Skift Take

Online travel agencies remain essential to the travel industry as consolidators of, and clearinghouses for, advertising dollars throughout the space. We do not see OTAs being removed from this position easily, but growing challenges have hurt ad efficiency. OTAs must remain nimble to keep pace.

Skift Research is dedicated to following the nuances of the online travel agency (OTA) market. With more happening online than ever, this year we are breaking our online travel agency coverage into a multi-part series exploring different aspects of the business model in depth. The first part of our series looks at advertising spend by online travel agencies in North America and Europe. Upcoming parts of the series will include a look at OTA-supplier dynamics and emerging market OTAs.

Our latest research report, The State of Online Travel Agencies 2018 Part I: Advertising, surveys the state of online travel agency (OTA) ad spending in North America and Europe, specifically Booking Holdings and Expedia. These OTAs are well-oiled machines that are some of the largest marketers in the world.

However, they face growing challenges. Hotels and airlines have launched major campaigns encouraging consumers to book direct and search ad auctions are crowded. We analyze the state of OTA ad dollars and find that despite the large dollar figure, efficiency is declining. New ad dollars do not appear to generate as many bookings as they once did.

Ultimately the online travel agencies remain essential to the travel industry. They act as consolidators of and clearinghouses for advertising dollars throughout the space. We do not see OTAs being removed from this position easily, but they must remain nimble — upping their brand advertising, while tailoring their substantial ad spend for maximum booking potential — to keep pace.

We launched last week the latest report in our Skift Research service, The State of Online Travel Agencies 2018 Part I: Advertising

Below is an excerpt from our Skift Research Report. Get the full report here to stay ahead of this trend.

Expedia and Booking are competing as fiercely as ever and, in addition, as consumer behavior continues to shift, more brands are moving online. This means more crowded search ad auctions, with bigger ad budgets behind them. A resulting increase in cost-per-click prices and a decrease in ad efficiency is not surprising.

Gross bookings / New Bookings Per Ad Dollar On The Decline

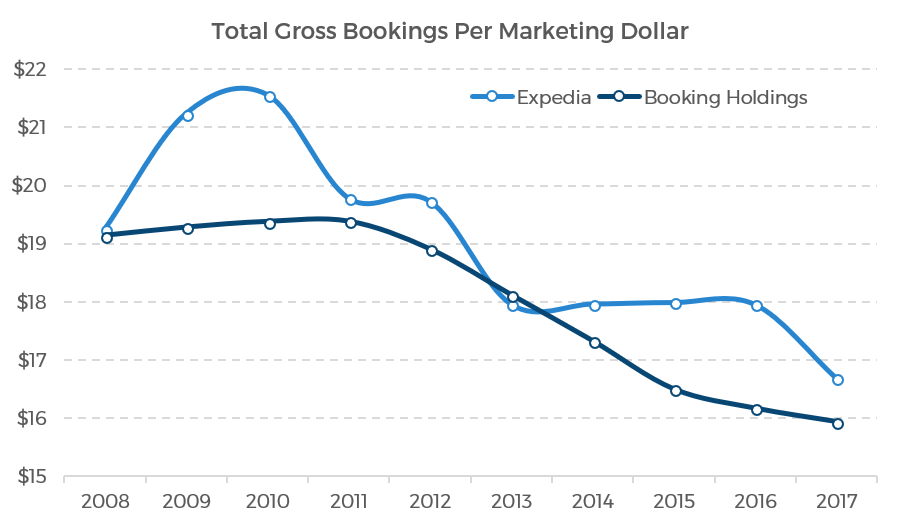

One way that Skift Research has attempted to understand advertising efficiency at the online travel agencies is to measure gross bookings per marketing dollar spent. It’s a crude metric as many factors drive the ultimate level of OTA bookings in addition to ad spending. But, we believe this metric captures an overall sense of marketing campaign performance.

The results show a steady decline in marketing efficiency, just like we would expect to see due to the challenges mentioned above. In 2008, Expedia and Booking Holdings were both able to book $19 of travel sales for every $1 they spent marketing (and ad budgets were almost entirely online). Today, every dollar spent marketing earns closer to $16 in bookings, a 15% decline in efficiency.

Source: Skift Research, Company Filings.

Preview and Buy the Full Report

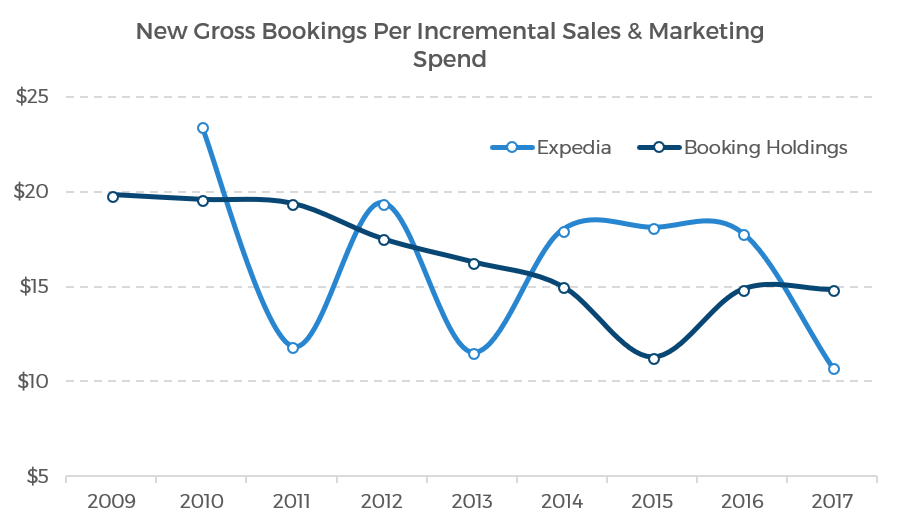

An alternative way to illustrate marketing efficiency is to only look at incremental dollars. In other words, how many new bookings can each additional dollar spent on selling and marketing above last year’s budget generate?

In 2010, each incremental dollar that Expedia devoted to marketing could pull in $23 in new bookings; at Booking Holdings, that figure was $20. But as the market has become saturated, additional dollars have become less effective. Expedia now only adds $8 in bookings for each new marketing dollar, a 67% decline. Booking Holdings has held in better, but still saw a 24% decline in efficiency, and now generates $15 in new bookings per new marketing dollar.

Source: Research, Company Filings.

Competition Between Rivals and Partners Eats Up Efficiency

During the company’s third quarter 2017 earnings call, Glenn Fogel, the CEO of Booking Holdings, said that, “in performance-based channels, competition for top placement has reduced ROIs over the years and been a source of margin pressure, with an increasing share of the unit economics accruing to the benefit of our advertising partners. This has been a concern to us since some of these partners use our advertising dollars to compete with us in the advertising funnel and represent themselves as places to not only research travel, but also book it.”

Fogel was effectively taking aim at metasearch platforms such as Trivago and TripAdvisor which take ad dollars from Booking Holdings, but also bid against them in generic keyword search auctions, decreasing ROI. In response, Fogel has decreased Booking Holdings spend on these sites. As an example, Booking Holdings represented 43% of Trivago’s platform in 2016, but is down to just 38% today.

Expedia faces similar challenges. CEO Mark Okerstrom has spoken of, “multiple layers of competition where, if you take ourselves [Expedia] versus Booking.com, … they’ve got Kayak and we’ve got Trivago. We’re bidding in Kayak versus them. They’re bidding in Trivago versus them. And then Trivago is bidding in Google versus both of us. And TripAdvisor — we’re all in TripAdvisor, they’re bidding [against all of us as well]. It’s everyone bidding against everyone [emphasis ours].”

Preview and Buy the Full Report

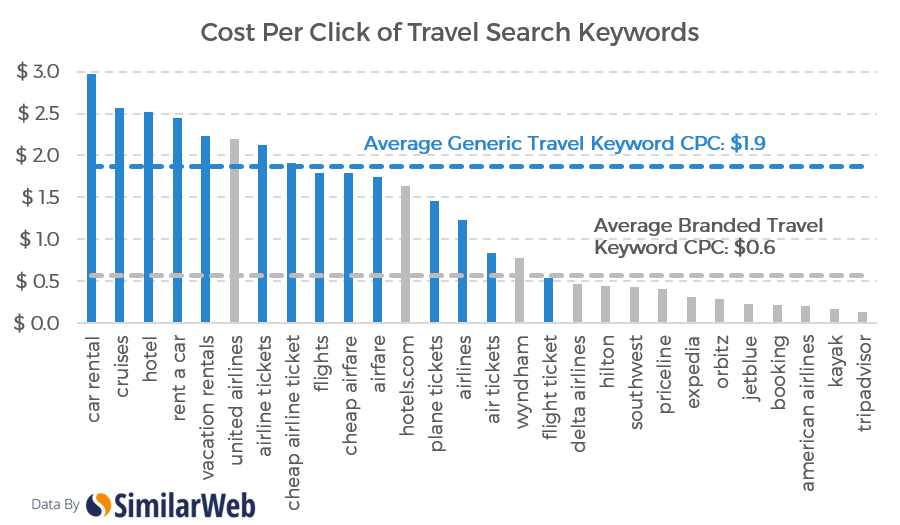

This dynamic where all the major travel brands bid in search auctions against all comers, and sometimes even against their own parent corporation’s best interest is apparent when analyzing cost-per-clicks (CPC). Companies will rarely bid on searches that inquire directly about a competitor’s brand name. Expedia typically does not find it efficient to bid on searches for “priceline,” as it’s unlikely to change that specific customer’s intent. Instead this war of all against all takes place on generic travel search terms such as “flights” or “hotels.” We partnered with SimilarWeb, a leading provider of web analytics, to analyze industry CPCs and found that generic travel search keywords command a CPC of $1.87 on average, more than three times as much as branded searches.

Source: SimilarWeb, Skift Research.

Subscribe now to Skift Research Reports

This is the latest in a series of research reports, analyst sessions, and data sheets aimed at analyzing the fault lines of disruption in travel. These reports are intended for the busy travel industry decision maker. Tap into the opinions and insights of our seasoned network of staffers and contributors. Over 200 hours of desk research, data collection, and/or analysis goes into each report.

After you subscribe, you will gain access to our entire vault of reports, analyst sessions, and data sheets conducted on topics ranging from technology to marketing strategy to deep-dives on key travel brands. Reports are available online in a responsive design format, or you can also buy each report a la carte at a higher price.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: advertising, booking holdings, expedia, marketing, online travel agencies, skift research

Photo credit: Online Travel Agencies, some of the largest sellers of airfares in the world, have long advertised their deals direct to consumers. Declining ad efficiency presents a challenge. Anton Porsche