One in Three Rentals Now in Urban Destinations

- Published:

- January 2017

- Analyst:

- Douglas Quinby

Over the past decade, private accommodation has undergone a period of unprecedented innovation and change. Not long ago, rentals were synonymous with week-long vacations to beach or mountain destinations. Traditional vacation rental was considered an alternative accommodation option, used by a small minority of travelers, and the segment lagged the broader travel industry in technology adoption and online distribution.

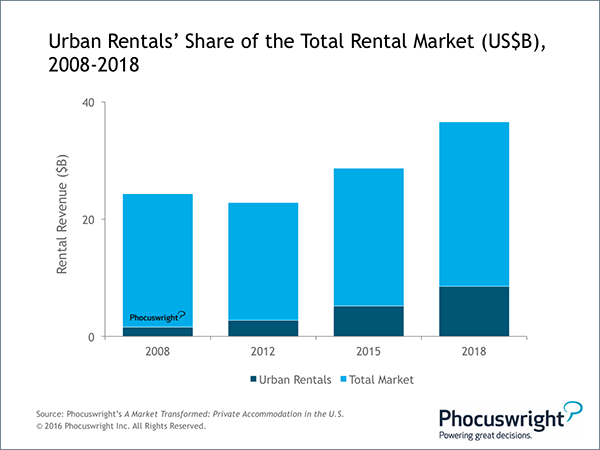

In just a few years, a new segment of private accommodation has emerged. Phocuswright's A Market Transformed: Private Accommodation in the U.S. maps this new generation of rentals. New-gen rentals have added to, rather than replaced, traditional vacation rentals, and are also increasingly competing with hotels. More than one in three rental stays are now in urban destinations, up dramatically from 13% in 2012. Urban stays tend to be shorter with lower average daily rates, so their share of rental revenue is lower, but it is significant and growing. City rentals accounted for 18% of total rental revenue in 2015, and this will rise to nearly one quarter of the U.S. private accommodation market as rentals take more demand away from hotels.

(Click image to view a larger version.)

The Rise of New-Gen Rentals

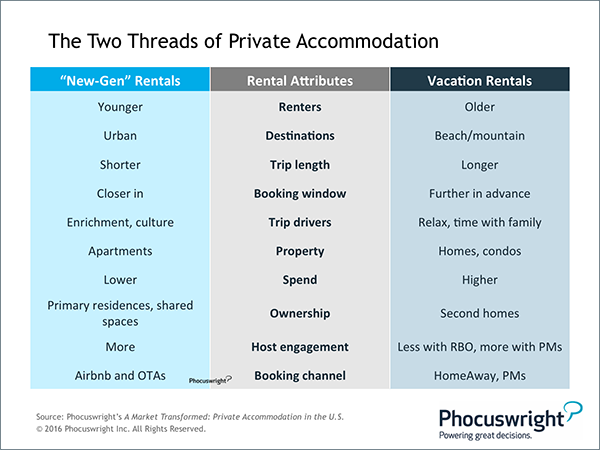

There are now two clear segments of private accommodation with distinct characteristics. Conventional vacation rentals continue to feature second homes in beach and mountain destinations and often attract older travelers, families or larger groups for longer, more expensive vacations. Owners of these properties are more likely to use a property manager, and travelers typically book directly with the property manager or on a home rental site such as HomeAway or VRBO.

In contrast, "new-gen" rentals are dominated by short, less expensive trips to urban destinations, with a younger demographic of travelers more interested in culture and personal enrichment. Rentals are often primary residences or even shared spaces, and as a result hosts are more likely to engage with their guests, adding a social element that some travelers embrace. Airbnb, which single-handedly expanded the definition of private accommodation to include primary residences, is a key booking channel for this new generation of rentals, along with OTAs.

(Click image to view a larger version.)

As Airbnb continues to push into traditional rental markets, however, the lines between traditional and "new-gen" rentals will likely begin to blur. Phocuswright's A Market Transformed: Private Accommodation in the U.S. provides an unparalleled, in-depth analysis of the U.S. private accommodation marketplace, including the following:

- Market sizing and distribution channel analysis with projections through 2018, including rental revenue, rental traveler population, total trip volume and supply

- Extensive analysis across key rental segments: urban and non-urban, rental-by-owner and professionally managed

- The competitive impact on hotels, including the rental market overlap, traveler perceptions of rentals vs. hotels, and why and when they choose rentals vs. hotels

- A close look at the U.S. rental traveler based on an expanded survey of more than 1,200 U.S. rental travelers: what they want, how they choose, shop and book, which rental sites they use, and much more

- Homeowner and host insights based on a survey of more than 800 rental homeowners and hosts, including who they are, why they rent, and what they want

- Comprehensive analysis of the property management landscape, including market sizing and population analysis, use of technology, distribution trends, and key challenges faced

For a detailed look at how this dynamic segment has evolved and where it's headed in the years to come, purchase Phocuswright's A Market Transformed: Private Accommodation in the U.S.

.png)

.jpg)