The thing about platforms that have a wide adoption and deep history is that they tend to persist. They have such economic inertia that, so long as they can keep morphing and grafting on new technologies, that they persist long after alternatives have emerged and dominated data processing. Every company ultimately wants to build a platform for this reason, and has since the dawn of commercial computing, for precisely this reason, for this inertia – it takes too much effort to change or replace it – is what generates the profits.

It is with this in mind that we contemplate the state of IBM and its System z and Power Systems platforms and its emerging IBM Cloud (formerly SoftLayer) public cloud, perhaps its final platform, in the wake of Big Blue reporting its financial results for the first quarter of this year.

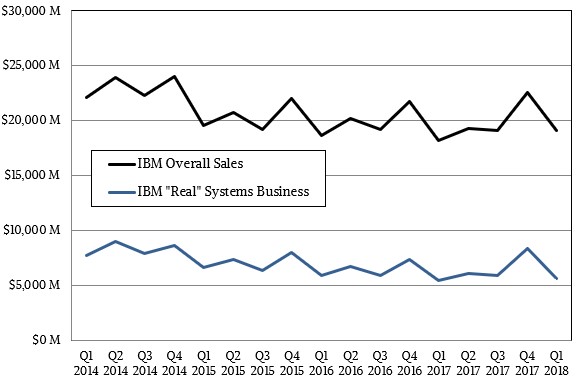

Way down inside, if you peel back all of the Cognitive and Watson mumbo-jumbo and the talk of “strategic imperatives” and other such things that IBM likes to talk about to try to prove it is a fast-moving and cool company, IBM is a systems company with a very large portion of its revenues and an even larger part of its profits coming from these two platforms, the System z mainframe and the Power Systems – now sometimes called the Cognitive Systems – line. The core systems business – meaning the servers, storage, and networking hardware and the operating systems and transaction processing software plus any financing needed for it – comprises about a third of IBM’s revenues and more than half of its gross profits, by our estimates. Various database and middleware stacks up on top of this, generating even more platform revenues and profits, but this is tougher to peel away.

The rest of IBM is admittedly different. The company has a wide portfolio of applications and services, and some applications (like Watson data analytics and software that can properly be called cognitive in the loosest sense of that word) are sold only as services. Like Hewlett Packard Enterprise and Microsoft and now defunct companies like Sun Microsystems, IBM has seemed like it was in a perpetual state of consternation and transformation in the three decades we have been watching it closely. There is always a set of workforce rebalancings, always a new strategic direction that seems to be imposed on IBM from the outside rather than created by the company itself and revealed to the world, always a new set of hopes that revenue will grow and profitability, although nothing like IBM enjoyed when it was the blue chip stock of the 1960s and 1970s, will be maintained in some fashion. Considering that the heart of Big Blue goes back to 1890, it is remarkable that it is still around at all, much less a company that generates around $80 billion a year in sales. Google and Microsoft bypassed IBM as the latter was on the way down and they were rising, but this is still a very large platform company and it can – and does – still do interesting and important things. Apple passed IBM back in 2011, on stratospheric sales of iPhones, and is more than twice the size of either Google or Microsoft. All four companies are platform providers in their own rights.

Again, this is not an accident.

In the quarter ended in March, IBM’s revenues rose by 5.1 percent to $19.1 billion, and its gross profits were up by 6.1 percent to $8.25 billion. There were a whole bunch of things that affected the bottom line in the quarter, including a settlement of two audits by the US Internal Revenue Service that gave it back $810 million, but IBM then took $610 million in restructuring charges for unspecified layoffs. The company also took some charges – IBM’s chief financial officer, Jim Cavanaugh, did not say how much – that pushed its overall systems business into the red ink. This was surprising, given that the z14 mainframe refresh was in full swing starting last quarter and the Power9 rollout is just getting started. Exactly what this restructuring is remains to be seen, but it had a big impact on the systems business.

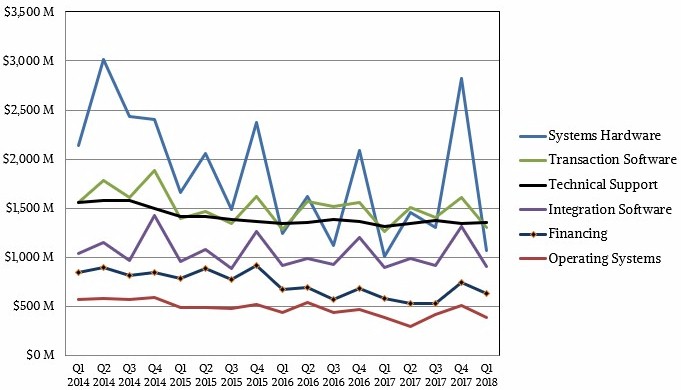

In the thirteen weeks making up the first quarter, IBM sold $1.5 billion of servers and storage plus a smattering of networking gear it resells and operating systems, up 4 percent (at constant currency) compared to the prior year’s first quarter. Systems hardware accounted for about $1.1 billion of that, up 6 percent (again at constant currency), and operating systems accounted for nearly $400 million more. We reckon that IBM had $627 million in gross profits for its Systems business (as it reports it), but it had a pre-tax loss of $203 million after restructuring, which is not a good thing. That’s bigger than the $186 million pre-tax loss that it posted in the year ago period when everyone knew that the System z14 and Power9 platforms were coming and sales slowed. This is not a good sign.

Within this Systems business, System z mainframe sales rose by 54 percent with the aggregate amount of MIPS capacity sold more than doubling. What this tells you is that IBM has to sell z14 mainframe capacity at a discounted price – about 25 percent or so if you do the math – compared to the prior z13 generation if it wants to get customers to buy.

IBM’s Power Systems business has not yet been uplifted by the approximately 9,000 hefty “Newell” Power Systems AC922 nodes that will go into the “Summit” supercomputer at Oak Ridge National Laboratory and the ‘Sierra” sibling to it at Lawrence Livermore National Laboratory. Only about a quarter of the nodes have been installed so far, but that still doesn’t do the IBM bean counters any good; the company, which is the prime contractor on the deal with the US Department of Energy for these machines, doesn’t get paid until they are accepted by the labs, not when they ship from the factory. IBM only started shipping the general purpose “ZZ” Power Systems machines, also based on Power9, at the end of March, so these did not really help all that much, either. Still, the Power System business, which has a much smaller IBM software component than the System z stack, still managed to grow by 3 percent in the quarter – albeit against a very easy compare because sales were not all that great for Power Systems a year ago.

IBM’s storage business, which is related to the z and Power lines but not firmly attached to them, had a 15 percent decline in the first quarter after turning in four consecutive quarters of growth. Cavanaugh suggested that this was due to a shift away from storage software to software defined storage (meaning it runs on standard server clusters) and cloud object storage (which IBM resells on its cloud), but that is silly. If IBM actually counted storage software as, let’s just say, storage instead of putting these two items in its transaction processing software category (which is just plain silly and an obvious ploy to pump up growth there), it might have a better – and more honest – story to tell. Frankly, if IBM did its books in a way that reflected its business more than it reflected the story it wants to tell Wall Street, it would be easier to understand what is going on. And that is precisely why IBM – and indeed, most public companies – behave like they do. They give the illusion of revelation, saying just enough to drive up the stock price or at least keep it from falling.

That is why we always take the trouble to try to figure out what the “real” underlying systems business is at IBM. We want to try to reckon how that core systems business is really doing.

To calculate the “real” systems sales each quarter, we take all of IBM’s systems hardware, operating system, and transaction software sales, plus 90 percent of its integration software, 75 percent of its technical support and financial revenues, and then add it all up. This real systems business, we reckon, grew by 3.6 percent to $5.64 billion in the first quarter, and represented 29.6 percent of IBM’s total sales and had a gross profit of $3 billion, which works out to 53.2 percent of revenue.

It is not clear how big the IBM Cloud is, because IBM again conflates what we would consider outsourcing and application hosting deals with real infrastructure and platform cloud services on the former SoftLayer public cloud. But clearly Big Blue wants this IBM Cloud to be its third platform. The irony is, this platform is not even built on its own iron, but rather X86 servers that it sources from Supermicro. This is not exactly a selling point for those System z and Power Systems platforms, now is it? If Power9 is good enough for Google, Oak Ridge, and Livermore, how come it is not good enough for IBM and its cloud customers? We admit that this would have all been a lot easier if Windows Server was still running on the Power architecture, and the fact that it isn’t is not a coincidence. (Microsoft and Intel certainly didn’t want this.) Another irony is that Windows Server is coming to Arm, and IBM has no play there.

IBM has a few big problems. First, no one really understands the full extent of the IBM software and services portfolios, and that is a limiting factor to IBM’s recovery. And second, IBM has spent 25 years selling anything to anyone at any price, just to close the deals, and it really doesn’t have the kind of conviction for its own platforms that it used to have when it was the cutting edge of enterprise computing. The companies that do have that level of conviction about their platforms have names we all recognize: Google, Amazon, Facebook, Microsoft, Alibaba, Tencent, Baidu, and China Mobile. Not only that, they have platforms you can describe – and subscribe to in a heartbeat, no fuss, no muss. That is the benefit of not having a legacy business that stretches back either five or three decades, we realize. Someday, these companies will all get their turn. Or, AI will eat everything and there won’t be a lot of discussion about information technology or data processing, which will be ubiquitous, transparent, pervasive, and perhaps even invasive.

hello, you are totally right in your first statement : very few ibmers have a kind of global knowledge and understanding of the IBM offerings portfolio, specially on the sales/pre-sales side. As an IT architect at a customer we witness such fact every time we contact IBM for information. Even on the only mainframe side there is a lack of global skill from IBM sales/pre sales representatives. I don’t mention the technology markets : it is worse. As we like IBM technologies, we have to replace the IBM pre-sales in order to sell their offerings internally.

In a past experience I even had to drive IBM pre-sales/sales team in order to reconquer a large customer which had left IBM for Sun (and I was no stranger for such loss : I was working at Sun at that time, but I began my professional carrer at IBM on “mainframes”). Such reconquest was a success.

regards