Buying things online has never been easier. Whether your shoppers are taking a break from work to buy a last minute gift for a friend, or shopping the latest deals from your highly successful email retargeting campaigns, they’re certainly no stranger to the world of eCommerce. Your site is getting thousands of visitors, if not more, per day. But are you doing the best job you can to provide a positive user experience to the cart… and beyond?

You may have impeccable site graphics and interactivity, but we’re interested in is what happens once a shopper tries to checkout. Yep – the steps after the ten-minute deliberation of pink shirt… black shirt…. Or both? The process that happens when a shopper begins to input payment information that will hopefully result in a successful sale.

You may have seen our Checkout Conversion Index which analyzed the checkout process of over 650 eCommerce merchants to determine which sites were offering a seamless checkout, and which sites could afford to spend more time thinking about the important role of payments. In conjunction with this index, we designed the Checkout Conversion Calculator so merchants could measure their own checkout flow against industry standards.

We decided to take a closer look at the data to illustrate some of the key insights. So what did we learn?

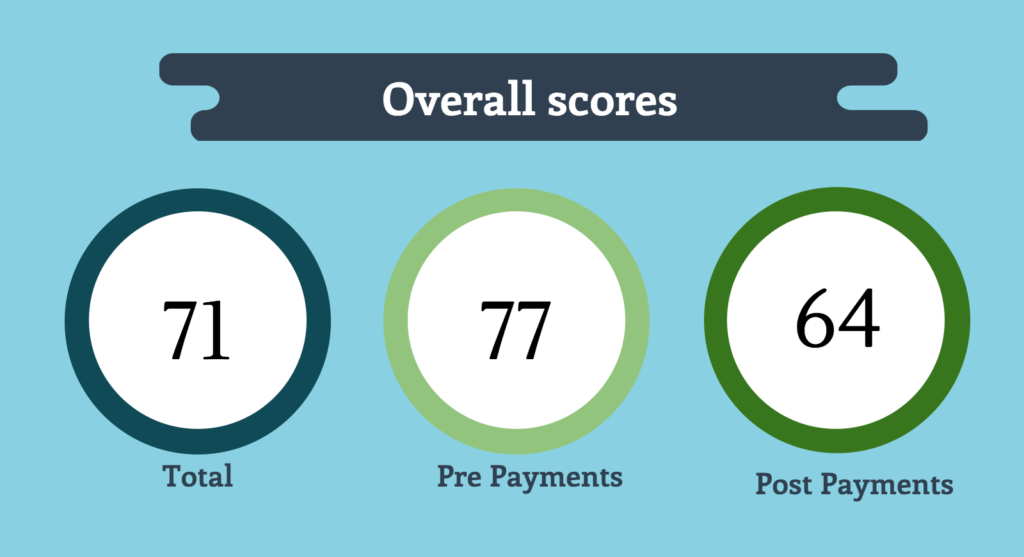

The average scores were much lower than we had hoped. More importantly, the post payment results were significantly worse than pre payments. This likely means that many merchants are using payment gateways that are not nearly sophisticated enough to support all their global needs.

First off, let’s break the results up by pre and post payments.

Pre Payments

Do you offer product reviews?

People talk. Shoppers are better informed now than they have been in the past. Between talking to friends, living on social media, and googling product reviews, people frequently conduct at least some research before buying a product. If your site does not offer product reviews or recommendations you’re missing out on a major opportunity to reassure the shopper that he or she is making the best possible purchase. It is likely that you could lose this sale to an inferior product simply because the other brand offers reviews.

Do you offer coupons?

In a similar vein to product reviews, people want to feel exclusive, and everybody loves a deal. If you don’t offer coupons you’re missing out on the chance to make the shopper feel loved, and feel like he or she is getting a good deal. Furthermore, with all the free coupon sites that exist, if a shopper can’t find one on your site, they are likely to search the internet for a discount. If they can’t find one on your site, but see a deal for a similar product somewhere else, they are likely to abandon the purchase.

Do you require users to set up a profile before checking out?

If you’ve read our Checkout Showdown blog series, you’ll see how frustrating it can be when a user is forced to fill out a profile before completing a purchase. Let the customer come to you. When he or she is ready to give you personal information, you’ll know.

Do you offer live help?

Sometimes shoppers want to be independent. They’ll come to your site with a card in hand ready to make a purchase without any help or distractions. Other times, shoppers may need more hand holding. Sometimes they’ll want help comparing two products, and other times they may just have last minute insecurities and want to talk to a person to feel good about the purchase. Whatever the situation, be sure to offer an obvious live help button to ease your shoppers through the finish line.

Post payments

How many forms of payment does your website accept?

With the evolution of alternative payments and mobile wallets, it is crucial to be able to empower shoppers with the tools to pay in a way that is going to be easiest for them. MasterPass, Visa Checkout and Apple Pay are just the beginning. Failing to adopt alternative payment methods now, doesn’t bode well for the future of eCommerce sites.

Do you have retry and failover capabilities?

If you haven’t learned about the importance of intelligent payment routing from our Wicked Smaht Payment Routing Video, you may want to give that a watch now. Often times when a card is declined, it is not because the shopper has insufficient funds. If your gateway is not connected to multiple banks locally, there may be an issue processing the transaction. In this case, it’s a best practice to be able to retry the transaction, and have failover capabilities to send the transaction to a second, and even third bank.

Do you offer subscriptions?

Did you know that transaction values above $2500 are only approved 83% of the time? The highest rate of success occurs for payments in the $25-$50 range. Of course you’re not going to change the price of your product to fit these ranges, but offering subscriptions will go a long way in increasing conversions. Instead of only offering one-time payment options, throw in a monthly and quarterly options to give people a price point they are more comfortable with.

In how many countries do you offer local currency and local payment methods?

Some of our findings were positive. For instance, we’ve stressed the importance of going local many times, and the percentages of merchants offering local currencies and payment methods was surprisingly high. If a shopper doesn’t see his or her preferred payment method during checkout, and information is presented in a foreign language, this will likely trigger a sense of panic and lead to checkout abandonment.

It’s time to do the math and discover once and for all if your checkout flow is leading to the highest conversion rate.