It was only a matter of time before technology started disrupting a relatively new market like vacation rentals. Emerging as a vital driver for rental businesses, and with the property management landscape developing rapidly from one year to the next, the progress of adoption of software and hardware solutions has never been really quantified – until now, that is.

THE EUROPEAN VACATION RENTAL SURVEY

So, what is the extent of technology adoption in the vacation rental market? What solutions are out there, and which property managers are utilizing them? The answers can be found in the latest report recently released by Transparent.

Transparent is a data intelligence company that is specialized in the short-term rental industry. Based in Spain and working closely with first-class public institutions, property developers, property management companies, hotels, and other market players, the company has the largest dataset of the vacation rental market. Since 2016, Transparent has been building data analytics products for institutions that seek a better understanding of the market.

This year, Transparent has released its first annual European Vacation Rental Survey; a study which aims to reflect the current state of the vacation rental market, as well as outline the performance drivers for property managers within the industry. The report is based off a survey in which over 500 property managers shared insights on their operations, marketing, distribution, pricing and more.

THE RESULTS

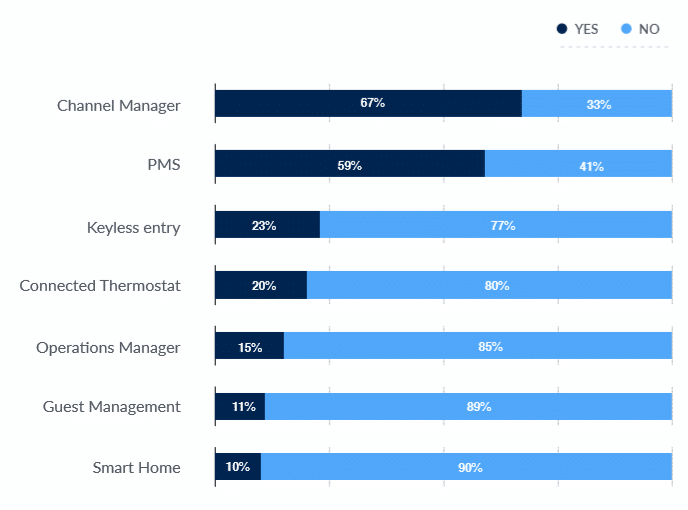

In the report, a whole section was dedicated to Technology Adoption. The results were as follows:

Out of seven different technology solutions – including smart homes, keyless entry, thermostats and others – only two are revealed to be widely adopted by property managers (PM). These two solutions are:

- Channel Managers (67% of respondents)

- Property Management Software (PMS) (59% of respondents)

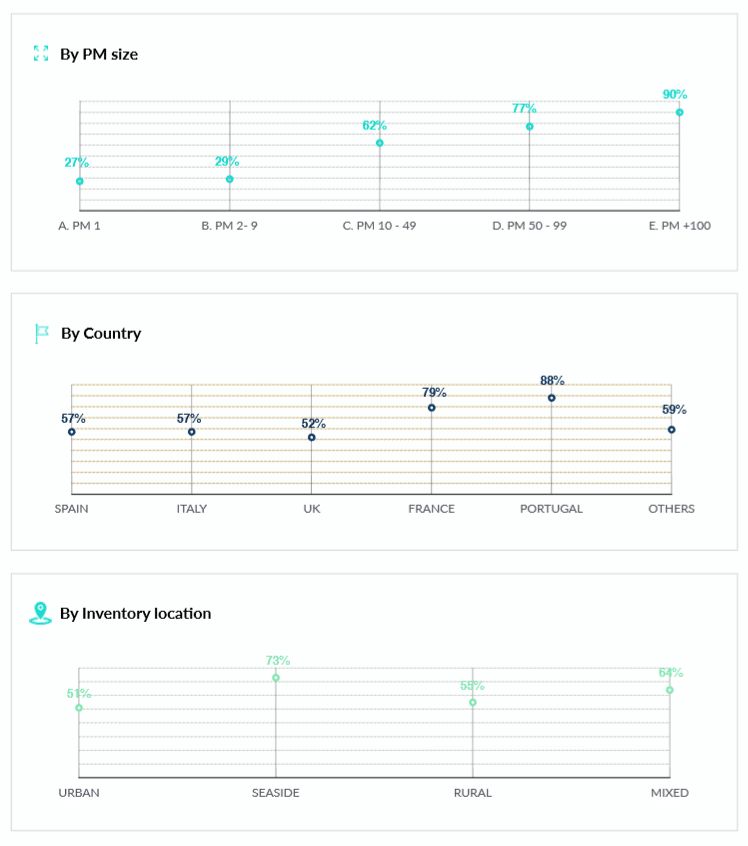

Results for PMS:

- The report revealed that the larger the property manager, the more likely they are to adopt a PMS (property management software). A whopping 90% of property managers who manage more than 100 properties report using a PMS. This number goes down as the number of managed properties decreases, with 77% of PMs managing 50-99 properties using a PMS, and only 29% of those who manage less than 10 properties.

- Portugal and France show the highest percentage of adoption, with 88% and 79% respectively.

- Seaside property managers show a higher than average use of the software.

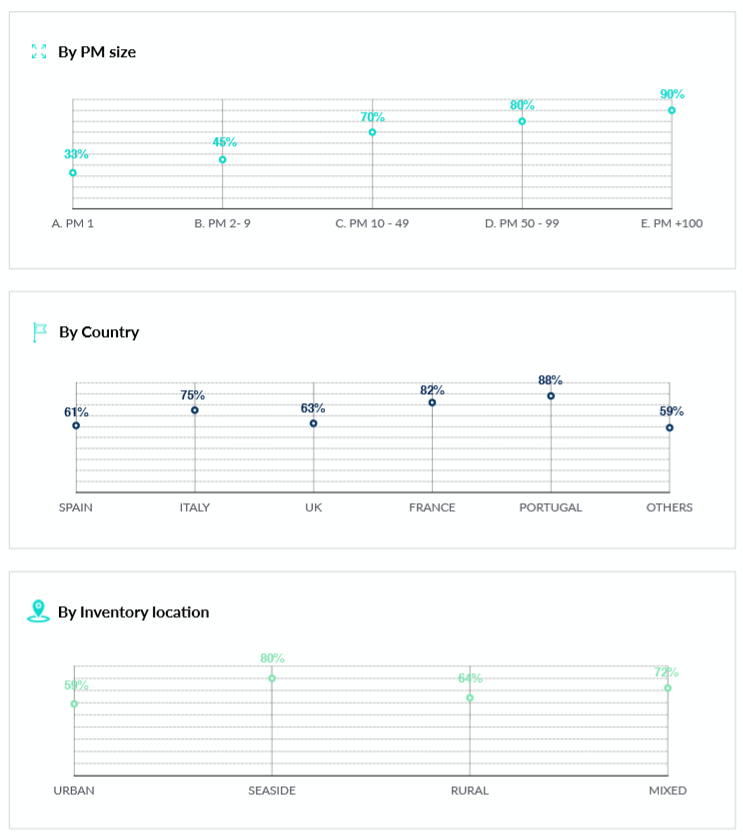

Results for Channel Managers:

- The same trend can be observed in terms of size and probability of adoption. Once again, 90% of PMs who manage more than 100 properties report using a channel manager software, with that percentage decreasing to 80% for those managing 50 to 99 properties, and only an average of 40% for those with less than 10 properties.

- Once again, Portugal and France are leading the way in terms of adoption with 88% and 82% of PMs utilizing a channel manager respectively. Italy follows closely in third place with 75%.

- Like with property management systems, seaside PMs also report the highest adoption of channel managers with 80%.

WHAT DOES THIS MEAN FOR SMALL-SIZED PROPERTY MANAGERS?

The fact that business size is directly proportional to the usage of technology should not come as a surprise. Having more properties to manage increases the need for a solution to monitor and automate operations, in addition to keeping track and organizing all relevant property details. Moreover, being a larger sized business usually indicates a wider financial capacity to give room for opting for more sophisticated business management tools.

However, the key point that can be inferred from this data is the role of software solutions as catalysts for growth.

Manual operations can be cheaper in the short-term, but in the long-term, they become a hindrance of expansion. Property managers spend a large amount of time on activities such as listing every property on several portals, setting up booking systems or even designing the business website. For a small-sized business with limited personnel, this is time taken away from marketing, outreach and growth in general.

In a nutshell, opting for introducing software solutions – while more expensive on the short-term – is an investment that gives even small property managers the necessary tools to catch up with the big players of the market.

About the Author