Skift Take

Airbnb's business model, which includes a traveler-booking fee, wouldn't be competitive when competing for hotel-room bookings against Expedia and Booking.com, a new report argues. But business models aren't set in stone the last time we checked.

Investors have been consumed with the notion that Airbnb is gunning for the online travel agencies and that it will eventually turn from apartment rentals to hotels and steal those big, fat hotel margins and profits from Expedia and Booking.com.

A new analyst report attempts to shoot down that argument. Financial services firm PiperJaffray argues that Airbnb would not be adept at selling hotel rooms over the next five years, likely won’t pursue it heavily, and therefore will not have a significant adverse impact on online travel agencies’ room-night bookings.

In addition, hotel expansion isn’t part of Airbnb’s core strategy as it focuses instead on expansion in China, business travel and vacation rentals, the report states.

The PiperJaffray report, “Airbnb Becoming a Powerful Force in Travel, But Impact to OTAs Minimal,” written by Michael Olson and Samuel Kemp, forecasts that while Airbnb will make share gains in vacation rentals, supplementing its foothold in urban, shared-space dwellings, and will expand the travel market with its apartment inventory, but its adverse impact on the hotel bookings of online travel agencies such as Expedia and Priceline will be merely 5.3 percent in the 2016 to 2020 period — or just 90 basis points per year.

“Therefore if Airbnb hits its 2020 targets [$10 billion in 2020 revenue], the impact to global hotel growth will be a headwind of less than 100 bps each year which, we believe, is not meaningfully impactful to the multiple investors should be willing to pay for Priceline and Expedia,” the report states.

PiperJaffray characterizes investor concerns that Airbnb will threaten major online travel agencies as “overblown.”

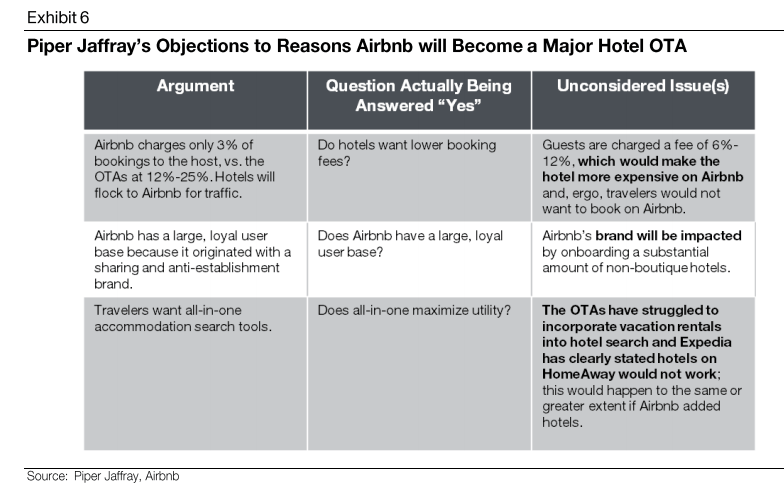

Among the factors that PiperJaffray cites as limiting Airbnb’s potential growth in hotels are that its hotel rates for consumers would not be competitive because it charges travelers a 6-12 percent booking fee while online travel agencies don’t; guests would be turned off if a currently “altruistic” Airbnb brand starts integrating those big, bad corporate hotels, and even the online travel agencies have had difficulties mixing together vacation rentals and hotels.

PiperJaffray outlines some of its arguments in the following graphic:

In addition, PiperJaffray argues that Airbnb wouldn’t have the resources to competitively market hotels head-to-head against the well-established online travel agencies as it has heretofore benefited from low customer acquisition costs because it basically created a new lodging category in shared-space accommodations.

Rather than compete against Expedia and Priceline in the hotel sector, “Airbnb is more likely to find other ways to partner with hotels, in our view, such as merging a future loyalty program, promoting Airbnb as an overflow option for hotels, or, in select instances, expand hotels’ investments in boutique accommodation options,” PiperJaffray states.

Au Contraire About Airbnb and Hotels

There are plenty of questions that can be raised about PiperJaffray’s analysis, which at times seems to suffer from a static view of the world.

For example, PiperJaffray argues that because Airbnb charges travelers a 6-12 percent booking fee — and online travel agencies don’t — then Airbnb’s hotel rates would be higher than those offered by Expedia and Priceline and therefore wouldn’t be competitive.

But business models aren’t crafted in stone. HomeAway, for example, which had never charged guests a booking fee, in recent months has implemented a traveler booking fee to bring its take rate to parity with Airbnb and TripAdvisor.

There isn’t anything that would bar Airbnb from changing its business model, which currently entails charging hosts a 3 percent booking fee and giving guests a free ride. With the volume of traffic that Airbnb gets it could potentially increase host or hotel commissions in the future and still undercut online travel agencies.

Speaking to a Bank of America Merrill Lynch investor conference March 15, Priceline Group CFO Daniel Finnegan said it wouldn’t be surprising for Airbnb to start offering hotels.

“I expect that they would,” Finnegan said.

However, Airbnb would have to change its business model and increase the 3 percent commission it charge in order to compete in variable, or paid, channels, Finnegan said.

Brand Hit To An ‘Altruistic’ Airbnb

The rhetoric about Airbnb’s ethos as an “altruistic” company is just that — marketing rhetoric. The bottom line is that Airbnb has investors and is in the business of making money. Period.

If Airbnb finds that it is in its financial interests to begin offering hotels in a big way then it eventually will and can figure out a way to manage any backlash and bring its customers along.

There is an argument to be made that specialization — sticking with just apartments and vacation rentals — won’t win the day in the long term. Just look at Booking.com, which has expanded beyond hotels to vacation rentals and apartments, and Expedia, which acquired HomeAway last year for $3.9 billion to supplement hotels with vacation rentals.

Expedia argues that comprehensiveness in its hotel inventory increases conversions on its sites and that when it goes from 50 percent coverage of available hotels in a destination, up from 25 percent, that its conversions double. Expedia plans on adding vacation rentals from HomeAway, and apartment rentals, to its Expedia and Hotels.com sites, and to bolster HomeAway’s sites with apartments in urban areas.

As another example, Wyndham Worldwide recently added professionally managed vacation rental properties in a separate vacation rental tab on its Wyndham sites to supplement hotels.

There are so many signs that lodging offerings are converging, with Hyatt and Accorhotels.com partnering with Onefinestay and the Oasis Collection, respectively, that it adds fuel to the argument that Airbnb will indeed try to add hotels over the next few years.

Online travel agencies indeed need to fine-tune how they mix in vacation rentals with hotels and plenty of work needs to be done, as PiperJaffray points out. Expedia, for example, doesn’t have a separate vacation rental tab but surfaces more than 200 private vacation homes when searching for a week-long stay in Orlando for six guests.

Numerous travel industry officials, such as the Priceline Group’s Darren Huston, have pointed out that the lodging revolution starts with “one customer” who may want to stay in a Marriott for a business trip and then an Airbnb or HomeAway rental for an extended leisure trip with the family.

Would it not be in Airbnb’s interests to offer the gamut of choices for these multifaceted travelers, especially if comprehensiveness increases conversions, which bolsters marketing budgets?

With all of Airbnb’s growing site traffic, $2.39 billion in funding to date and the prospect of increased conversions because of a more comprehensive offering, Airbnb should be amply equipped to eventually compete against the online travel agencies in digital marketing for hotels.

Like PiperJaffray, officials at Expedia and the Priceline Group say they are not overly concerned about Airbnb.

We’ll have ample opportunity to revisit this issue over and over again in the next few years.

Dwell Newsletter

Get breaking news, analysis and data from the week’s most important stories about short-term rentals, vacation rentals, housing, and real estate.

Have a confidential tip for Skift? Get in touch

Tags: airbnb

Photo credit: A hotel room listing in Brooklyn, NY on Airbnb.