2018 Growth Benchmarks for Private SaaS Companies

June 13, 2018

NOTE: Updated private SaaS company growth data can be found here – 2020 Private SaaS Company Growth Rate Benchmarks

Revenue growth is the most important metric for valuing a SaaS company, yet it’s hard to find good benchmarking data for a relevant peer group. Comparisons to multi-billion-dollar public companies are not helpful, and neither are the anecdotal data points from angel investors or VCs. To provide some better context on this question, we surveyed over 900 private SaaS companies regarding their 2017 revenue growth and published the data in a recent research brief.

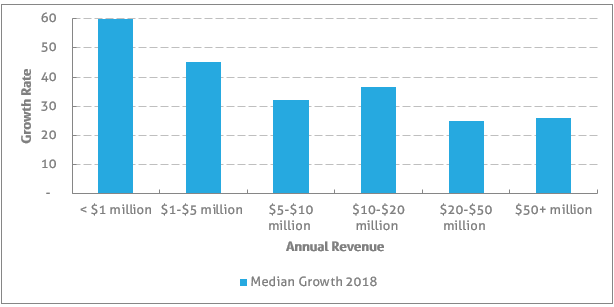

Our analysis looked at the impact of venture capital funding, average contract value, and a few other key variables. Most importantly, we segmented growth rates based on the size of the company since a 100% growth rate for a start-up is a lot different than a 100% growth rate in a much larger business.

As you can see in the chart above, growth rates decline as revenue levels increase. This is simply due to math (a larger denominator) but boards and management teams need to use the data above to set informed growth plans and not simply base assumptions on prior year performance. It’s also worth noting that overall growth in the SaaS industry is pervasive as 90% of the companies in our survey reported annual revenue growth of greater than 10%.

Other takeaways from our analysis included:

- The median age of companies with $1 million in ARR is 6 years, with those raising venture capital reaching the milestone in 4 years, and bootstrapped companies getting there in 7 years.

- Bootstrapped companies were growing at 28% per year, whereas companies that had raised angel or venture capital financing were growing at 43% and 50% respectively.

- Average contract value (ACV) does not appear to impact growth rate.

- SaaS companies targeting a horizontal market are growing faster than companies attacking a vertical industry: 40% growth versus 35% respectively.

- At nearly all revenue levels, SaaS companies that bill annually in advance grow faster than their peers that bill monthly.

We hope that you find this information useful in running or valuing your SaaS business. To download the full analysis, please see – Benchmarking Private SaaS Company Growth Rates.

Note: Updated data can be found in this post – Private SaaS Company Valuations: 2019

Our Approach

Who Is SaaS Capital?

SaaS Capital® is the leading provider of long-term Credit Facilities to SaaS companies.

Read MoreSubscribe