Skift Take

It’s dangerous to give Amazon breathing room in any industry; better to think through its implications for travel today. Amazon is not simply a threat, it offers lessons and opportunities for travel executives as well.

Amazon started out selling books but has since moved on to become an “everything store.” This shift contributed to a wave of retail bankruptcies over the past three years and nowadays, so much as a rumor of Amazon can move markets. Yet the company has been mostly absent from the travel industry.

Our latest research report, Amazon: Lessons, Threats, and Opportunities for Travel, seeks to take a comprehensive look at the many ways that this company could interact with the business of travel. In the first section of the report, we consider what it would take to build an “Amazon of travel” through a deep dive into the company’s business model. We distill four lessons from its model that we believe can apply to the travel companies large and small.

In the second half of the report, we look at what direct impact Amazon could have on the travel competitive landscape. Most obviously, Amazon could offer its own travel product and compete directly as an online travel agency or metasearch engine. We analyze what that scenario could look like but also examine other possibilities. For instance, Amazon could play an increasingly large role in direct marketing by virtue of its growing display ad business and its leading position in voice search. It may also wind up in travel through its expanding line of smart devices could open up new avenues for search or place it directly in-destination as part of the guest experience.

We launched last week the latest report in our Skift Research service, Amazon: Lessons, Threats, and Opportunities for Travel.

Below is an excerpt from our Skift Research Report. Get the full report here to stay ahead of this trend.

How Could Amazon’s Entrance into Travel Change the Competitive Landscape?

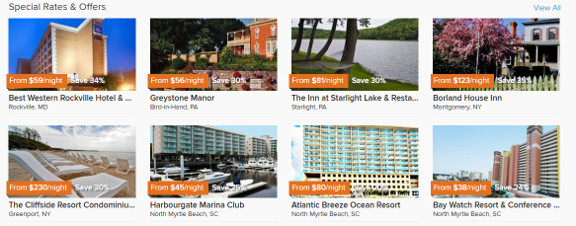

In April 2015, Amazon launched a new Amazon Destinations page, as reported by Skift. The offering was mostly focused on local getaways and allowed hotels to push published and discounted rates. The move got plenty of attention from competitors and media sources.

Many hotel partners were excited about the opportunity when only a few months later, in an abrupt about face, Amazon shut down the business. An Amazon spokesperson at the time said that “we have learned a lot and have decided to discontinue Amazon Destinations.”

Preview and Buy the Full Report

Was it all just a bad dream for Expedia and Booking, or will Amazon be back with a vengeance? It’s a million dollar (or more!) question with no definitive answer, but Skift believes it highly likely that Amazon will play some role in the future of travel.

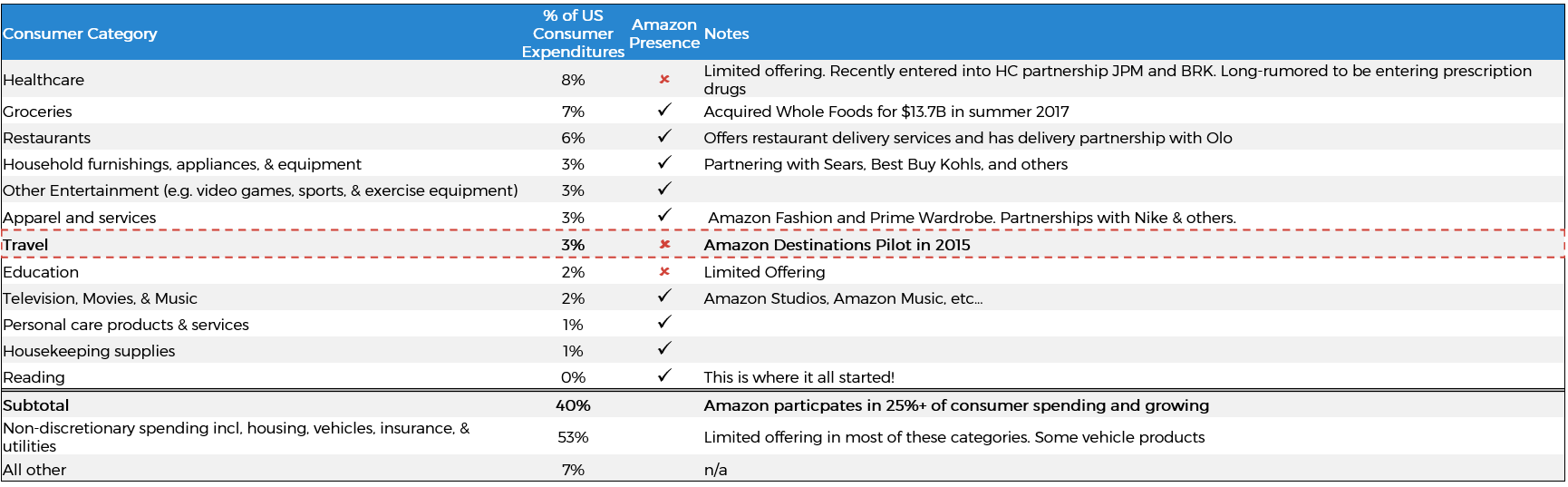

To examine this, Skift Research broke down aggregate consumer expenditures in the U.S. What we found was that Amazon participates in categories that collectively represent 25% of total U.S. consumer spending, and that figure is growing.

Housing, vehicle purchases, utilities, fuel, and retirement savings account for 53% of consumer expenditures and Amazon does not participate seriously in any of these categories. These are all large non-discretionary and/or financial products. In almost every other major consumer category, Amazon has an offering, even if it’s a small one.

The most notable exceptions to this rule are healthcare, education, and travel. Yet Amazon has long been rumored to be exploring a healthcare offering and recently announced an exploratory partnership with J.P. Morgan and Berkshire Hathaway. The company does have limited resources in education, such as in textbooks, but a large share of consumers’ education spend is tuition which (presumably?) Amazon cannot compete for.

That leaves the travel category as a strange outlier, representing $215 billion of annual U.S. consumer spending, 3 percent of the overall total, with effectively no competition from Amazon. That opportunity is nearly 14 times larger than the spend on books, Amazon’s original raison d’etre.

Source: Skift Research, Bureau of Labor Statistics, Company Filings

Preview and Buy the Full Report

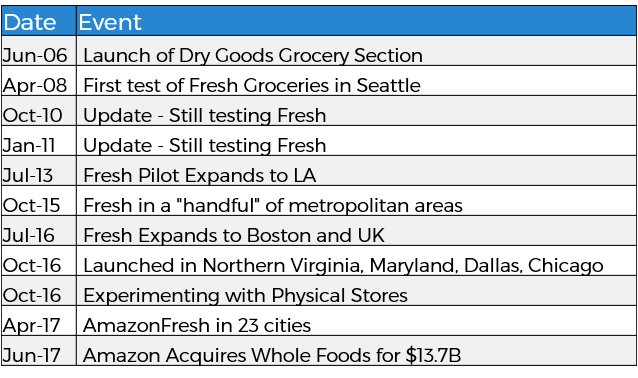

Did Amazon try, decide it couldn’t hack it, and give up for good? This also seems unlikely to us. Consider the case study of groceries. Amazon launched its very first grocery offering, selling dry goods only, in 2006. Two years later, in 2008, it began testing fresh grocery delivery in Seattle, which expanded to L.A. in 2013 and a handful of other metropolitan areas in 2015. Finally, the businesses began to rapidly expand in 2016.

The $13.7 billion acquisition of Whole Foods may have felt like it came out of nowhere when it shook up the entire grocery space in 2017, but its roots go back over a decade.

Source: Skift Research, Company Filings

We cannot know Amazon’s strategy for certain, but we would caution against assuming its unsuccessful 2015 Destinations test means the end of its travel ambitions.

Subscribe now to Skift Research Reports

This is the latest in a series of research reports, analyst sessions, and data sheets aimed at analyzing the fault lines of disruption in travel. These reports are intended for the busy travel industry decision maker. Tap into the opinions and insights of our seasoned network of staffers and contributors. Over 200 hours of desk research, data collection, and/or analysis goes into each report.

After you subscribe, you will gain access to our entire vault of reports, analyst sessions, and data sheets conducted on topics ranging from technology to marketing strategy to deep-dives on key travel brands. Reports are available online in a responsive design format, or you can also buy each report a la carte at a higher price.

Have a confidential tip for Skift? Get in touch

Tags: advertising, amazon, metasearch, online travel agencies, skift research

Photo credit: Alexa, how could Amazon upend travel business models? The rise of voice search and smart devices, like the Echo pictured, could push Amazon into travel. Rahul Chakraborty / Unsplash