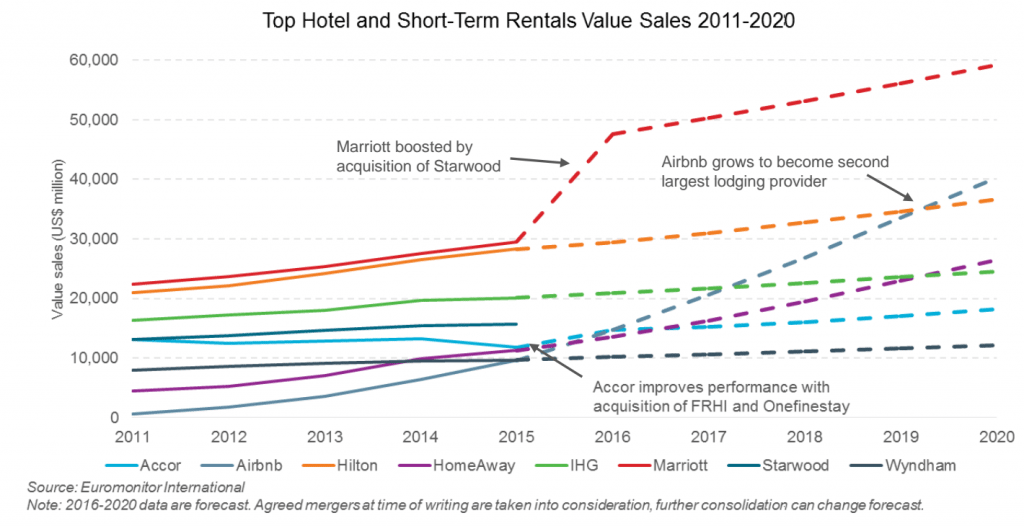

Even as CEOs of major hotel chains argue that Airbnb doesn't threaten their bottom lines, the projection that some short-term rental companies will have higher room sales than some hotels by 2020 makes their footing less secure.

Some hoteliers still brush off the threat of Airbnb and suggest that the short-term rental company hasn’t had any impact on their own businesses.

But if new projections pan out from Euromonitor International, a London-based global market research firm, Airbnb will be the world’s second largest hospitality company in 2020 in terms of total room sales. Airbnb would only be dwarfed by the combined Marriott-Starwood and will have nearly $40 billion worth of short-term rental sales per year by 2020.

A lot could happen between now and 2020 that could alter these projections or completely disprove them, particularly with Airbnb. But Airbnb’s multi-billion dollar stockpile of cash and its ambitions to bring business travel into its fold point to considerable staying power.

Euromonitor’s recent report on short-term rentals argues Airbnb’s branching out in terms of target audience and property composition will help determine how cities and countries adapting their regulatory frameworks to either legalize or ban it. “It has lost its image as a technology start-up and peer-to-peer platform championing the rights of homeowners,” the report states.

“It is clear that the company is attracting more than just private homeowners, with independent hotels, serviced apartment operators and real estate agents showing an interest in using the platform to rent out properties,” the report states.

“If Airbnb continues to support and increase the amount of commercial businesses offering properties on its platform, legislators are likely to come down hard on the company. Airbnb will need to be seen battling against this corporatization if it wants to continue its growing support from legislators, but this stance against businesses might ultimately hamper the platform from growing its supply, especially of luxury properties.”

Even by 2020, according to Euromonitor’s projections, Airbnb’s total annual sales will be about $20 billion behind Marriott-Starwood’s. Another large chain such as Hilton or IHG could make a bold merger or acquisition like Marriott International did last year and change the lineup of biggest players. (See Chart 1 below).

The following charts based on financial data show how Airbnb, HomeAway and major hotel chains fit into the overall global accommodations picture and how that could shift by the end of this decade. These projections also take into account recent merger announcements.

Chart 1: When comparing both hotel and alternative accommodation companies, the combined Marriott-Starwood is projected to be the largest hospitality company in 2020 in terms of “value sales” (Euromonitor’s term for how much guests pay to rent a hotel room or short-term rental, including revenue secured by chains and property owners.) Marriott was already the largest company in terms of room sales in 2015.

Airbnb is projected to be the second largest hospitality company in terms of room sales (or, in its case, sales from short-term rentals) by 2020, but a lot could happen between now and then to alter that projection.

The chart below indicates that Marriott, for example, had nearly $30 billion in room sales in 2015 but its annual 10-K Securities and Exchange Commission filing says the company’s overall 2015 revenue was about $14.5 billion. We asked Euromonitor to clarify how it makes these projections and where its data comes from:

“At Euromonitor we look at the lodging industry from a consumer point of view, so we look how much travelers spend at each brand,” said Wouter Geerts, Euromonitor’s travel analyst for lodging. “So according to our calculations (and we base this on number of rooms, occupancy rates and revenue per available room provided by the companies in their annual reports), globally around $29.5 billion was spent on Marriott-branded hotel rooms.”

“This is different from the revenue reported by Marriott, as their revenue is the money the company makes. However, like all large hotel chains, Marriott only owns a small number of its branded hotels and most of its revenues are based on franchise and management fees. In the case of the owned hotels it would include room value sales but for most of Marriott’s hotels this isn’t the case.”

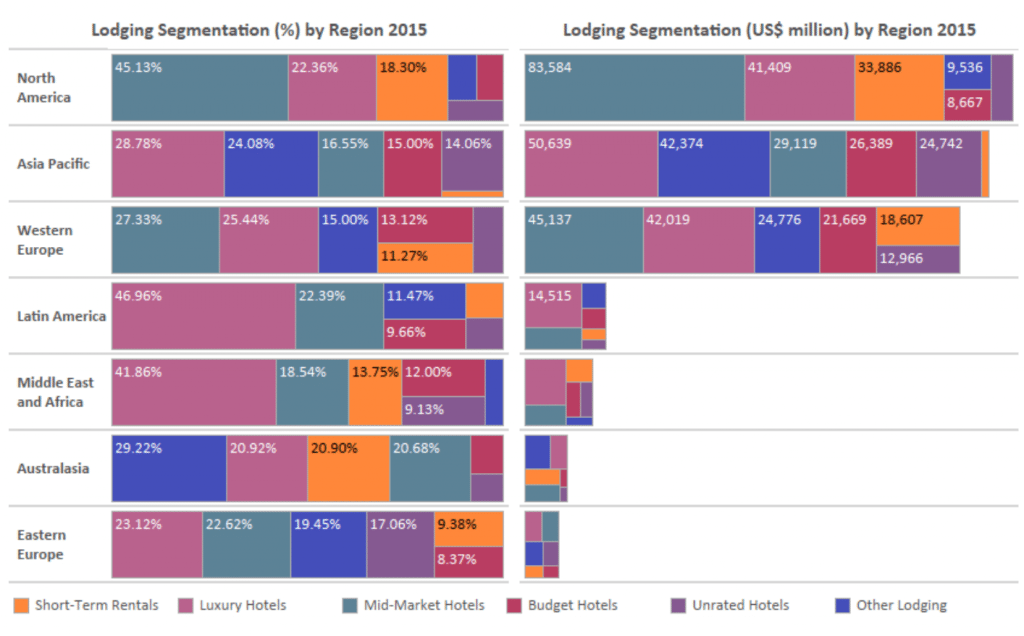

Chart 2: In 2015, short-term rentals were one of the largest percentages of accommodations in North America, Western Europe, the Middle East and Africa, and Asia-Pacific. Short-term rentals’ percentages of total lodging were largest in North America and Asia-Pacific while North America and Western Europe had the largest revenue for short-term rentals.

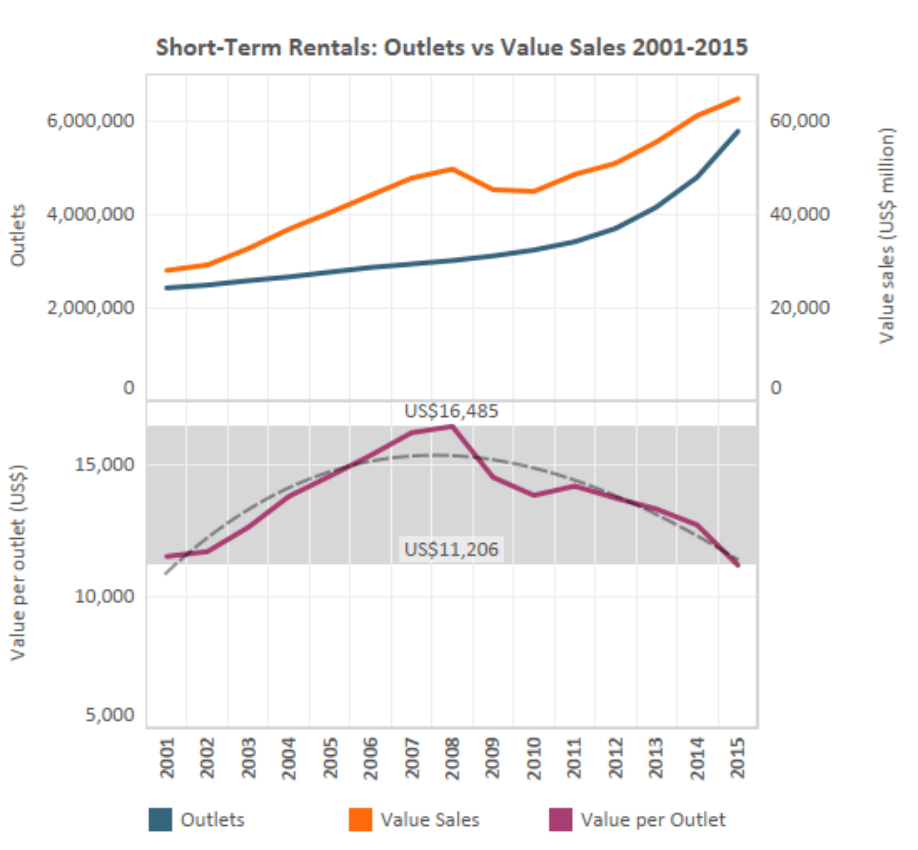

Chart 3: The average amount a short-term rental guest has paid per booking has decreased since 2008 as short-term rentals’ popularity has grown in general. The fact that value sales growth is trailing outlet growth (Euromonitor’s term for room inventory) means that value sales per available inventory are in a downward spiral. This is mostly due to demand for short-term rentals not keeping pace with that sector’s expanding supply. Airbnb has more than 2 million listings around the world, for example.

“This downward trend means that for hosts, offering their listing on more exclusive websites, better marketing, and offering something different from the majority of hosts will become more important to stand out from the ever-increasing crowd,” the report states.

“Airbnb will need to consider how it carries on attracting supply if average sales continue to drop.”

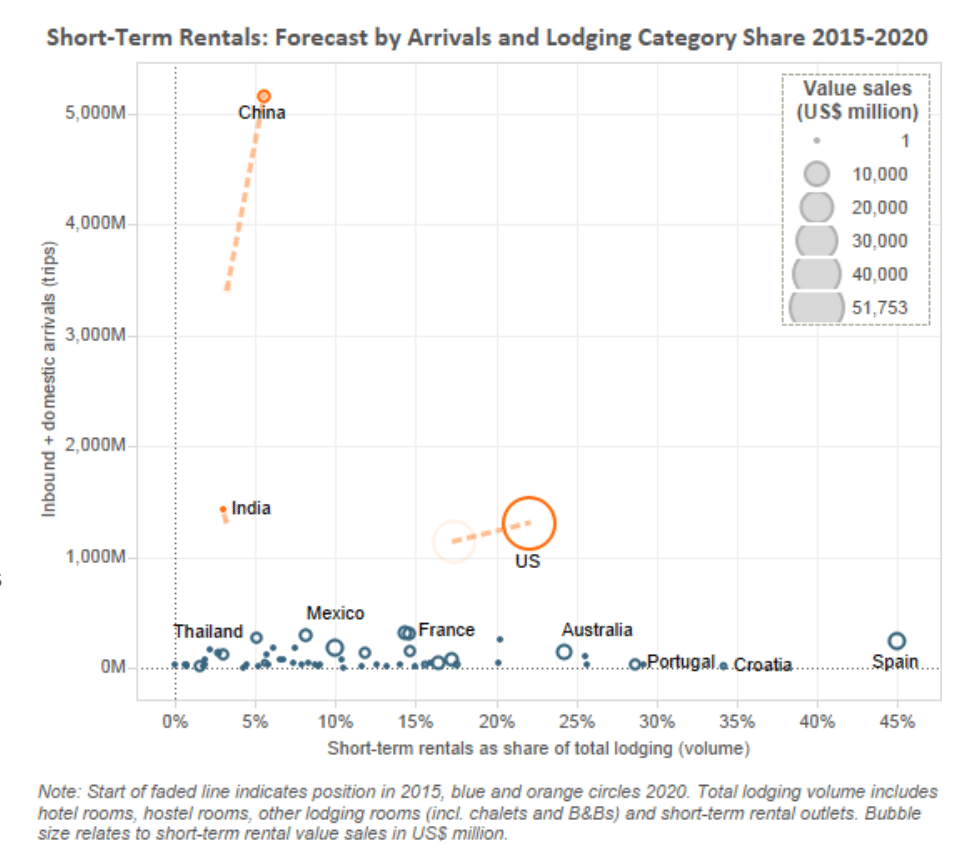

Chart 4: The U.S. is one of the largest markets for short-term rentals. Short-term rentals made up about 17 percent of total available accommodations in the U.S. in 2015 and Euromonitor projects it will account for about 23 percent in 2020.

Spain (not shown on this chart) is already showing signs of oversupply in short-term rentals. By 2020 more than 45 percent of the country’s accommodations will be short-term rentals.

Source: Euromonitor International

Dwell Newsletter

Get breaking news, analysis and data from the week’s most important stories about short-term rentals, vacation rentals, housing, and real estate.

Have a confidential tip for Skift? Get in touch

Tags: airbnb, euromonitor, sharing economy, short-term rentals

Photo credit: An Airbnb listing in Medellin, Colombia. Juan Jaramillo / Airbnb