This is the Product Death Cycle. Why it happens, and how to break out of it

The hardest part of any new product launch is the beginning, when it’s not quite working, and you’re iterating and molding the experience to fix it. It may be the hardest phase, but it’s also the most fun.

The Product Death Cycle

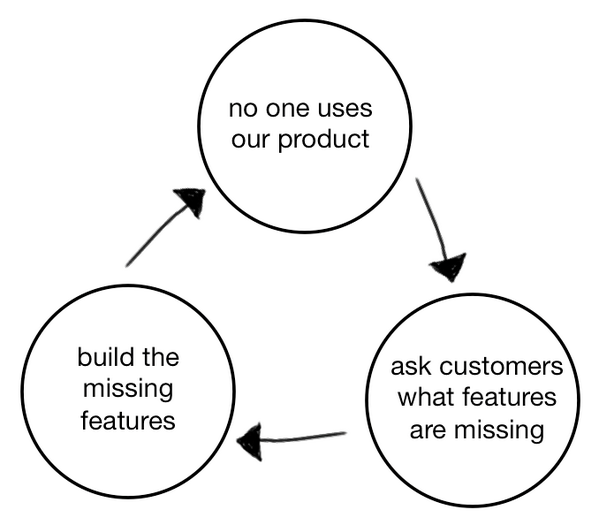

All of this was on my mind when I saw a great tweet from about a year ago, on the Product Death Cycle, when things go wrong. David Bland, a management consultant based in San Francisco, tweeted this diagram:

This is what I’m calling the Product Death Cycle

– @davidjbland

A year ago when I saw this, I retweeted this diagram right away, and a year later, it’s hit 1,400+ RTs overall. This diagram has resonated with a ton of people because sadly, we’ve seen this Product Death Cycle happen many times. We’ve maybe even fallen into it ourselves – it’s all too easy. I’ve written about this phase before, in After the Techcrunch bump: Life in the Trough of Sorrow. As well as some thoughts and strategies related to getting to product/market fit sooner rather than later.

Let’s talk about each step of this cycle, why it happens, and present a list of questions/provocations that might allow us to escape.

1) No one uses our product

The natural state of any new product is that no one’s using it :) So that’s not a problem in itself. However, the way you react to this problem is what causes the Product Death Cycle.

2) Ask customers what features are missing

One of the big early mistakes is to be completely user-led rather than having a product vision. This manifests itself in asking users “What features are missing?”

Here are the problems with this approach:

- Users who love your product now may not represent the much larger market of non-users who’ve never experienced it. So the feedback you get might be skewed towards a niche group, and the features they suggest may not be mainstream

- User research is great for coming up with design problems, but you can’t expect users to come up with their own design solutions. That’s your job! They may be stuck in a certain paradigm and won’t have the tools/skills to come up with their own solutions. Faster horses and all that

- “What features are missing?” assumes that just adding more features will somehow fix the problem. But there are many, many other reasons why your product may not be working- maybe the pricing is wrong. Or it’s not being marketed well, the activation is broken, or the positioning sucks, etc.

Even the Simpsons know that slavishly listening to feature requests is a bad idea. Thus the episode about The Homer, a car that tried to appeal to everyone:

Instead of asking for what’s missing, instead the solution is to ask- what is the root cause of users not using the product? Where’s the fundamental bottleneck? In a world where 80% of daily active users are lost within 30 days, there’s a lot of reasons why users are bouncing before they even get into the “deep engagement features” you’ve built out. Asking engaged users what features they want won’t help much- instead you’ll likely get a laundry list of disorganized features that will push you towards your competitors.

One book recommendation on this topic: Harvard Business School professor Youngme Moon’s book on competitive differentiation precisely describes the process in which customer research quickly leads to muddled differentiation, it’s worth reading.

3) Build the missing features

The second jump in the Product Death Cycle is to take features that customers have suggested, and just build the missing features. However, this quickly falls into the Next Feature Fallacy, which is the mistaken belief that just adding one more new feature will suddenly make people want to use your whole product.

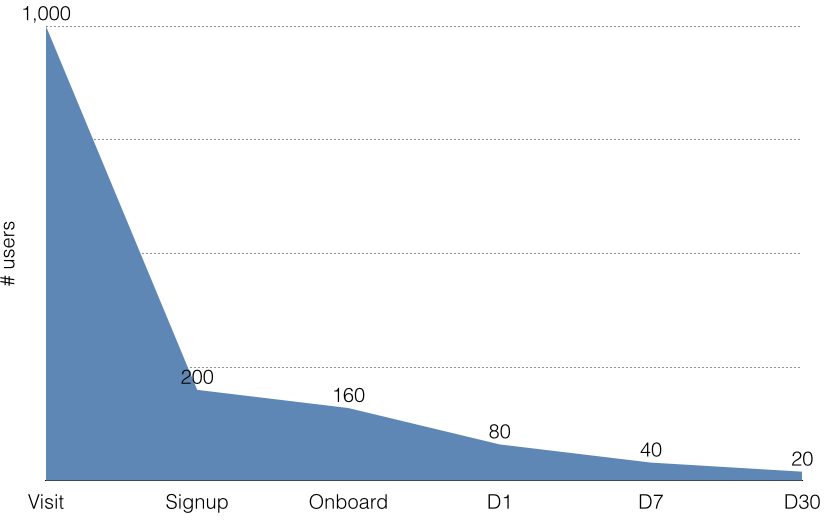

As I discussed in that essay, every product has an amazing dropoff of usage from when people first encounter it:

I’ve also published some real-life data at Losing 80% of mobile users is normal. The point is, most interaction with a product happens in the first few visits. That’s where you can ask the user to setup for long-term retention and to present the user with a magic moment. Building a bunch of “missing” features is unlikely to target the leakiest part of the user experience, which is in the onboarding. If the new features are meant to target the core experience, it’s important that they really improve the majority workflows within the UI, otherwise people won’t use them enough to change their engagement levels.

To break out of this part of the Product Death Cycle, ask yourself- is this enough of a change to influence the experience? Is it far enough “up the funnel” to impact the leakiest parts of the product experience? Is this just another cool feature that only a small % of users will experience?

Breaking out

The Product Death Cycle is tricky because it’s driven by the right intentions: Listen to customers and build what they want. People in the Product Death Cycle naturally believe that they are doing the right things, but good intentions don’t translate to good traction. Instead, ask “why?” over and over, to understand the root cause for lack of growth.

The response to these root causes should consist of a large toolkit of responses- maybe marketing: Pricing, positioning, distribution, PR, content marketing, etc. Maybe it has to do with the strategy: Going high-end instead of low-end. Building a utilitarian product instead of a network-based one, or vice versa. The point is, the solution should be tailored to the root cause, rather than to be explicitly driven by the desire of every product team to build more product.

Thanks again to David Bland for sharing the Product Death Cycle diagram with all of us.

PS. Get new updates/analysis on tech and startupsI write a high-quality, weekly newsletter covering what's happening in Silicon Valley, focused on startups, marketing, and mobile.

Views expressed in “content” (including posts, podcasts, videos) linked on this website or posted in social media and other platforms (collectively, “content distribution outlets”) are my own and are not the views of AH Capital Management, L.L.C. (“a16z”) or its respective affiliates. AH Capital Management is an investment adviser registered with the Securities and Exchange Commission. Registration as an investment adviser does not imply any special skill or training. The posts are not directed to any investors or potential investors, and do not constitute an offer to sell -- or a solicitation of an offer to buy -- any securities, and may not be used or relied upon in evaluating the merits of any investment.

The content should not be construed as or relied upon in any manner as investment, legal, tax, or other advice. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Any charts provided here are for informational purposes only, and should not be relied upon when making any investment decision. Certain information contained in here has been obtained from third-party sources. While taken from sources believed to be reliable, I have not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. The content speaks only as of the date indicated.

Under no circumstances should any posts or other information provided on this website -- or on associated content distribution outlets -- be construed as an offer soliciting the purchase or sale of any security or interest in any pooled investment vehicle sponsored, discussed, or mentioned by a16z personnel. Nor should it be construed as an offer to provide investment advisory services; an offer to invest in an a16z-managed pooled investment vehicle will be made separately and only by means of the confidential offering documents of the specific pooled investment vehicles -- which should be read in their entirety, and only to those who, among other requirements, meet certain qualifications under federal securities laws. Such investors, defined as accredited investors and qualified purchasers, are generally deemed capable of evaluating the merits and risks of prospective investments and financial matters. There can be no assurances that a16z’s investment objectives will be achieved or investment strategies will be successful. Any investment in a vehicle managed by a16z involves a high degree of risk including the risk that the entire amount invested is lost. Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by a16z and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. A list of investments made by funds managed by a16z is available at https://a16z.com/investments/. Excluded from this list are investments for which the issuer has not provided permission for a16z to disclose publicly as well as unannounced investments in publicly traded digital assets. Past results of Andreessen Horowitz’s investments, pooled investment vehicles, or investment strategies are not necessarily indicative of future results. Please see https://a16z.com/disclosures for additional important information.