A lot of people are worried about how quickly Tesla is burning through cash. In a Monday story, Bloomberg extrapolated Tesla's recent cash burn rate—$3.48 billion over the last 12 months, or $6,500 per minute—to estimate that Tesla might run out of cash before the end of 2018.

Tesla has had to raise billions of dollars to fund the development and manufacturing of its cars, batteries, and other technology. At the end of 2017, Tesla had $9.4 billion in outstanding debt, requiring hundreds of millions of dollars in annual interest payments. With no profits in sight, pessimists worry that Tesla will find it difficult to raise still more money—money it may need to complete its production ramp-up of the Model 3.

Tesla CEO Elon Musk insists that there's nothing to worry about. "Tesla will be profitable & cash flow+ in Q3 & Q4, so obv no need to raise money," he tweeted last month.

We're skeptical that Tesla will reach profitability or positive cash flow that quickly. But history does suggest that concerns about Tesla's cash flow may be overblown.

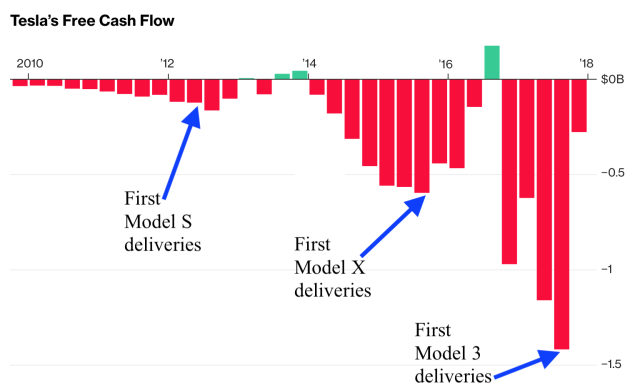

Check out this chart of Tesla's free cash flow over the last eight years:

The chart comes from Bloomberg, but I've added annotations for the launch of Tesla's last three vehicles.

In 2011 and early 2012, Tesla suffered increasingly negative cash flow as the company spent heavily to prepare for manufacturing of the Model S. That cash burn rate peaked in the third quarter of 2012—just after the delivery of the first Model S in June 2012. Then in 2013, as Model S production hit its stride, Tesla's cash flow was slightly positive for three out of four quarters in 2013.

The pattern repeated itself with the Model X. Tesla's burn rate soared in 2014 and 2015, peaking right around the time of the first Model X delivery in September 2015. Then the burn rate declined, and Tesla actually saw positive cash flow in the third quarter of 2016.

So far, we've seen a similar trend with the Model 3. Tesla saw a massive burn rate in the year before the first Model 3 delivery as the company invested heavily in manufacturing capacity. Then the burn rate declined in the final quarter of 2017.

At a minimum, this means that it's a bit misleading to extrapolate 2017 free cash flow statistics into 2018. In 2017, Tesla was investing heavily in Model 3 production facilities. In 2018, Tesla hopes to reap the benefits from those investments in the form of Model 3 revenues. It's hard to say how much lower the 2018 burn rate will be, but it seems quite likely that it will be somewhat lower.

And Musk has another reason for optimism: he has gone through all of this before. It's often forgotten that Tesla's previous cars saw similar manufacturing delays much like the ones Tesla is experiencing now with the Model 3.

Tesla "told investors that it will fall well short of its production targets for its Model S electric vehicle and that it needs to raise additional funds to keep operating over the next 12 months," the MIT Technology Review reported in September 2012. "The company's problems seem to highlight the challenges of getting into the automotive-manufacturing industry from scratch."

After three months of production, Tesla had only delivered 132 Model S cars. And analysts worried about Tesla's cash-flow problems.

Three years later, Tesla only managed to deliver 208 Model X vehicles to customers during the first full quarter of Model X manufacturing. Again, analysts worried about Tesla's cash flow.

Tesla's losses are bigger this time because the Model 3 is a much more ambitious project than Tesla's earlier cars. Tesla is aiming to manufacture as many as 500,000 vehicles per year by 2020, and that level of output requires more extensive manufacturing facilities.

Of course, this doesn't mean that Tesla will ultimately succeed with the Model 3. But it's misleading to focus too much on quarter-by-quarter cash flow numbers. Tesla has a market capitalization of $50 billion. As long as its valuation is that high, it can easily raise an extra billion dollars by selling more shares. Existing shareholders don't like raising capital this way because it dilutes the value of existing shares—and Musk claims that it's not needed—but it's an option if Tesla finds itself needing more cash.

Tesla will only face an existential threat if investors start to lose confidence in the company's long-term prospects. If that were happening, we'd see signs of it in a plunging stock price. Tesla's market capitalization is down about 20 percent from its 2017 highs, but the stock is still higher than at any point prior to 2017, suggesting that investors still have confidence in Musk's long-term vision.

reader comments

212